Last year Indian SMBs have contributed over 40% to India’s total exports, with 46% of their customer base now international.

Every business starts with the dream:

“I’ll build this company, scale it in a few years, and my product or service will be known worldwide.”

Once you get the moment of happiness and soon realization hits.

Shipping your product globally was half the journey. Getting paid in full, on time, and without losing a chunk to fees or poor exchange rates is where most Indian SMBs start feeling the pinch.

You begin your research. And soon, two big names keep showing up: PayPal and Payoneer.

Both promise global reach, trust, and convenience.

But which one works best for Indian SMBs in 2025?

It’s a question 8 out of 10 founders ask us.

So in this blog, we’re breaking it down with numbers, clear comparisons.

If you're exploring beyond these two or already paying 5%+ on PayPal, we’d genuinely suggest visiting Karbon.

Karbon gives you PayPal-level speed and security, with just a flat 1% deduction.

Paypal Vs Payoneer

Paypal Overview, Exchange Rate, Deduction and More

In January 2025, PayPal continued to dominate the market for online payment processing technologies worldwide, holding a market share of 45%.

No doubt it is one of the oldest, most prominent platforms for international payment processing.

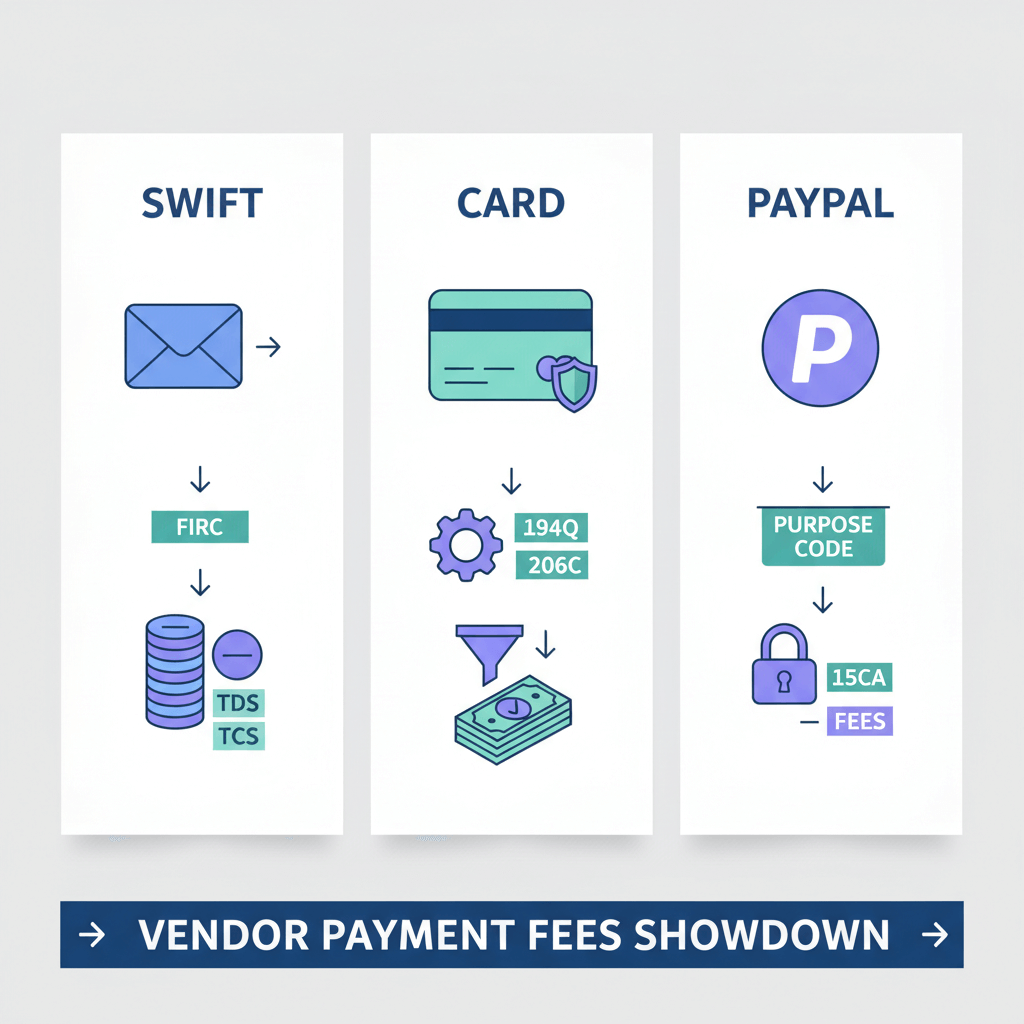

PayPal operates in 200+ countries and supports 25+ currencies and accepts payments through cards, PayPal balance, and linked bank accounts.

PayPal Fees:

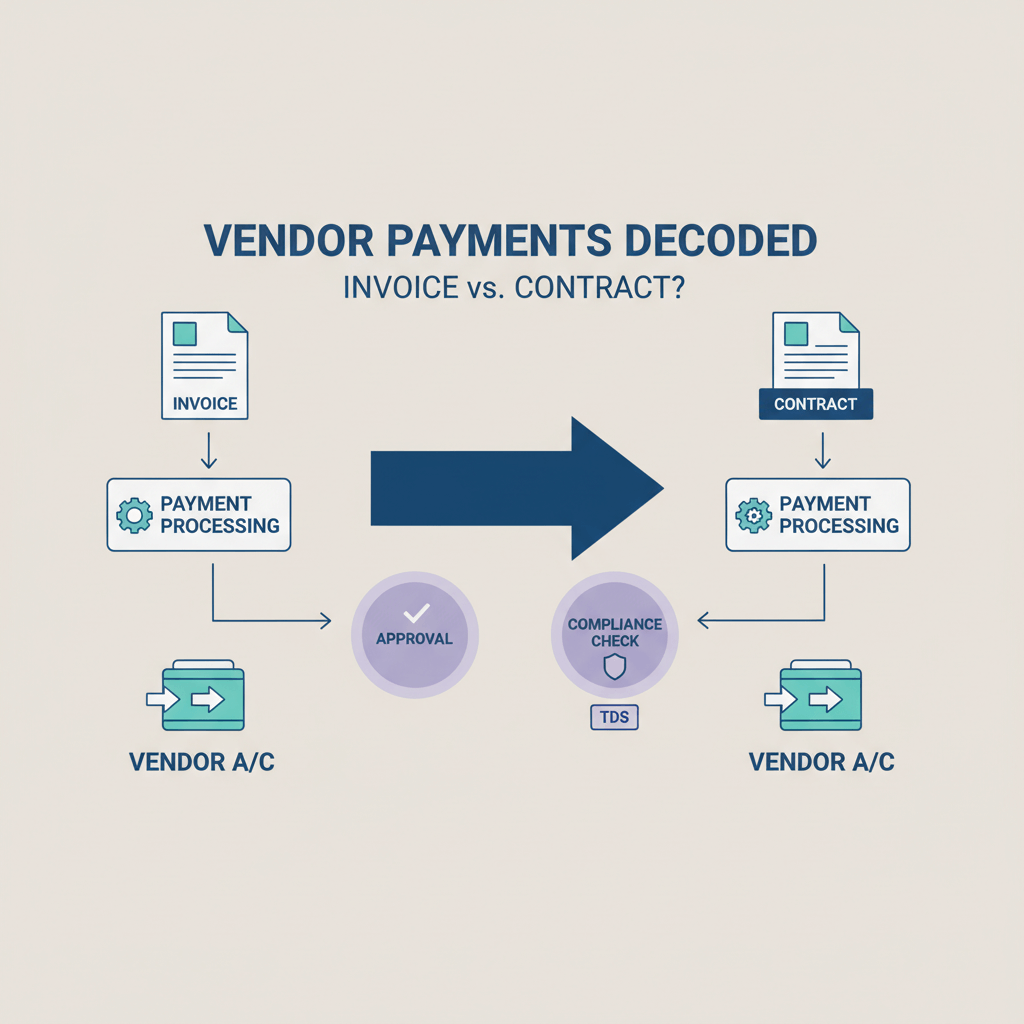

PayPal doesn’t have a single fee structure. There are multiple charges that add up quickly.

Here’s a breakdown for $100 international transaction:

Next comes the currency conversion. When PayPal converts this to INR, it uses a marked-up exchange rate, lower than what you’d find on Google.

That’s almost ₹300 gone just on exchange markup, before it reaches your bank.

How Does This Compare to Karbon?

Challenges for Indian SMBs Using PayPal

Even though PayPal is trusted worldwide, Indian SMBs face a few key challenges:

• High total fees (~7–8%): You lose a big chunk of your revenue on every transaction, making your pricing less competitive globally.

• Low exchange rates: You end up receiving less in INR than expected, which reduces your actual profit margins.

• Payment holds (up to 21 days): Delayed access to funds can disrupt operations, especially if you rely on regular cash flow for salaries, inventory, or marketing.

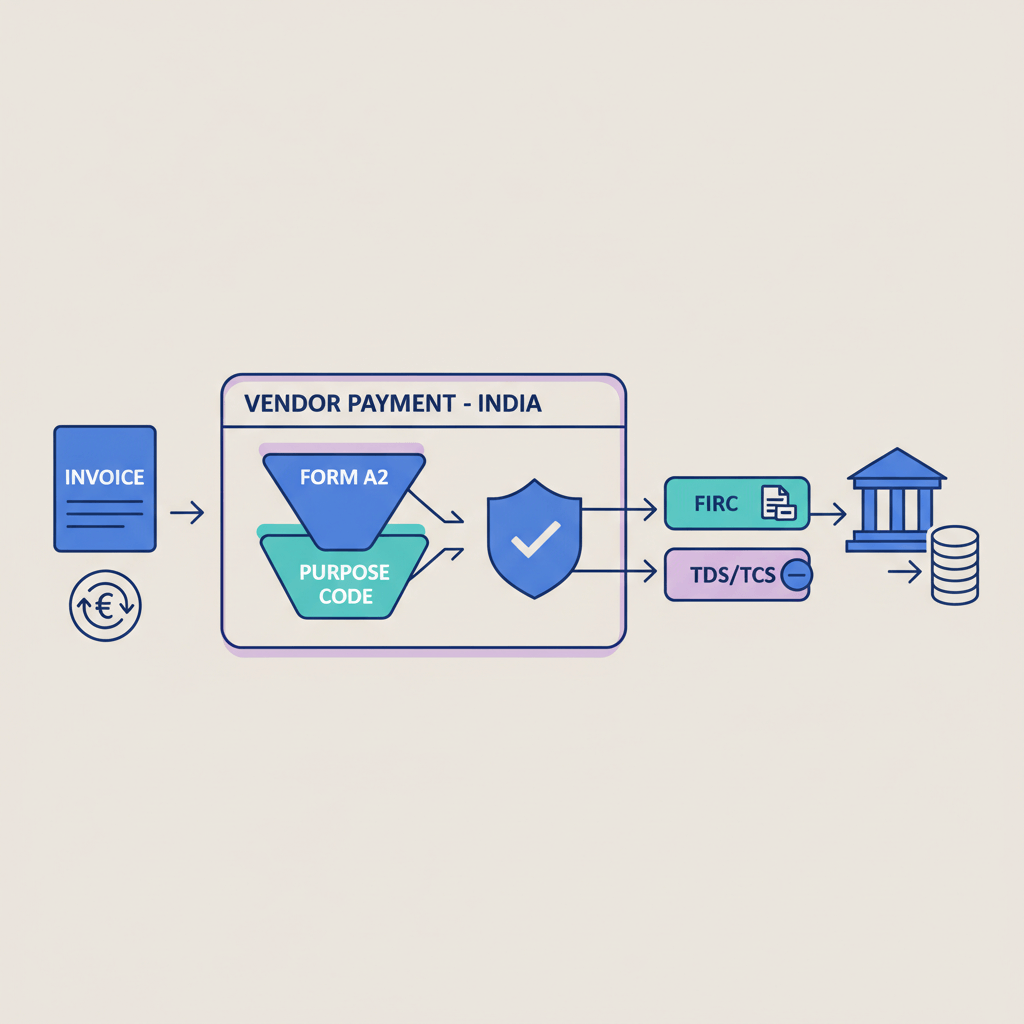

• No reliable e-FIRC support: Without proper documentation, claiming export benefits or staying compliant with Indian tax laws becomes difficult.

• Limited India-specific support: Resolving INR payout or compliance issues like 15CA/CB or FIRC takes multiple follow-ups and delays payments or tax filings.

Payoneer Overview, Exchange Rate, Deduction and More

Payoneer has become a preferred platform for freelancers and export-focused SMBs, especially those working on global marketplaces like Upwork, Amazon, and Fiverr.

It offers receiving accounts in major currencies (USD, EUR, GBP) and supports direct bank withdrawals in INR. Fees range from 0–3% depending on the payment method, with an added 2% for currency conversion.

Payoneer Fees:

Payoneer doesn’t hit you with upfront charges, but the deductions are still significant once you look closely.

Here’s a breakdown for a $100 international transaction:

Payoneer sets its own exchange rate, which includes a markup similar to PayPal. It’s lower than the real mid-market rate, reducing how much INR you actually receive.

That’s roughly ₹250 lost to exchange markup alone.

How Does This Compare to Karbon?

Challenges for Indian SMBs Using Payoneer

• Works best only with marketplaces like Upwork or Fiverr, not with direct clients.

• Lacks easy invoicing or payment link options for B2B service exports.

• Account freezes can halt payouts with little notice.

• Chargebacks and disputes are difficult to resolve.

• Manual e-FIRC generation and frequent delays.

The True Cost of “Convenience”

Sticking with PayPal or Payoneer often feels like the safe, convenient choice. You've used them for years, your clients are familiar with them, and switching sounds like a hassle. But that convenience can quietly cost you thousands every year. Between high transaction fees, poor exchange rates, and delayed access to funds, your business bleeds money.

For every $1,000 received, you could be losing ₹3,000–₹5,000 in hidden charges.

What seems like a small trade-off for ease adds up fast, especially for growing SMBs.

Convenience is not the same as familiarity.

As Henry Ford says:

Looking for a Better Alternative?

For Indian SMBs international payments range anywhere from $500 to $20,000 per month.

With platforms like PayPal or Payoneer, even at the lower end, you could be losing ₹3,000–₹50,000 every month in hidden fees and poor exchange rates.

That’s money that could go into better inventory, hiring, or marketing.

Karbon was designed with these Indian SMBs in mind. It charges a flat 1% on all incoming payments, uses the real exchange rate, and provides automated e-FIRC for compliance.

FAQs

Which platform saves more money on international payments: PayPal or Payoneer?

Payoneer usually has lower transaction and withdrawal fees compared to PayPal. While PayPal may deduct over 5% in fees and currency conversion, Payoneer tends to charge around 3–5% in total. However, both platforms have hidden costs in exchange rates, which can eat into your earnings.

Is Payoneer a better fit for Indian exporters than PayPal?

Yes, especially if you're an Indian SMB working with marketplaces like Amazon, Upwork, or Fiverr. Payoneer supports local bank withdrawals in INR and offers features like receiving accounts in USD or EUR. PayPal may be more suitable if you prioritize wide client familiarity but is costlier in the long run.

Are PayPal and Payoneer offering the same service?

Not quite. Both help you receive international payments, but PayPal focuses more on peer-to-peer and business transactions, while Payoneer specializes in cross-border payouts for freelancers, sellers, and service providers. Their fee structures, supported countries, and compliance support also differ significantly.

What’s the biggest difference between PayPal and Payoneer for Indian SMBs?

The key difference is in cost and flexibility. PayPal is widely accepted and easier for clients, but often has higher fees and less transparency. Payoneer offers more flexibility in receiving currencies and lower fees, but it works best when tied to platforms or marketplaces.

Who gives a better exchange rate: PayPal or Payoneer?

Neither gives you the mid-market rate you see on Google. Payoneer's rate is slightly better than PayPal’s in most cases, but both platforms include hidden markups. If exchange rate is a priority, exploring platforms like Karbon that use the real rate can help you receive more INR per dollar.

.png)