Let’s explore opportunities, tailor strategies, and chart a course to financial success together.

Every time a currency’s value rises or falls, it’s never random.

Each shift reflects a mix of real economic conditions, policy decisions, and global events shaping demand and supply of currencies.

The dollar to euro or INR to USD looks like a simple number conversion to us. However, each exchange rate tells the story of a country’s current relationships with other countries, its leadership, and the wider world around it.

So, what really makes a currency’s value go up and down?

In this guide, we’ll break down 12 factors behind exchange rate changes and explain how they shape the global currency market every day.

What Are the Factors Affecting Foreign Exchange Rates?

Any business involved in international trade has its eyes set on the exchange rate. It is one of the most important determinants of the business’s profitability.

Which is why it’s important to understand what really determines the exchange rate in India.

The simple answer is — the foreign exchange rate is determined by the supply and demand of the currency.

If the demand for the Indian Rupee is high among foreign investors, it will reduce the supply of the Indian Rupee, increasing its value.

But that’s a very simplistic explanation. There are other geopolitical, governmental, and economic factors that determine the exchange rate.

1. Market Speculation

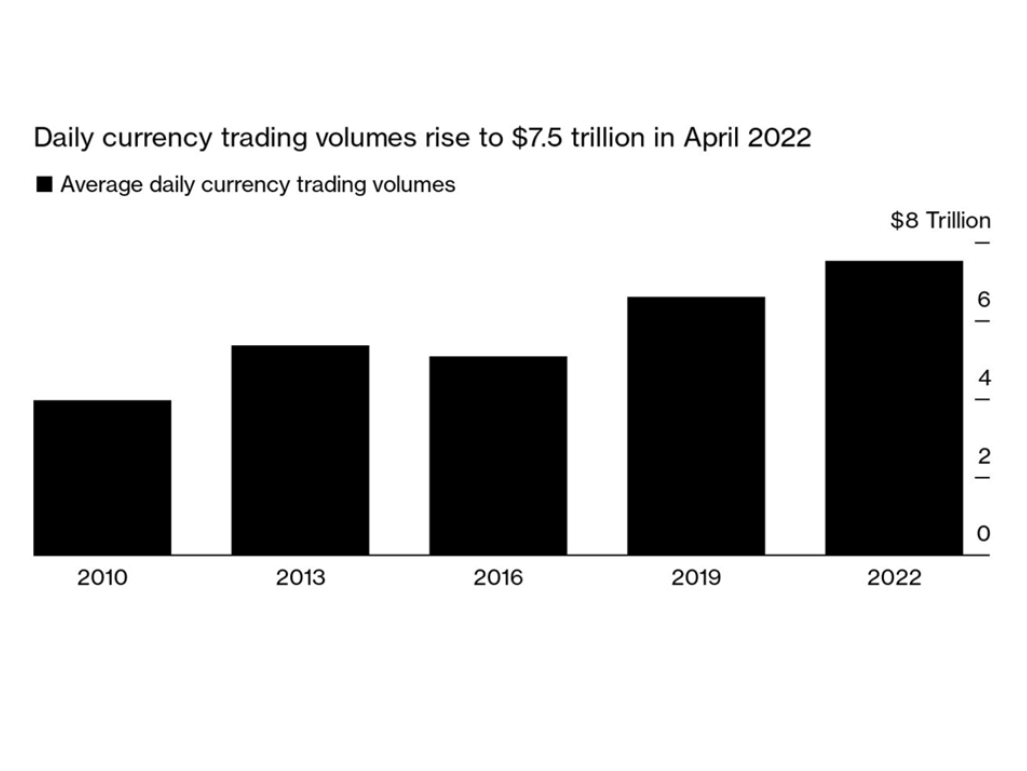

Market speculation is one of the biggest forces behind daily currency movements. Traders, hedge funds, and large investors bet on whether a currency will rise or fall based on how they read a country’s economic outlook.

If they bet correctly, the returns can be high. This is why speculation is a daily activity in the global currency market.

Globally, more than 90% of daily forex trading, worth over $7.5 trillion every day, is speculative rather than linked to real trade or investment (BIS Triennial Survey, 2022).

In India alone, the daily forex market turnover averages $40–50 billion, and a significant portion of this comes from investors hedging or speculating on where the rupee is headed.

While speculation adds liquidity to markets, it can also cause sharp and unpredictable swings in exchange rates. A sudden wave of negative sentiment can trigger big outflows, weakening the rupee, while bullish bets can push its value up.

For central banks like the RBI, large speculative flows make it harder to keep the currency stable, so they use regulations and position limits to curb excessive risk-taking.

2. Global Economic Conditions

A country’s exchange rate doesn’t exist in isolation. It’s affected by what’s happening in the global economy. Strong global growth usually boosts demand for trade, investments, and commodities, helping many currencies stay stable or appreciate.

When the global economy is healthy, countries that export goods and services benefit from higher foreign earnings, which increases demand for their currencies. For example, a surge in demand for German cars or Japanese electronics can strengthen the euro or yen.

On the other hand, a global recession or crisis can trigger reduced demand for exports, falling commodity prices, and sudden capital flight to safer assets like the US dollar or gold. This can weaken many currencies at once.

3. Foreign Investment Flows

Foreign investment flows through stock markets and debt markets have a big influence on the exchange rate.

When global investors buy Indian stocks or bonds, they bring in foreign currency, boosting demand for the rupee and often strengthening its value.

India attracts significant Foreign Portfolio Investment (FPI). For example, FPIs hold over $620 billion worth of Indian equities and debt (NSDL, 2024). In bullish periods, billions of dollars can flow in within weeks, lifting both stock markets and the rupee.

However, these flows can reverse just as quickly. If global investors become cautious (due to global rate hikes, risk aversion, or domestic uncertainty) they often pull money out. This sudden outflow means they sell rupee assets and convert back to dollars, putting pressure on the rupee to depreciate.

4. Political Stability

Political stability is one of the biggest trust signals for currency markets. When a country has stable leadership, predictable policies, and smooth transitions of power, investors feel safer putting money there.

That’s why stable democracies like Switzerland or Germany see fewer sudden capital outflows compared to politically volatile regions.

This is why we see major currency movements when there is an election. Sudden policy shifts, coups, or protests create uncertainty.

5. Trade Balance

A country’s trade balance measures whether it sells more abroad than it buys. A trade surplus supports the currency because foreign buyers need to convert their money to pay for exported goods and services.

As you know, Germany and China have run huge trade surpluses for years. This steady demand for euros and yuan supports their currencies’ strength.

The U.S. dollar stays strong because it’s also the world’s reserve currency and attracts huge investment inflows.

So, trade balance is powerful but interacts with other flows too.

6. Interest Rates

Interest rates are yet another factor that determines the exchange rate. When a country’s central bank raises rates, investors earn better returns on deposits, bonds, or other interest-bearing assets. This attracts foreign capital, increasing demand for the currency.

Central banks adjust rates not just for exchange rates but to fight inflation or boost growth — but every rate change ripples through the currency market too.

7. Inflation Rates

Currencies tend to hold value when inflation is low and stable. High inflation erodes purchasing power, pushing prices up and confidence down.

Central banks like the European Central Bank or the RBI watch inflation closely — if inflation rises too fast, they may raise rates to cool it down and defend the currency’s value. Stable inflation signals good economic management, which supports a stronger currency.

8. Economic Indicators

Every major currency reacts to key economic signals:

- GDP Growth: Healthy GDP growth attracts investors looking for growth markets. For instance, India’s robust 7%+ GDP growth has helped draw foreign capital despite global slowdowns.

- Employment Data: Strong job numbers mean healthy domestic spending, which boosts economic confidence. In the US, the Non-Farm Payrolls report is so influential that it can move the dollar within minutes.

- Manufacturing & Services Data: High factory output and strong services activity mean a country is producing, exporting, and earning more — all of which support the currency.

Markets digest these reports monthly or quarterly to judge whether a country’s currency will likely strengthen or weaken.

9. Government Debt

How much a government borrows and how responsibly it manages that borrowing can have a big impact on its currency’s strength.

When a country keeps its debt at a manageable level, investors trust that it can repay what it owes without needing drastic steps like printing large amounts of money or raising taxes too sharply.

Problems arise when government debt grows too large compared to the country’s income, and there is no clear plan to reduce or control it.

10. Foreign Exchange Reserves

Forex reserves are a country’s emergency backup. They let the central bank buy or sell currency to smooth out sudden swings.

China holds the world’s largest reserves, which is over $3 trillion USD. So, they have the power to stabilize the yuan.

Countries with large reserves can resist currency attacks or market panic better than those with tiny reserves.

11. Monetary Policy

Monetary policy is how a central bank steers the economy through interest rates, money supply, and open market operations. It’s a major factor affecting inflation, liquidity, and exchange rate trends.

When markets trust that the central bank (RBI in the case of India) will step in to fight inflation or defend the currency if needed, the currency stays more stable, even in global shocks.

You can check out our article on the latest RBI rules regarding foreign remittances, and how they will affect business in 2024.

12. Geopolitical Events

Finally, geopolitics can shake currencies overnight. Wars, sanctions, trade disputes, pandemics, and global supply chain shocks create huge uncertainty and risk.

Geopolitical risks are hard to predict, but they remind us that currencies react not just to economics but to politics, security, and global trust.

How Does the Exchange Rate Affect Your Business?

The exchange rate can directly influence your revenue, costs, and profit margins if you deal with international payments. Here’s how:

1. Impact on Earnings

If you export products or services and get paid in foreign currency, a stronger home currency means you get fewer rupees when you convert those earnings. For example, if you’re an Indian freelancer paid in US dollars, a stronger rupee means each dollar buys you less. This reduces your final income in INR.

Conversely, when the rupee weakens, you earn more when converting foreign currency back home.

2. Impact on Costs

If your business imports raw materials, equipment, or services from other countries, a weaker rupee makes those imports more expensive. You’ll need more rupees to buy the same amount of dollars, euros, or yen — increasing your input costs.

A stronger rupee, on the other hand, makes imports cheaper, so your costs come down. This can help businesses that rely heavily on imported machinery, fuel, or components.

3. Profit Margins and Pricing

Fluctuating exchange rates can squeeze your margins if you can’t adjust prices quickly. Exporters might lose out if the rupee strengthens suddenly after signing a fixed-price contract. Similarly, importers can be caught off guard by sudden currency depreciation, raising their input costs overnight.

To protect profits, many businesses hedge their currency risk through forward contracts or currency options. This locks in exchange rates for future transactions and brings more certainty to their cash flows.

4. Competitiveness in Global Markets

A weaker currency makes your goods and services cheaper for foreign buyers, giving you a competitive edge. Many export-focused economies prefer a slightly weaker currency for this reason.

But if your currency strengthens too much, your goods become expensive for foreign buyers, which can hurt export volumes and reduce global market share.

5. Financial Planning and Cash Flow

Exchange rate swings can affect how you plan your budgets and manage cash flow. Predicting how much money you’ll receive (or owe) in your local currency gets tricky when rates are volatile. Businesses that ignore these fluctuations often end up with surprise losses or squeezed working capital.

Final Thought

Understanding the different factors that influence the exchange rate in India gives businesses an edge. Though predicting exchange rates is challenging, having the right knowledge helps businesses ensure they are prepared for both opportunities and challenges in the global market. By monitoring interest rates, inflation, and geopolitical events, businesses can make informed decisions and manage risks.

FAQs

1. How can I check the current exchange rate for the Indian Rupee?

You can check the live INR exchange rate on trusted sources like the RBI’s official website, your bank’s forex portal, Google Finance, XE.com, or Reuters. Always compare rates before making large transactions to spot hidden markups.

2. Is a strong currency always good for the economy?

Not always. While a strong currency makes imports cheaper, it can hurt exports because goods become more expensive for foreign buyers. Many countries prefer a balanced currency to keep both exports and imports competitive.

3. Why do exchange rates vary between banks and money transfer services?

Banks and money transfer services add their own markup to the real interbank exchange rate. They also include service fees and hidden costs. This is why the rate you see on Google may be slightly better than what your bank gives you.

4. Can individuals or small businesses protect themselves from sudden exchange rate swings?

Yes. Freelancers, exporters, and importers often use hedging tools like forward contracts, currency options, or simply holding multi-currency accounts to reduce risk. Many Indian banks and fintechs offer basic hedging services.