When Wise launched in India in 2017, it quickly became the go-to platform for businesses wanting to send money internationally. It was simple, fast, and cost-effective—just what businesses needed back then.

But since 2020, things have started to shift, especially in India. Due to evolving regulatory rules from the RBI, Wise has faced some hurdles that are leaving businesses frustrated. Some of the issues include:

• Account restrictions that make it tough for certain high-risk industries to use the platform.

• Rising transaction fees, with some payments now costing over 2%.

• Unpredictable transfer delays that mess with cash flow and reliability.

• Limits on high-value transactions, causing big payments to get stuck.

• The absence of GST invoicing and account managers for larger businesses.

• No support for virtual accounts, debit/credit card integrations, or digital wallet payments in India.

With these issues piling up, businesses are beginning to look for alternatives to Wise.

There are alternatives out there offering lower fees, fewer restrictions, and more reliable service.

Wise Features, Benefits, and Drawbacks for Businesses

(SMEs, Goods Exporters, B2B Service Providers, Global Teams, Remote-First Companies)

1. International Money Transfers & No Hidden Fees

• Benefits: Transfer money to 80+ countries with competitive exchange rates and low fees, making it ideal for paying suppliers, contractors, and service providers globally. With transparent pricing, you only pay a flat fee or a small percentage for currency conversion—no hidden markups like traditional banks.

• Drawback: Payments, especially large transfers, can take 2-3 business days, potentially causing delays in cash flow. For certain currencies or larger transfers, fees can rise up to 2%. Payment methods, such as credit cards, can also increase costs.

2. Multi-Currency Account (Wise Borderless Account)

• Benefits: Hold 50+ currencies in one account, with local Indian bank details (INR) to receive payments. Perfect for businesses handling both local and foreign transactions.

• Drawback: Currency conversion fees apply when moving funds between currencies. While Wise’s conversion is more transparent, fees still add up over time. Alternatives like Payoneer offer multi-currency accounts with local bank details in more countries, which can sometimes reduce conversion costs.

3. Payroll Management

• Benefits: Pay international employees or contractors with lower fees than traditional banks. Supports bulk payments efficiently.

• Drawback: Local payroll isn’t as seamless as international payments, and delays may occur in certain cases, especially when transferring funds from international accounts.

Wise Alternatives for Businesses

If your business is facing challenges with Wise, such as high fees, account restrictions, or processing delays, you may be looking for alternative platforms that offer more cost-effective, efficient, and flexible solutions. Here are some Wise alternatives that can better suit the needs of various businesses:

1. Karbon FX: Best Wise Alternative for Exporters and B2B Service Providers

Why Choose Karbon FX?

• Low-cost international payments: Ideal for businesses involved in international trade or service-based businesses that need to reduce transaction costs.

• Flat 1% fees: You save almost X% compared to Wise, as Wise’s fees can go up to 2%, depending on the currency and transfer method.

• 60-day money hold option: Karbon FX allows businesses to lock in exchange rates for up to 60 days, which helps protect against currency fluctuations. Wise doesn’t offer a similar feature for holding funds or locking rates over extended periods.

• Virtual accounts: Karbon FX provides local bank details for USD, EUR, and more. This is similar to Wise’s multi-currency accounts, but Karbon FX supports more currencies and offers a broader range of local bank details.

Drawbacks:

• Limited availability: Karbon FX isn’t as globally accessible as Wise, which may limit its use in certain regions.

• Higher fees for smaller transactions: While Karbon FX is ideal for larger transactions, its fees can increase significantly for smaller amounts, while Wise often offers lower fees for smaller transfers.

2. OFX (formerly OzForex): Best for High-Volume Transactions

Why Choose It:

• No transfer fees for large transactions, making it perfect for high-value payments.

• Great exchange rates with transparent pricing—no hidden markups.

• Customizable bulk payment solutions for businesses that make frequent international payments.

Drawbacks:

• Minimum transfer amount of $1,000, which makes it unsuitable for smaller transactions.

• Longer processing times, typically 2-5 days for some payments.

• Limited currency options compared to Wise, PayPal, or other alternatives.

3. Payoneer: Best for Remote Teams and Payroll Management

Why Choose It:

• Multi-currency accounts: Hold and manage 50+ currencies in one place with local bank details in multiple countries (USD, EUR, GBP, etc.).

• Bulk payments: Easily pay multiple vendors or contractors with competitive fees.

• Invoicing and payroll solutions: Streamlined invoicing tools and global payroll services for businesses with international teams.

• Fast transfers: Instant payments to Payoneer accounts, reducing wait times.

Drawbacks:

• Higher conversion fees: Payoneer applies a markup to exchange rates, making it more expensive for currency conversions than Wise.

• Withdrawal fees: $1.50 fee per withdrawal to a local bank.

• Processing times: International payments may take 1-3 business days to process.

• Limited support: Some regions have slower customer support, which can be frustrating for businesses with urgent needs.

Wise Features, Benefits, and Drawbacks for Freelancers in India

1. Receiving Payments from International Clients

• Benefits: Freelancers can receive payments in multiple currencies without the need for a separate international bank account. It’s simple and straightforward to get paid from clients worldwide, which is ideal for those working with global clients.

• Drawback: Conversion fees can add up over time, especially for freelancers who deal with multiple currencies frequently. The exchange rates are competitive but still fluctuate, and Wise’s fee structure can be higher when it comes to smaller amounts or certain currencies.

2. Wise Debit Card for Spending

• Benefits: Freelancers can get a Wise debit card linked to their multi-currency account, allowing them to spend their earnings without the usual foreign exchange fees. This can be very useful when making international purchases or paying for freelance tools and subscriptions.

• Drawback: The card can only be used in places where Mastercard is accepted, and availability may be limited in certain parts of India, especially for those living in more remote areas or who need a card for local transactions as well.

3. Low Fees for International Payments

• Benefits: Wise’s fees are significantly lower than traditional banks, typically ranging from 1% to 2% per transaction, making it a good choice for freelancers who work with clients across the globe.

• Drawback: While Wise’s fees are low, transaction costs can rise for smaller payments, particularly if you are using certain payment methods (like credit cards) or converting between specific currencies. The flat fee structure can be a disadvantage for freelancers receiving frequent, smaller payments.

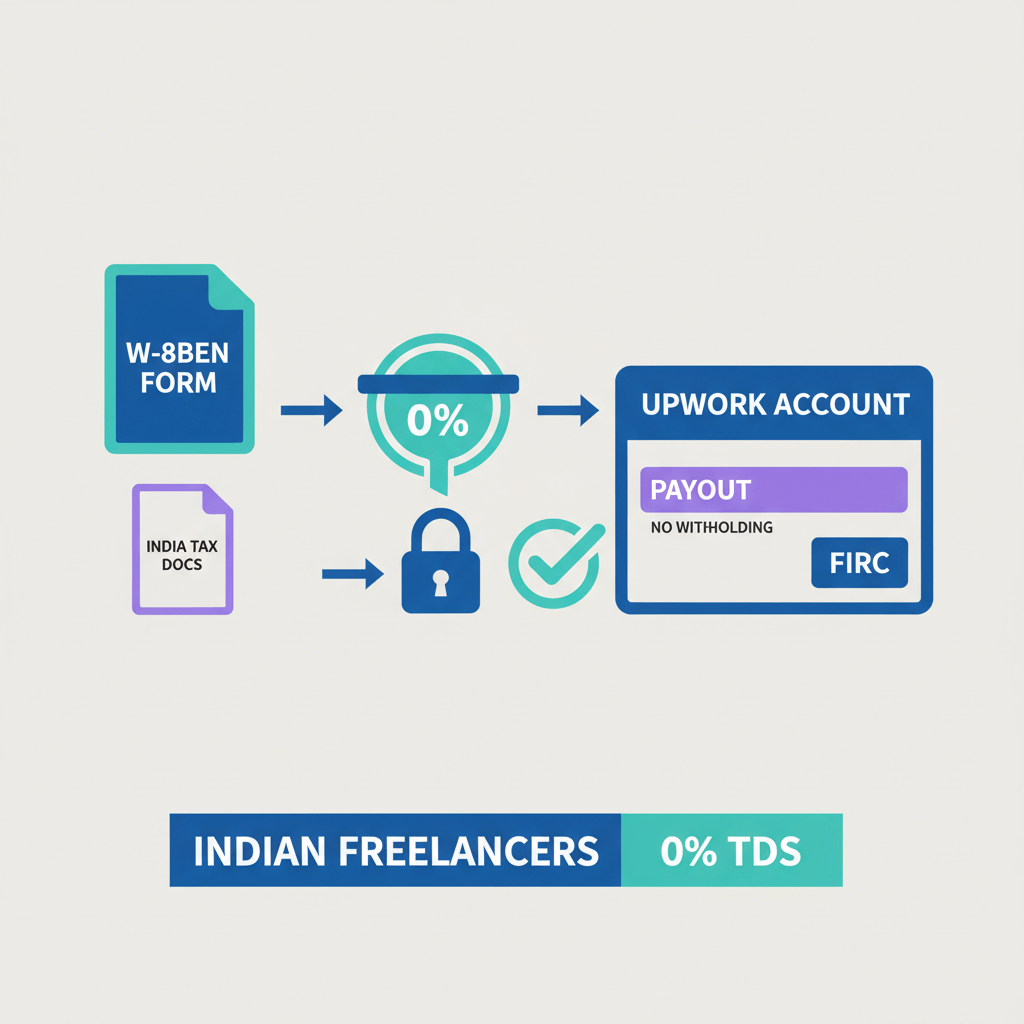

Freelancer Alternatives for Wise in India

1. Karbon FX: Best Wise Alternative for Indian Freelancers

Why Choose It:

• Flat 1% fee for receiving international payments, significantly lower than PayPal's 4% or more, and Payoneer's 1.5%-3% on conversions.

• Easy integration with freelancing platforms like Fiverr, Upwork, and Indian freelancing sites such as Freelance India, Truelancer, and Guru. You can link your Karbon FX account directly to these platforms, allowing you to receive payments quickly and at a fraction of the cost.

• 60-day money hold option: Lock in exchange rates for up to 60 days, reducing the impact of currency fluctuations. This is a feature Wise doesn't offer.

• Virtual accounts: Receive payments in USD, EUR, and other currencies, with local Indian bank details (INR). This saves freelancers from high conversion fees, as Karbon FX offers a broader range of local currencies compared to Wise.

• Payment Link Option: Freelancers can generate a payment link to receive payments from clients, eliminating the need for clients to sign up on the same platform. You can simply share the link, and the client can pay easily.

Drawbacks:

• Limited Availability: Karbon FX is still not as widely available in all countries as PayPal or Payoneer.

• Higher fees for smaller amounts: Though 1% is great for high-value payments, smaller amounts might attract slightly higher fees, especially for frequent payments.

2. Payoneer: Wise Alternative for Freelancers with Global Clients

Why Choose It:

• Multi-currency accounts: Hold 50+ currencies and receive payments with local bank details (USD, EUR, GBP).

• Freelance platform integration: Easily link with Fiverr, Upwork, and Freelance India for seamless payments.

• Global reach: More countries and payment methods supported compared to Wise.

• Flexible withdrawal options: Payoneer offers more ways to withdraw your funds internationally.

Drawbacks:

• Higher conversion fees: Payoneer applies a markup on exchange rates, making it pricier than Wise.

• Withdrawal fees: $1.50 per withdrawal to local banks.

• Processing delays: Payments may take 1-3 business days to process.