With the growth of global eCommerce, Indian businesses are increasingly selling beyond borders. In fact, India ranks among the top 5 countries on platforms like Amazon and Etsy in terms of active cross-border sellers. As international demand grows, so does the need for reliable, export-friendly payment infrastructure.

There are tons of international payment platforms you might have come across. But when you explore a bit deeper:

• Some platforms don’t support INR payouts or require you to set up a U.S. entity

• Many don’t provide automatic FIRA documents, which are essential for export compliance.

• Others offer limited customer support for Indian users or are available only by invite.

• Most have currency conversion markups or unclear timelines for settlements to Indian bank accounts.

That’s why we’ve created this guide:

To help Indian brands choose the best international payment gateway based on what works in India.

Top 10 Best International Payment Gateways:

1. Stripe

Stripe is designed for businesses that want full control over how payments work on their website or app. It is available in over 42 countries and lets you accept international payments through cards and digital wallets using hosted checkout or APIs.

With support for 135+ currencies, including INR, USD, EUR, and AUD, it is a great fit for Indian e-commerce brands selling globally and offering multi-currency pricing.

Payouts to Indian bank accounts usually take 2 to 5 business days, and instant payouts are available if you are eligible. Stripe follows RBI rules, so you will need to complete KYC and provide your IEC. It does not automatically give you FIRAs, but your bank can help you get them.

It integrates well with platforms like Shopify and WooCommerce, though you might need a developer to set it up. There is no local phone support, but their help docs and email support are solid.

Pricing & Fees:

• International cards: ~3% + currency conversion.

• Instant payouts via debit/eligible account: 1.5%, min $0.50.

• No setup or monthly fee.

Integration Options

Robust APIs, multi-language SDKs, pre-built integrations (Shopify, WooCommerce).

Pros

• Complete API control

• Multi-currency checkout

• No recurring fees

• Fast instant payouts

Cons

• Invite-only

• Requires developer effort

• No domestic wallet support

• Currency conversion markup

Is it Stripe available in India?

Yes, the invite-only feature is available for Indian businesses.

2. PayPal

PayPal is one of the most widely recognized global payment platforms, operating in over 200 countries with more than 300 million users. It is ideal for businesses looking for a plug-and-play solution to start accepting international payments quickly, without heavy developer work.

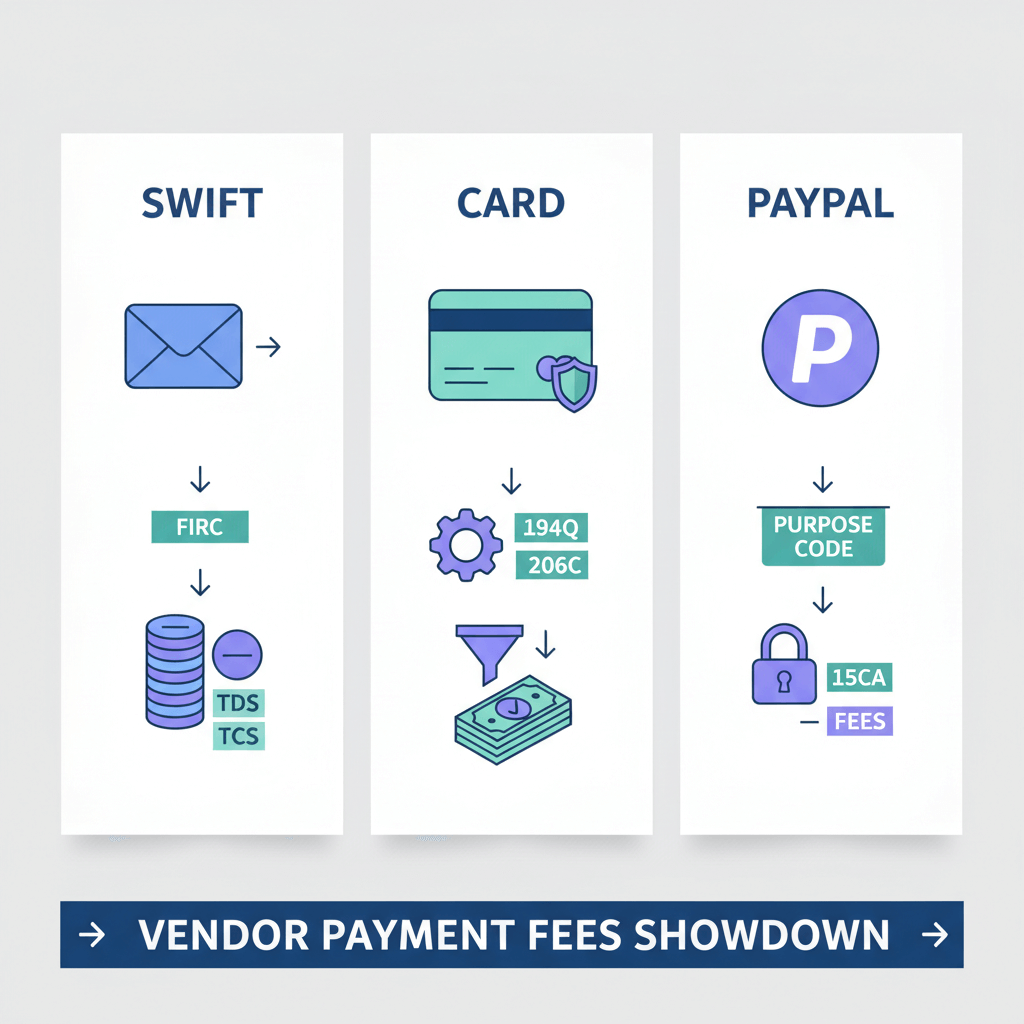

It supports around 25 major currencies including INR, USD, EUR, and AUD, making it a convenient option for Indian freelancers, e-commerce sellers, and small businesses that serve global clients. International payments typically arrive in 1 to 5 days, and funds must be withdrawn to your bank account within 7 days to remain compliant with RBI norms. You will receive a FIRA from PayPal after withdrawal.

PayPal is compliant with RBI rules under its PA-CB-E license and follows standard KYC and remittance regulations. It offers easy integrations through buttons, embedded checkout options, and plugins for platforms like WooCommerce and Shopify. Customer support is available 24/7 via email and phone.

Pricing & Fees

• International transactions: ~4.4% + currency conversion margin

• Micropayment plan available for transactions under $10

Integration Options

Invoicing, smart payment buttons, embedded checkout, and plugin support for popular platforms.

Pros

• Globally trusted and widely accepted

• Fast setup and minimal integration

• Export-compliant with RBI license

• Micropayment-friendly

Cons

• Higher transaction fees

• Mandatory withdrawal within 7 days

• No scheduled INR payouts

• Slower than instant payout options

Is Paypal available in India?

Yes. PayPal operates in India under an RBI-approved PA-CB-E license for cross-border export payments.

3. Razorpay

Razorpay is one of India’s top payment gateways, offering both domestic and international payment support for businesses. It allows merchants to accept card payments and bank transfers in over 100 currencies and also integrates UPI and Net Banking for Indian customers.

For exporters, Razorpay offers a dedicated MoneySaver Export Account with a low 1% fee and no forex markup up to ₹1 lakh, along with support for FIRA generation. Domestic payouts are settled within two working days, while international timelines vary depending on the settlement structure. Export support isn’t enabled by default—you’ll need to raise a request through their support ticket system.

It’s compliant with RBI remittance regulations and offers FIRA via the export account. Integration is easy through APIs, plugins, and a standard checkout UI. While customer support is India-based and generally effective, some users report delays when handling international issues.

Pricing & Fees

• International cards: 3% + GST

• MoneySaver Export Account: 1% fee, no markup up to ₹100k

Integration Options

REST APIs, hosted checkout, and plugins (Magento, WooCommerce)

Pros

• Supports both domestic and export payments

• Low export fees with no markup

• FIRA support included

• Fast domestic settlement

Cons

• Export feature not enabled by default

• Documentation can be complex

Is Razorpay available in India?

Yes. Razorpay is fully operational in India and offers export-enabled features upon request.

4. CCAvenue

CCAvenue is one of India’s oldest and most widely used international payment gateways, active since 2001. It powers a large portion of the country’s e-commerce sector and supports both INR and USD transactions for Indian exporters.

It supports over 27 currencies, including USD, GBP, and SGD, with options to accept card and net banking payments from global buyers. Payouts in USD typically take 3–5 days and depend on your site being live and approved by the bank. Onboarding is quick with digital KYC and no setup fees.

While its interface is somewhat dated, the platform remains fully compliant with RBI export norms and supports FIRA generation. Integration is possible through hosted checkout and plugins like BigCommerce. Support is multilingual and India-based, though ticket resolution can be slow.

Pricing & Fees:

• No setup fees

• Collection fees vary by currency and partner bank

Integration Options:

Hosted checkout, plugins (BigCommerce)

Pros

• Supports INR + USD transactions

• No onboarding charges

• Multilingual support

Cons:

• Outdated user interface

• Slower settlement due to bank review

Is CCAvenue available in India?

Yes. CCAvenue is fully available in India and supports cross-border payments for exporters.

5. PayU Biz

PayU Biz is part of PayU Global and supports international payments across 50+ emerging markets. It serves over 450,000 merchants and recently received full RBI approval as a Payment Aggregator in India.

It supports over 125 currencies and offers plans for both domestic and international payments. Payouts typically follow a T+2 schedule, excluding holidays. An annual maintenance fee applies, and pricing structures differ depending on your plan. The platform is fully RBI-compliant and provides FIRA support for export payments.

PayU Biz integrates with WooCommerce, Shopify, and other platforms through APIs and plugins. Its customer support is local and frequently updated, offering assistance via phone and email.

Pricing & Fees

• Maintenance: ~₹1,888/year

• T+2 settlement timeline

• Fee structures vary by plan

Integration Options

REST APIs, hosted checkout, and plugins (WooCommerce, Shopify)

Pros

• Export license in place

• Strong international support

• Standard settlement timelines

Cons

• Annual maintenance charges

• Delays on bank holidays

Is PayU available in India?

Yes. PayU Biz is fully operational in India and is RBI-authorized for domestic and international processing.

6. Square

Square offers a complete POS and online commerce solution for merchants in select countries. It is widely used in markets like the US, UK, Canada, Australia, and Japan, and supports online and in-person payments through a unified platform.

It supports key currencies like USD, GBP, AUD, and EUR, with transparent pricing and fast payouts. However, Square is not available in India, and Indian businesses cannot use its services for exports or local sales.

Integration is seamless in supported countries via POS apps, APIs, and plugins, and customer support is region-specific and responsive.

Pricing & Fees

• Flat processing rates

• No FX markup for merchants

Integration Options

POS hardware, APIs, e-commerce plugins

Pros

• Unified POS + online setup

• No hidden charges

• Fast payout speeds

Cons

• Not available in India

• No support for Indian currencies or exporters

Is Square available in India?

No. Square only operates in select international markets and is not available for Indian merchants.

7. FIS Global (Worldpay)

Worldpay, operated by FIS Global, is an enterprise-grade international payment gateway designed for large businesses with international operations. It supports over 300 payment methods and 126 currencies, making it ideal for companies with complex global payment needs.

While not directly available in India, Indian businesses can access Worldpay through global partner integrations. It’s best suited for companies needing custom-built, multi-currency checkout flows with advanced reporting tools and high transaction volumes. Settlement timelines typically range from 1 to 4 days, depending on your banking partners.

Worldpay is fully PCI-DSS compliant and adheres to global financial regulations. Integration options include advanced APIs and tools like the FIS Money Movement Hub. Customer support is available 24/7, tailored for enterprise clients.

Pricing & Fees

• Enterprise-only pricing

• Custom quotes based on volume and geography

Integration Options

FIS PayDirect, Money Movement Hub, advanced APIs

Pros

• Covers 126+ currencies

• Highly customizable

• Suited for global scale

Cons

• Not directly available in India

• Complex onboarding for smaller merchants

Is FIS Global (Worldpay) available in India?

Partially—only accessible via international or partner integrations.

8. Sage Pay (now Sage Payments)

Sage Pay (now part of Sage Payments) is a UK/EU-focused payment service integrated with TransferMate to offer international vendor payments. While it doesn’t have a direct presence in India, it can be used by EU or UK entities paying Indian vendors.

It supports over 25 currencies and is known for its strong FX rates and ERP integrations, especially with Sage Intacct. Payouts for vendor payments are often near-instant through TransferMate. It is regulated within the EU and operates in full compliance with local financial authorities.

Integration is focused on ERP systems, with automation for invoice and vendor management. Support is offered during EU/UK business hours.

Pricing & Fees

• Competitive FX rates

• Enterprise quotes depending on volume

Integration Options

ERP (Sage Intacct), vendor flows, API

Pros

• Strong FX through TransferMate

• Streamlined vendor payouts

• ERP-ready automation

Cons

• No direct India support

• Not designed for consumer payments

Is Sage Pay (now Sage Payments) available in India?

No. Sage Pay services are limited to UK/EU clients and their vendors.

9. Instamojo

Instamojo is a fast, India-based payment gateway built for micro and small businesses selling in INR. It’s designed for simplicity. It is ideal for digital sellers, service providers, and creators selling domestically.

It only supports INR and does not offer any global payment functionality. Payments are settled to Indian bank accounts in two working days, and the platform is fully compliant with RBI norms for domestic payment aggregators.

Integrations are low-code and no-code, with options like payment links, WordPress, and WooCommerce plugins. Support is provided via email and chat.

Pricing & Fees

• ~2% per domestic transaction

• No setup or maintenance fees

Integration Options

Payment links, WordPress, WooCommerce, API

Pros

• Quick and easy setup

• Ideal for domestic businesses

• Low technical barrier

Cons

• No foreign currency support

• Not suitable for exporters

Is Instamojo available in India?

Yes. Fully domestic and widely used by Indian SMBs.

10. Amazon Pay

Amazon Pay enables merchants to offer a checkout experience powered by Amazon, allowing buyers to pay using their Amazon account. It’s especially useful for sellers on Amazon marketplaces or websites looking to add a trusted checkout option.

Indian sellers can use Amazon Pay for INR transactions, and the Amazon Global Selling program supports cross-border transactions from international customers. Supported currencies include USD, GBP, and EUR, with payouts typically taking 7–14 days, depending on your seller tier and region.

The platform is RBI-compliant and acts as a payment aggregator. Integration is simple through Amazon Pay buttons and SDKs, and support is offered through Amazon Seller Central.

Pricing & Fees

• Commission-based (varies by product and category)

• No additional FX markup

Integration Options

Amazon Pay buttons, login with Amazon SDK

Pros

• Trusted brand with global reach

• Streamlined checkout

• Amazon seller support

Cons

• Payouts take 7–14 days

• Commission structure can be complex

Is Amazon Pay available in India?

Yes. Available to Indian sellers, including those targeting global customers via Amazon.

Summary Comparison

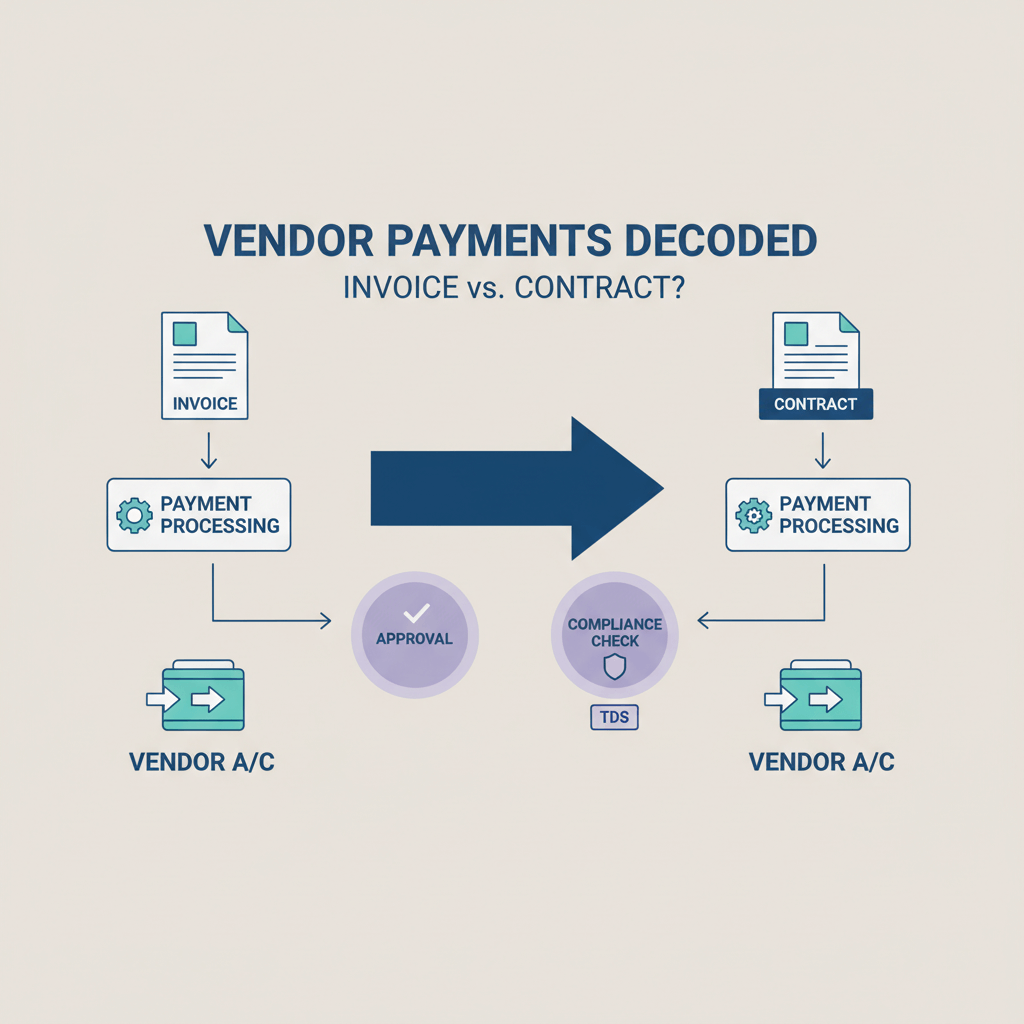

What to Consider When Choosing an International Payment Gateway?

Choosing the right international payment gateway helps you get paid reliably, in the right currency, and within regulatory limits. E-commerce exporters should evaluate:

• Currency Support: Can you accept payments in USD, EUR, AUD, and settle in INR?

• Settlement Speed: How long does it take for funds to reach your Indian bank?

• Fee Transparency: Watch for hidden charges—look beyond just the per-transaction rate.

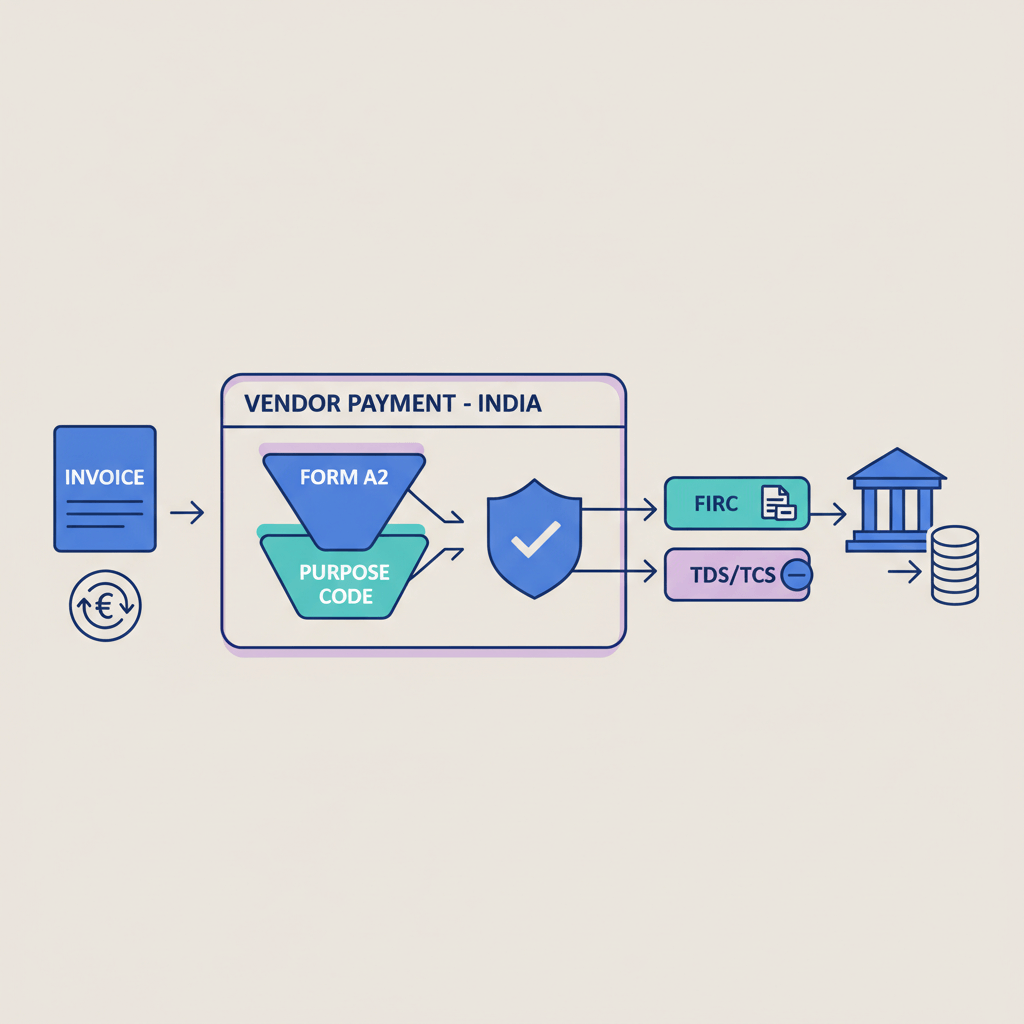

• Compliance Readiness: RBI purpose codes, FIRA generation, and GST export reconciliation matter.

• Integration Options: Choose one that fits your platform—Shopify, WooCommerce, or custom stack.

• Customer Support: Local support is crucial when remittances get stuck or flagged.

Best International Payment Gateways for Ecommerce:

1. Amazon

Best Gateway: Amazon Pay (built-in)

Amazon doesn’t require an external payment gateway. All payments made by customers go through Amazon’s own systems, and funds are directly settled to the Indian seller’s bank account. Export transactions are handled within Amazon’s compliance framework.

• No need for Razorpay, PayPal, or Stripe

• Export documentation (like FIRA equivalents) is available via Amazon reports

(promote Karbon here)

2. eBay

Best Gateway: PayPal

PayPal remains the most widely accepted option for Indian sellers on eBay. It’s globally trusted, easy to set up, and well-suited for small exporters and resellers.

• Automatically provides FIRA after withdrawal to your Indian bank

• eBay also supports Payoneer (not covered here), but PayPal has broader global familiarity

• Ideal for freelancers or small businesses with international customers

3. Etsy

Best Gateway: PayPal

Etsy Payments supports PayPal as one of its payout channels in many countries. For Indian sellers, PayPal offers a simple way to receive funds and is well-suited for selling handmade or small-ticket items.

• Great for micropayments

• FIRA available after fund withdrawal

• Minimal technical setup required

4. Shopify

Best Gateways: Razorpay, CCAvenue, PayU Biz, Stripe

Shopify allows multiple payment gateway integrations, making it flexible for Indian sellers going global.

• Razorpay and PayU Biz: Good for both INR and export payments; provide FIRAs

• CCAvenue: Works well with Shopify plugins and supports USD settlement

• Stripe: If invited, provides seamless multi-currency checkout with strong API tools

Each of these supports Shopify plugins or API-based integration, so the choice often depends on your technical team and export volume.

5. Noon (UAE)

Best Gateway: CCAvenue or PayU Biz

Noon handles end-customer payments internally, but Indian sellers receive payouts through cross-border providers. CCAvenue and PayU Biz are well-suited for this, especially under aggregator programs like Noon Global.

• Support USD payouts with export documentation

• FIRA available through both platforms

• Best suited for sellers partnering with Noon’s UAE operations

Using Karbon as an International Payment Gateway

Karbon is an RBI-compliant cross-border remittance platform for Indian businesses. It provides virtual global accounts in USD, GBP, EUR, and other currencies, allowing sellers to get paid locally by platforms like Amazon, Walmart, Etsy, etc and then convert those payments to INR at reasonable exchange rates.

Karbon benefits:

• No foreign transaction charges from marketplaces

• Automatic FIRA issuance and GST reconciliation

• RBI-compliant with purpose codes and IEC mapping

• Works well for D2C brands, Amazon sellers, SaaS exporters, and B2B freelancers.

FAQs:

Q1. Which payment gateway is best for integrating with Shopify or WooCommerce?

Stripe, Razorpay, and PayU offer seamless plugins for Shopify, WooCommerce, and BigCommerce. PayPal also works out of the box with most platforms, while CCAvenue and Instamojo support custom integrations or hosted payment links.

Q2. Do I need a business account to use a payment gateway for global sales?

Yes. Most international gateways require you to register as a business entity (sole proprietorship, LLP, or Pvt Ltd) with GST and an Import Export Code (IEC) to remain FEMA-compliant and generate FIRAs.

Q3. Can I accept international payments in foreign currency on my website?

Yes, if your payment gateway supports multi-currency checkout (e.g., USD, EUR, GBP). Stripe, Razorpay, PayU, and PayPal allow customers to pay in their local currency while you receive INR settlements in India.

Q4. How long does it take for international e-commerce payments to reach my Indian account?

Stripe / PayPal / PayU / Razorpay: 1–5 working days

CCAvenue / Instamojo: Typically 2–4 working days

Amazon Pay (Global): Settlements start 14 days after first sale, then weekly

Q5. Do I get a FIRA or FIRC for each international e-commerce transaction?

Yes, but not all gateways auto-issue it. PayPal and Razorpay allow you to download it. CCAvenue may require coordination with your bank. Karbon provides FIRAs automatically as part of export compliance.

Q6. What’s the difference between displaying prices in INR vs. USD on my website?

Displaying prices in USD or EUR improves user experience for global buyers and reduces cart abandonment. Gateways like Stripe and PayPal support true multi-currency checkout; others like Instamojo may only allow INR billing.

Q7. What fees should I expect for international card payments?

Typically, expect:

Gateway fee: ~2.5% to 4.5% per transaction

FX markup: 1% to 3% on currency conversion

GST: On platform fees only, not on foreign earnings

.png)