PayPal has restrictions on sending, receiving, and fees. Karbon gives Indian businesses more freedom.

PayPal is one of the most widely used online payment platforms in the world. It enables individuals and businesses to send and receive payments in multiple currencies across borders with ease.

With features like one-click checkout, invoicing, and buyer protection, it’s become a trusted option for millions of users globally.

However, for users in India, PayPal functions quite differently. Due to local regulations, it comes with several restrictions. Especially when it comes to domestic transactions or sending money abroad.

This guide breaks down exactly how PayPal works in India in 2025, what you can (and can’t) do with it, and whether it’s the right fit for your business.

Who Can Use PayPal (Globally)?

Here’s how PayPal works for most countries worldwide:

To use PayPal, you must:

• Be at least 18 years old (or the age of majority in your country)

• Have a valid email address

• Link a bank account, debit card, or credit card

• Be located in a country where PayPal operates

PayPal offers two types of accounts:

Personal account – for online shopping, receiving payments from friends/family, or freelancers.

Business account – for merchants and companies who want to accept payments professionally.

These are the most common features PayPal offers all over the world.

But due to RBI’s restrictions in India, some features are restricted.

Does PayPal Work in India?

Yes, PayPal works in India, but only for international transactions. (Only for receiving money from abroad, not sending)

As of 2025, PayPal India allows users to:

• Receive payments from international clients (in USD, EUR, GBP, etc.)

• Withdraw funds to their linked Indian bank account

Since 2021, PayPal no longer supports domestic payments within India.

You cannot:

• Use PayPal to pay Indian merchants.

• Send money to Indian friends/family.

• Pay or receive money via UPI or wallets like Google Pay.

Types of Businesses PayPal Is Built for in India

Based on PayPal India’s official website, their offerings are customized for the following business categories:

1. Small Businesses

Functions they can do:

• Accept payments online and in-person

• Send invoices

• Generate payment links or QR codes

• Connect with ecommerce platforms like Shopify, WooCommerce

• Get business insights and manage sales

Available payment methods:

• PayPal Wallet

• Credit and debit cards (Visa, Mastercard, etc.)

• Local methods via links

2. Enterprise Businesses

Functions they can do:

• Modular payment solutions across global channels

• Advanced fraud detection and compliance

• Analytics and reporting

• Pay Later options, global checkout optimization

Available payment methods:

• Global cards

• PayPal, Pay Later, Venmo (US)

• Regional methods in 200+ markets

3. Third-Party Platforms & Marketplaces

Functions they can do:

• Onboard sellers

• Route payouts globally

• Accept and make payments

• Handle compliance (KYC, AML, OFAC)

• Consolidated reporting & risk management

Available payment methods:

• PayPal

• Cards (global + local)

• Pay Later

• Subscriptions & Invoicing

4. Developers

Use APIs and SDKs for:

• One-time, recurring, vaulted payments

• Disputes, invoicing, subscriptions

• Card processing and checkout customization

Available payment methods:

• PayPal

• Credit/debit cards

• Apple Pay, Google Pay

• Regional wallets (depending on user’s country)

Who Is PayPal Built for in India?

The international transaction supported by Papal are most suited for:

• Ecommerce sellers and DTC brands exporting globally

• SaaS and subscription platforms accepting international cards

• Developers and marketplaces building payment flows

• Businesses targeting individual foreign consumers

PayPal Is Not For Businesses Dealing With:

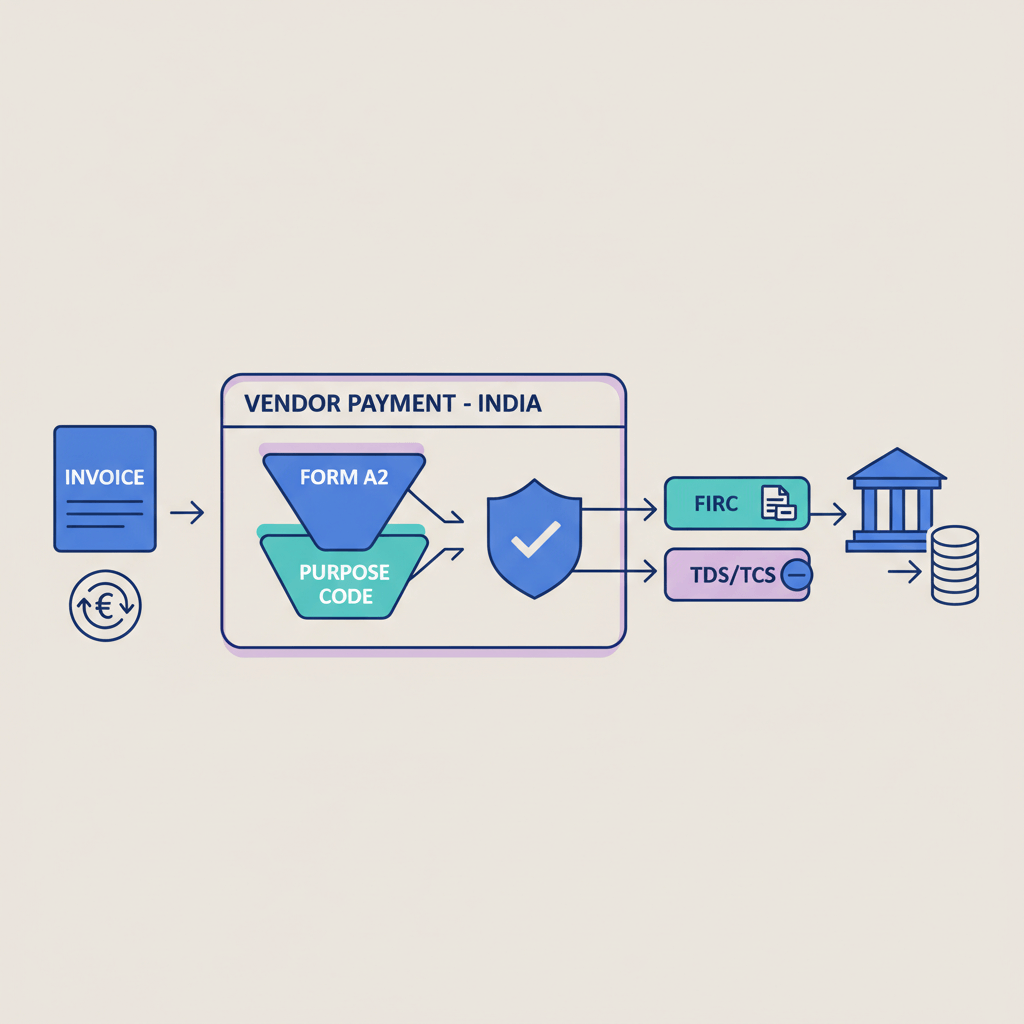

• Import-export businesses needing FIRA, 15CA/CB, BOE

• Freelancers in India needing stable, compliant inward remittance

• (They often report delays, account holds, or FX compliance issues)

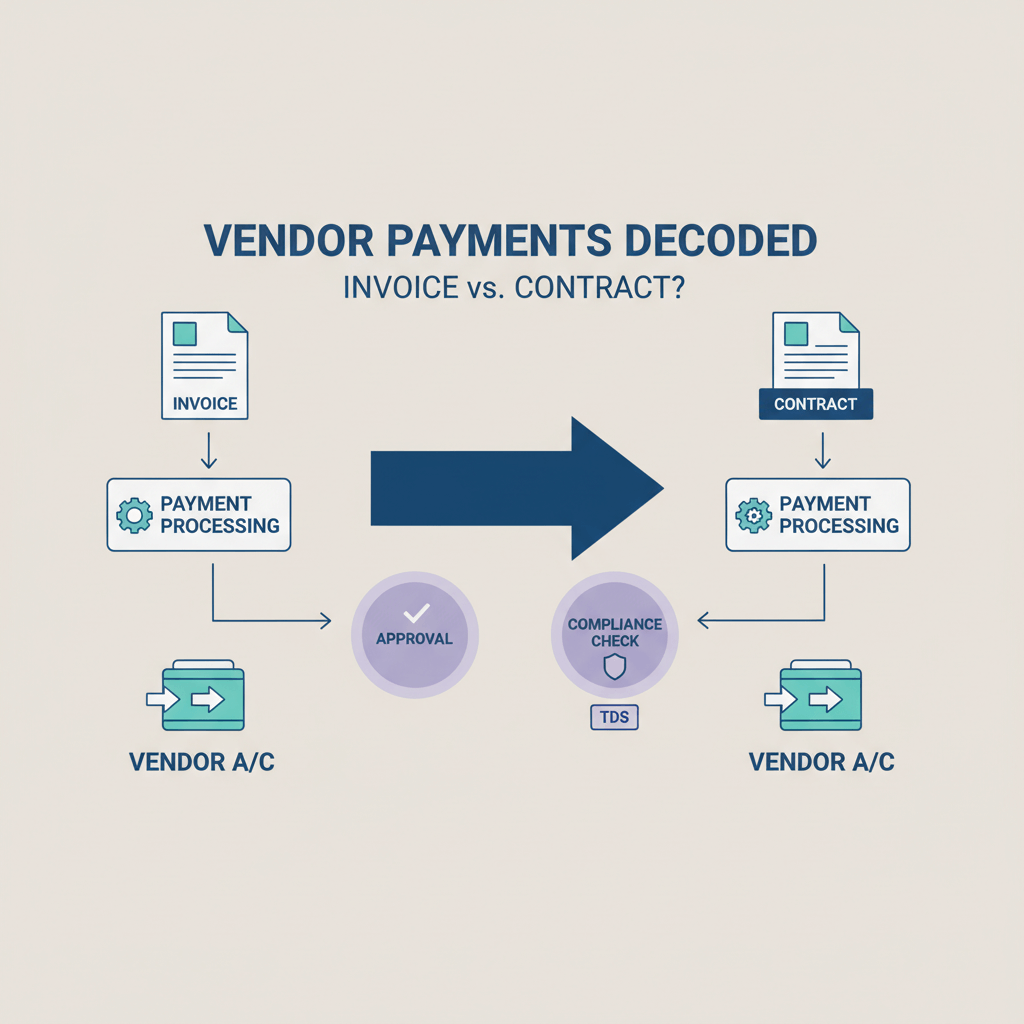

How to use PayPal to receive money from abroad?

Create Personal Account In PayPal:

1. Go to PayPal.in → Sign Up → choose Individual

2. Enter email, password, name, other details

3. Verify email via link

4. Link and verify a debit/credit card using OTP

5. (Optional) Link bank account for withdrawals

Create Business Account In PayPal:

• Go to PayPal.in → Sign Up → choose Business

• Provide business type, PAN, email, etc.

• Verify email

• Link bank account (verified via micro-deposits)

• Link card if needed for transactions

You cannot use either account to send money abroad or make international payments to other PayPal users.

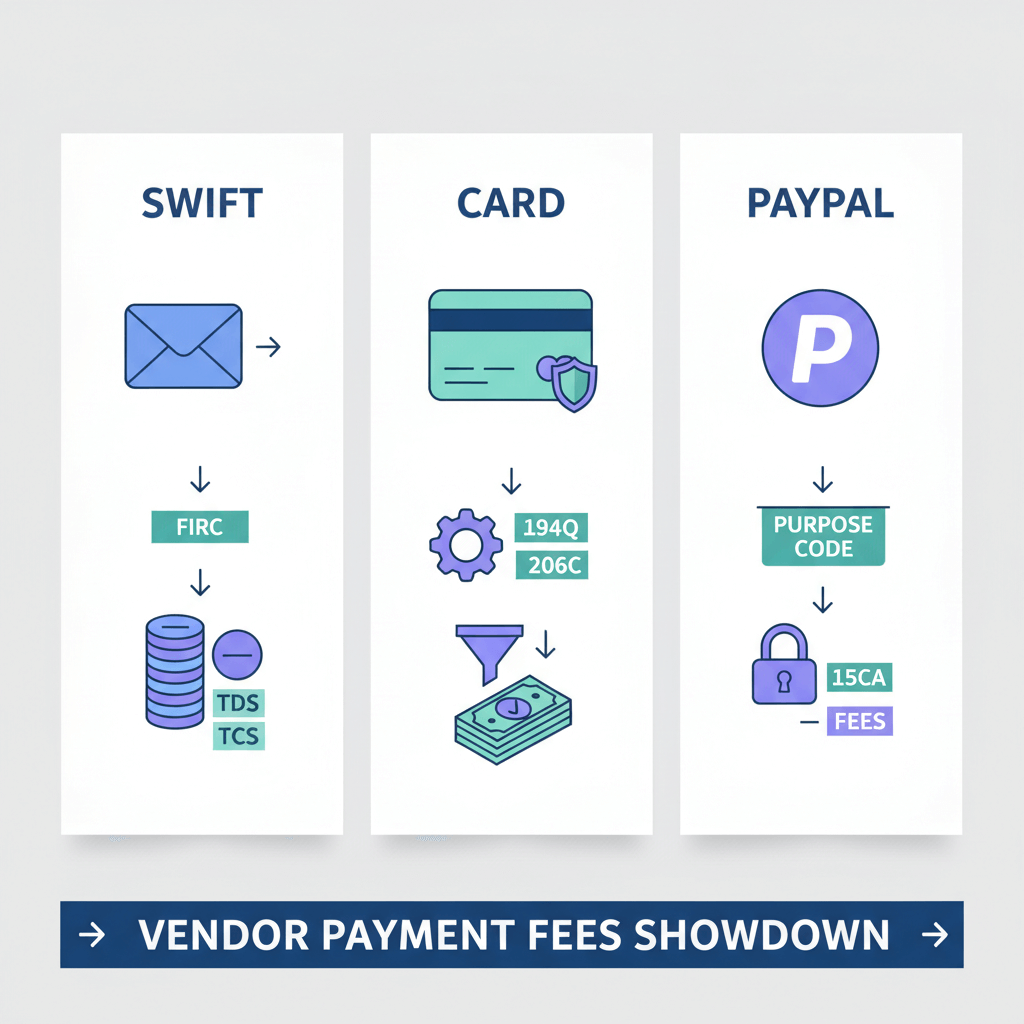

PayPal Fees and Exchange Rates in India

PayPal charges Indian users two types of fees when receiving payments from abroad. First, there’s a transaction fee of 4.4% on the total amount received, along with a fixed fee based on the currency.

In addition, PayPal applies a currency conversion fee of approximately 3% to 4% above the mid-market exchange rate, which means you receive a lower INR value than what standard forex rates suggest.

If you receive $1,000 from a U.S. client:

• $44 is deducted as transaction fees

• $30–$40 may be lost due to PayPal’s inflated exchange rate

• You might receive ₹77,000–₹78,500, depending on the USD-INR rate that day

No setup or monthly maintenance fees

• PayPal only charges fees when you get paid

• There's no cost to open an account or integrate basic features

Is PayPal Secure?

PayPal is one of the most widely trusted payment providers globally, with several layers of security protocols.

They have the following security protocols:

• End-to-End Data Encryption: Your data is protected during transmission and storage

• PCI-DSS Compliant: Meets industry standards for secure card handling

• Two-Factor Authentication (2FA): Extra protection during login

• Advanced Fraud Monitoring: Machine learning-powered transaction checks

• Buyer & Seller Protection: Eligible accounts are covered in cases of fraud or delivery issues

However, Indian users have raised concerns about:

• Delayed fund settlements for new accounts or "suspicious" transactions

• Account freezes due to compliance or foreign remittance policies

According to user forums and review platforms like Trustpilot, many freelancers in India have experienced issues with fund holds and verification delays.

Is PayPal the Best Option in India?

While PayPal is technically available in India, it may not be the best fit for many users, especially businesses, because of several important restrictions. It only allows users to receive international payments and does not support sending money abroad or making domestic payments.

There is also a transaction limit. Users can receive a maximum of USD 10,000 per transaction, which can be restrictive for large-value payments.

When you add relatively high fees and the lack of support for INR balances, PayPal becomes less practical compared to newer, more India-focused payment solutions.

Final thoughts

The answer to your question- will PayPal work in India?

Yes, but only to receive international payments. It’s suitable for small ecommerce brands or global SaaS firms collecting foreign payments. But it’s not ideal for freelancers, import-export businesses, or anyone needing regulatory documents like FIRA.

Looking for better control, compliance, and FX savings?

FAQs

How does PayPal work in India?

PayPal in India is limited to receiving international payments. You can withdraw funds to your linked Indian bank account, but you cannot use it for domestic purchases, sending money abroad, or paying Indian merchants.

How much does PayPal charge in India?

PayPal charges a 4.4% transaction fee plus a fixed currency-based fee, along with a 3%–4% currency conversion markup. This means you may lose around ₹4–₹6 per US dollar due to fees and forex spread.

Can PayPal send money to UPI or wallets like Google Pay or Paytm?

No. PayPal India does not support sending money to UPI apps or any Indian digital wallets.

Does PayPal convert currency automatically?

Yes. If you receive foreign currency, PayPal automatically converts it to INR when withdrawing to your Indian bank account. However, the exchange rate includes a markup, making it less favorable than market rates.

Can I hold foreign currency in my PayPal India account?

No. PayPal India does not allow you to hold balances in foreign currencies. All funds are auto converted to INR before withdrawal.

Where is PayPal available and how is it used from India?

PayPal operates in over 200 countries. In India, it's only for receiving international payments. You can’t use it for domestic or peer-to-peer payments due to RBI restrictions.