With Karbon, get paid in USD at ~1% cost, and manage your money your way.

For freelancers, consultants, and exporters in India, PayPal feels like the easiest way to get paid in USD.

The platform has earned that reputation for being trustworthy and convenient — rightly so.

Most businesses start with PayPal. But a few months in, we’ve heard them say the same thing: “It’s costing me too much.”

The problem is, it’s an expensive way to bring your hard-earned money home. Between transaction fees and hidden currency conversion markups, you can quietly lose 5%–8% of your earnings every time you get paid.

This guide breaks down exactly how much PayPal charges for USD to INR, including what you really take home on payments of $1,000 or $10,000. It also suggests better alternatives to save on exchange rates and markup fees.

What Services Does PayPal Offer in India?

PayPal’s biggest advantage in India is its simplicity. With just your email ID, you can accept payments from clients in the US, UK, Europe, and over 200 countries.

Of course, you still need to link an Indian bank account and complete KYC with documents like your PAN, address proof, and bank details. But once you’re verified, getting paid is as easy as sending an invoice link or sharing your PayPal email.

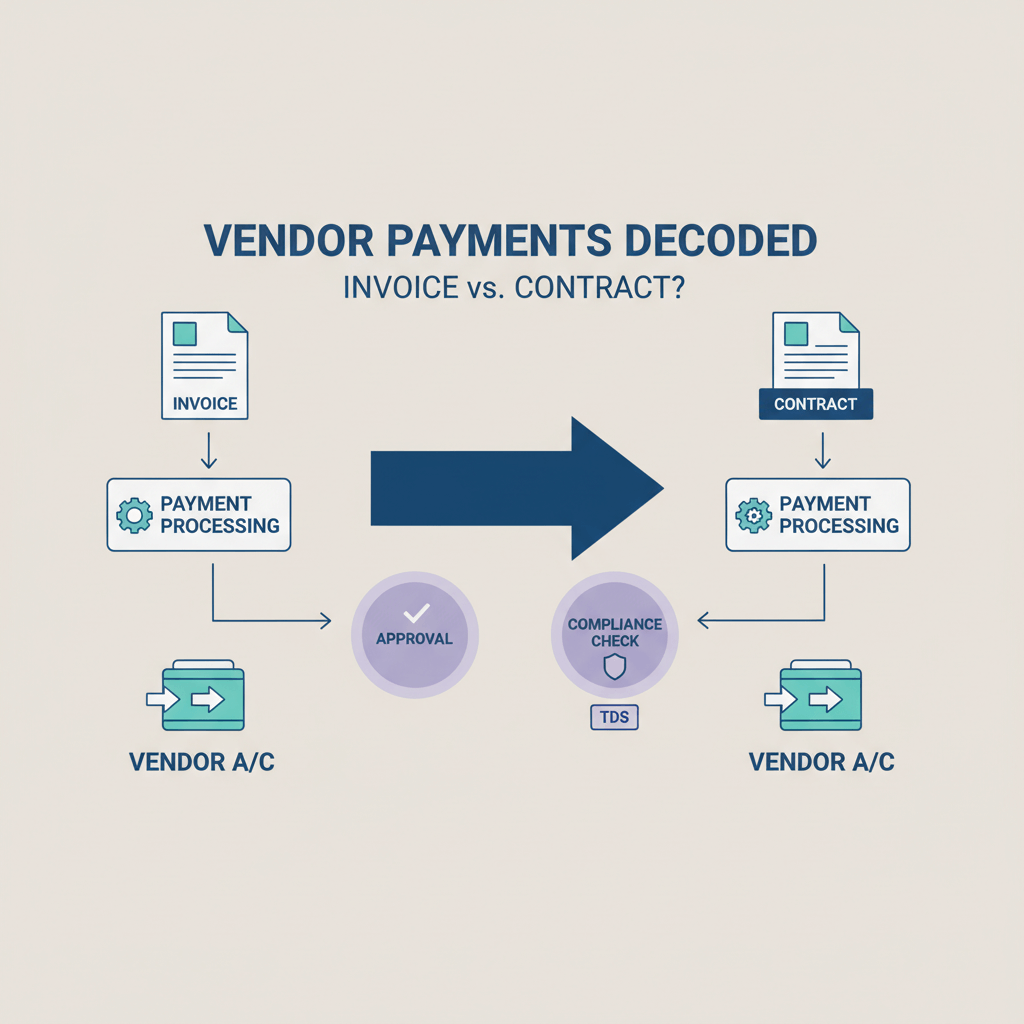

Here’s how the flow works:

• Your client pays you in USD (or any supported currency).

• The money lands in your PayPal account.

• PayPal automatically converts it to INR and transfers it to your linked Indian bank account.

You don’t have to chase clients for wire transfers or handle complex forex paperwork for every small job. That’s why so many freelancers, consultants, and small businesses use PayPal as their first step into international payments.

What You Can’t Do with PayPal in India

PayPal’s global features don’t work completely for Indian users. You can’t use your PayPal India account to pay overseas vendors or contractors in foreign currency. In short, outward remittance isn’t allowed for Indian users under RBI rules.

Secondly, you also can’t hold a PayPal balance in USD. Indian forex laws require any USD you receive to be converted to INR and withdrawn to your local bank account. PayPal must do this automatically within 24 hours of the money clearing.

If you see a 7–14 day wait, that’s because PayPal may hold payments temporarily for new sellers, high-risk transactions, or fraud checks. Once cleared, the funds auto-withdraw. You can’t choose to hold them or time the withdrawal yourself.

How Much Does PayPal Charge in India?

If you search “USD to INR” on Google, you’ll see the real mid-market exchange rate. Currently, it’s around 83.30 INR per USD. Over the past year, it has mostly fluctuated between 82.50 and 83.80. PayPal never gives you that exact rate.

Two things eat into your money when you use PayPal to receive USD in India:

Transaction Fee

For international commercial payments, PayPal typically charges 4.4% of the payment amount. Plus, it adds a fixed fee (around $0.30 USD per transaction). This is PayPal’s standard fee for processing and handling the payment.

.png)

If you receive payments through marketplaces like Fiverr or Upwork, they may also charge their own platform or withdrawal fees on top of PayPal’s fee. So your total cost can vary slightly depending on where the payment comes from.

Currency Conversion Spread

.png)

When PayPal converts your USD to INR, it doesn’t use the fair mid-market rate you’d find on Google. Instead, it builds in a hidden markup, usually 2.5%–4% above the real exchange rate. So every dollar you receive loses more value when it’s converted to rupees.

Example: What Happens When You Receive $1,000 USD Using PayPal

Let’s break this down with a simple example. Suppose you complete a project for $1,000 and get paid directly into your PayPal account.

• PayPal deducts its standard fee: 4.4% of $1,000 = $44

• You’re left with $956.

• When this converts to INR, PayPal applies its own rate. The rate is 2.5%–3% lower than the real mid-market rate. That’s about another $24–$28 lost in the spread.

In the end, your $1,000 becomes around $928.

If You’re Using Fiverr or Upwork, Read This

Most freelancers on Fiverr or Upwork get hit twice. First, the platform charges its own service fee. Fiverr takes up to 20% of your gig price. Then when you withdraw using PayPal, you pay PayPal’s fees and conversion spread too.

Example: What Happens When You Receive $1,000 USD From Marketplace Using PayPal

• Earn $1,000 on Fiverr. Fiverr keeps 20% ($200).

• Withdraw $800 via PayPal.

• PayPal’s 4.4% fee on $800 is about $35. Add the FX spread (~$20–$24).

When the payment settles, you’re left with $740–$745. There’s a total cut of 25%.

The $10,000 Payment Breakdown for Exporters/Businesses

Agencies, consultants, and small exporters moving larger amounts feel this even more. If a client pays you $10,000, PayPal’s percentage stays the same — but the absolute cost jumps.

• 4.4% fee: $440

• FX spread at 3%: about $285 lost to the markup

• Total cost: $725 gone before the money lands in INR.

Reviews: What Indian Users Say

To understand the real problems Indian freelancers and businesses face with PayPal, we did a bit of first-hand research. We went through user reviews on platforms like Trustpilot, consumer forums, Reddit threads, and YouTube comments.

.png)

PayPal, as we said, is popular for its ease of use and global reach. Many users appreciate how simple it is to send an invoice and get paid without needing clients to do complex wire transfers.

But there were two major complaints that kept coming up.

High Fees

.png)

This frustration came up repeatedly. Some freelancers said they only realised how much they were losing after comparing PayPal’s payout to other services.

Payment Holds

.png)

The second most common issue is PayPal putting payments on hold for up to 7–14 days, especially for new accounts or large payments. Many users complain that this creates unnecessary cash flow gaps and delays when you’re relying on that money for bills or business expenses.

Better Ways to Get Paid Than PayPal

PayPal is convenient, no doubt about that. But once you’re earning in USD regularly, it makes sense to look at better ways.

Some methods are a bit less convenient but save you a lot in fees. Others are just as easy as PayPal but with no hidden charges and better exchange rates.

Open a Foreign Currency Account (EEFC)

If you’re a registered exporter or have a business that gets paid from overseas, an EEFC (Exchange Earners’ Foreign Currency) account can be a good start.

This account lets you legally hold your earnings in USD or other foreign currencies in India. You don’t have to convert everything to INR immediately. You can wait and convert when the rate is better.

Many Indian banks like SBI, ICICI, and HDFC offer EEFC accounts. The only catch is you’ll need to be a registered business or exporter to open one.

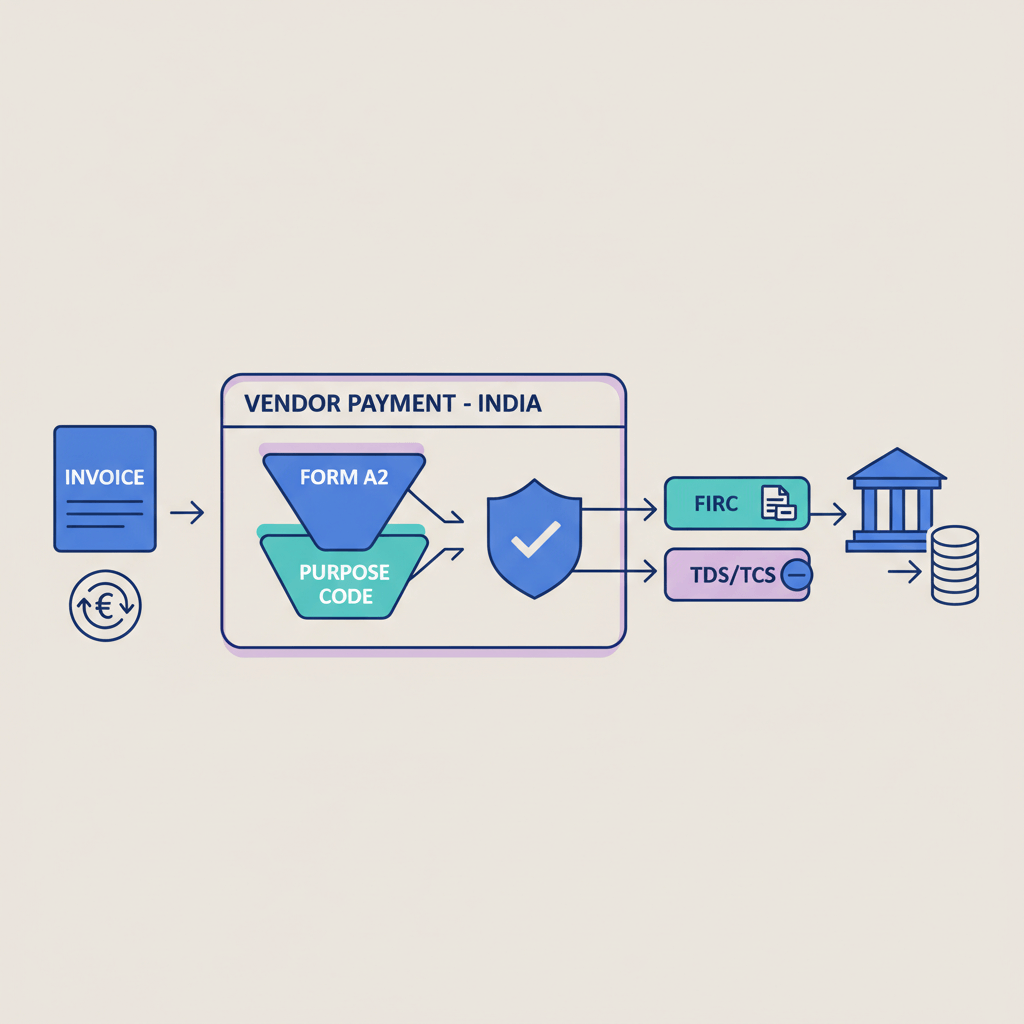

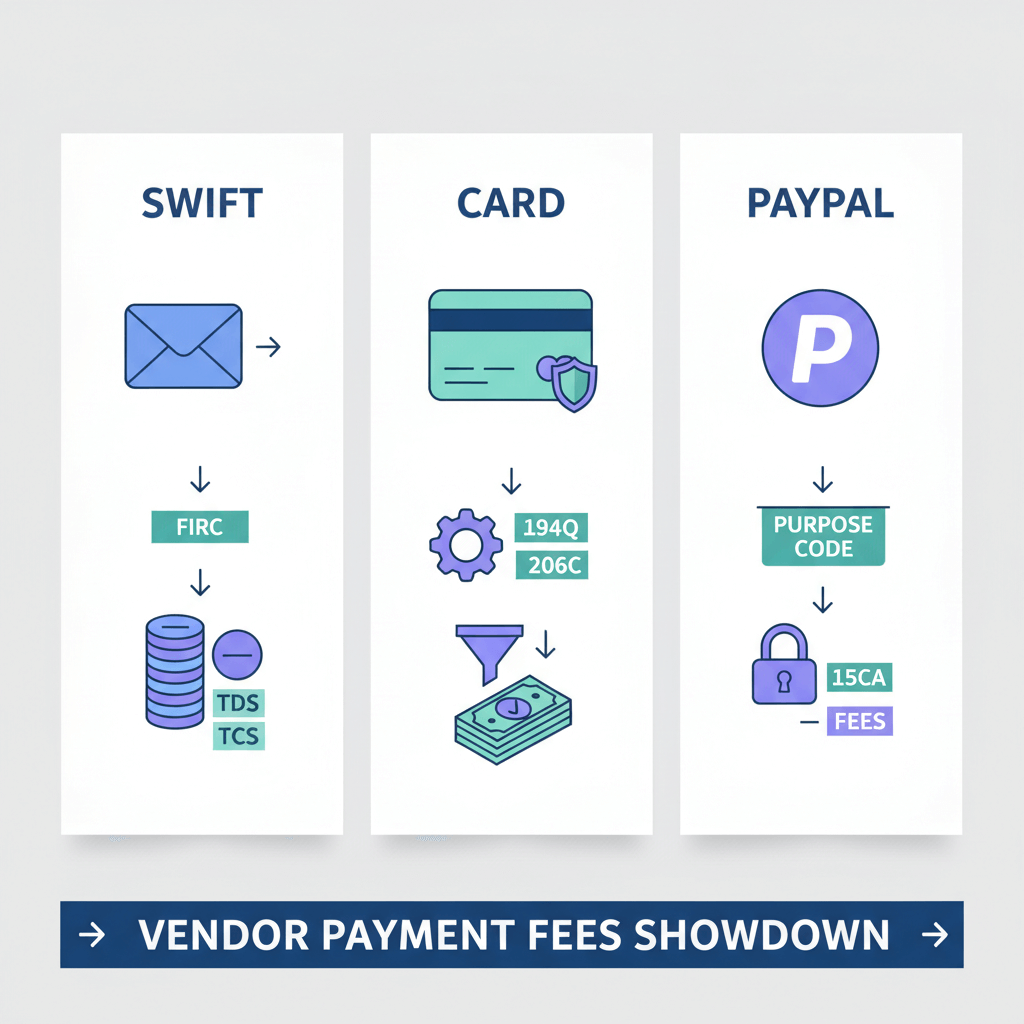

Use SWIFT Transfers

For larger projects, a direct SWIFT transfer can save you more than PayPal.

Clients send the payment straight to your Indian bank account. The bank’s currency conversion spread is usually lower than PayPal’s hidden markup. There’s a flat inward remittance fee, but for bigger deals, it’s worth it.

Most SWIFT payments arrive in 1–3 working days. But keep in mind, you might face some delays or paperwork at times. Some banks may ask you to visit a branch or submit export documents if it’s a big amount.

If you have an EEFC account, you can even hold the USD in your account and convert it when the rate looks good. This gives you more control over your earnings than PayPal’s forced daily conversion.

Try Platforms with Lower Fees (Like Karbon)

Some payment platforms in India have come up in recent years. They are equally secure, convenient, and are designed to help freelancers and small exporters get paid with less loss.

For example, Karbon lets you receive USD payments directly with lower currency conversion costs than PayPal. You usually get rates closer to the actual mid-market rate you’d see on Google.

Karbon vs PayPal: Which One Is Better?

Final Thoughts: Should You Keep Using PayPal?

If you’re doing the occasional $100–$500 gig on Fiverr or Upwork, PayPal’s convenience can be worth the fees. For small, one-off projects, it’s quick, trusted by clients, and easy to set up.

But if you’re billing $1,000, $5,000, or $10,000 projects every month, those hidden fees can add up to lakhs every year.

Knowing exactly how much PayPal charges for USD to INR helps you plan better. We do not recommend freelancers or businesses to abandon PayPal overnight. You can keep it as a backup and slowly switch larger payments to better options like SWIFT transfers or platforms with fairer conversion rates.

FAQs

Does PayPal charge for international transactions?

Yes. It takes a service fee (around 4.4%) plus a currency conversion markup.

How much does PayPal charge for USD to INR today?

There’s no fixed daily rate. The FX markup is usually 2.5%–4% above the real market rate.

Can PayPal convert dollars to rupees?

Yes, it can. It automatically converts your USD balance to INR and withdraws it to your linked bank.

Can I keep USD in my PayPal balance?

No. PayPal India must auto-withdraw to INR to comply with local rules.

What’s a better option than PayPal for USD to INR payments?

The better option depends on your goal. If you need better exchange rates and flexibility, a foreign currency account (EEFC), direct SWIFT transfer, or a modern multi-currency solution like Karbon can save you 3%–5% per payment.