When an exporter ships goods internationally, there are mandatory formalities they must adhere to. This includes paying duties, submitting various documents, and following procedures. Without complying with these rules, the goods cannot leave the country.

There are at least 10-17 different documents required from the start to the completion of the shipment process.

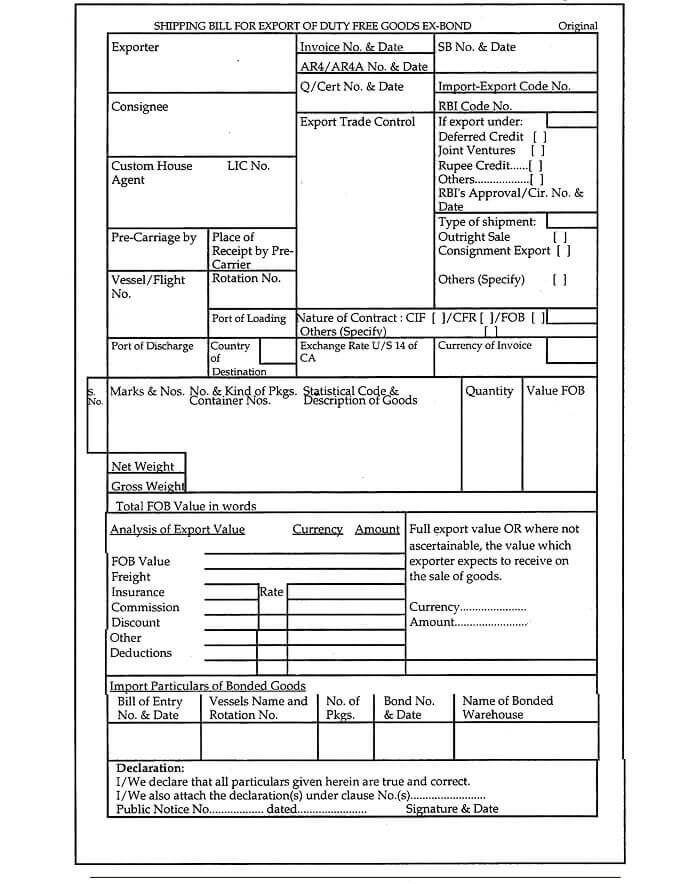

One of the key documents you’ll need is the shipping bill. This must be filed with the Customs Department before the goods can be loaded for shipment, whether by air, sea, or land.

What is a Shipping Bill?

A shipping bill is a detailed form that includes important information about your shipment—what exactly you're sending, the value of the goods, where they’re headed, and any other relevant details.

You can file it electronically through India’s e-filing system. If there’s a technical issue, and you can't file it online, you can also request an exemption. In such cases, the Principal Commissioner or the Commissioner will allow you to submit a physical version of the shipping bill instead.

Types of Shipping Bills

Shipping Bill Format and Components

Exporter’s Information

This section captures all the essential details about the exporter:

- Name and Address: The full details of the exporter, including the registered office address.

- IEC Code: The unique Import Export Code (IEC) assigned to the exporter, which is necessary for international trade.

- Contact Information: The exporter’s contact details, including email and phone number, to ensure easy communication for follow-ups.

Consignee’s Information

Here, the recipient's details are specified:

- Recipient Name and Address: The name and address of the buyer or the company receiving the goods.

- Destination Country: The country where the goods are headed. This helps Customs track international shipments.

Details of Goods

This part describes the goods being exported:

- Description of Goods: A clear and concise description of the items being exported.

- HSN Code: The Harmonized System of Nomenclature (HSN) code, which is used globally to classify goods for customs and tax purposes.

- Quantity and Value: Precise information on the quantity of goods being shipped and their total value.

- Packaging Details: How the goods are packed (e.g., boxes, containers) and their total weight.

- Customs Tariff: The tax category under which the goods fall, as per customs regulations.

- Country of Origin: The country where the goods were produced or manufactured. Both exporter and receiver of goods would need a certificate of origin to proof the country of origin.

Export Declaration

This section confirms that the exporter has complied with export laws and paid necessary customs dues. It includes:

- A declaration from the exporter that all regulations have been followed.

- Details of any export benefits or incentives, such as Duty Drawback or government schemes, if applicable.

- The port of export, along with the mode of shipment (sea, air, or road).

Customs Duty and Incentive Details

This part specifies any applicable customs duties the exporter must pay. It also mentions any exemptions or incentives the exporter is eligible for, such as:

- Export Promotion Capital Goods (EPCG) scheme

- Duty Drawback for refunds on duties paid on imported goods used in manufacturing.

Shipping Details

Here, exporters provide information about the shipping process:

- Vessel Name: For goods shipped by sea.

- Airway Bill Number: For goods being transported by air.

- Container Details: If the goods are shipped in containers, relevant details about the containers will be included.

Exporter’s Declaration

In the final section, the exporter confirms that all the details provided are correct and comply with Indian Customs regulations. This declaration ensures that the exporter takes full responsibility for the shipment’s compliance.

Frequently Asked Questions On Shipping Bills

Is a Bill of Lading and Shipping Bill the same?

No, a Shipping Bill and a Bill of Lading are not the same.

- A Shipping Bill is filed with Customs for export clearance, detailing the goods, their quantity, and destination.

- A Bill of Lading is issued by the carrier as a receipt, confirming they’ve received the shipment and will deliver it to the specified destination.

What happens if the Shipping Bill is not filed on time?

If the Shipping Bill is not filed on time, the export clearance may be delayed, and the goods cannot be shipped until the proper documentation is submitted.

Can I make changes to the Shipping Bill after submission?

Once the Shipping Bill is filed and accepted by Customs, changes can only be made under specific circumstances. You may need to request an amendment through the Customs Department.

What happens if the exporter’s details are incorrect on the Shipping Bill?

Incorrect exporter details on the Shipping Bill can lead to delays, penalties, or even the rejection of the shipment. It's essential to ensure all details are accurate before submission.