Key takeaways

- Pick the right rail for the job: US clients pay cheapest via ACH to a virtual USD account, EU clients via SEPA, big enterprise invoices via SWIFT when needed.

- Use a virtual multi currency account to collect locally in USD, EUR, GBP, then settle INR in 24 to 48 hours, with platforms like Karbon Business.

- Lock in savings: ACH to virtual USD can cost about 1 percent with zero FX markup, versus PayPal at 3 to 4 percent and wires with flat fees plus bank FX margins.

- Stay compliant by mapping the right RBI purpose code, typically S0191, S0199, or S0101, and auto generating e-FIRA for every inward remittance.

- For smaller, irregular payouts, use payment links, for larger milestones, prefer bank rails to reduce dispute risk and fees.

- Organize invoices, e-FIRAs, and settlements in one folder, reconcile monthly, and consult a CA for GST and FEMA nuances.

- Test with a small invoice, confirm flow end to end, then shift your regular clients to the optimal rail.

What payment rails actually matter for Indian developers

Payment rails are the networks that move money from your client to you, think of them as highways that vary by speed, cost, and coverage. For a concise primer on the landscape, see what are payment rails, payment rails explained by Stripe, and a merchant focused overview of payment rails.

ACH, SEPA, card, and SWIFT in plain English

ACH (Automated Clearing House): the workhorse of US domestic transfers, batch processed, one to three business days, costs cents, but US only. You can still use it by collecting into a virtual USD account from a platform like Karbon Business, then receiving INR within 24 to 48 hours.

SEPA and UK FPS: lightning quick in the EU and UK, great for European clients, you will need virtual EUR or GBP details to collect locally.

Card rails: good for small or urgent milestones via payment links, higher fees and chargeback exposure.

SWIFT: the global wire standard, reliable for large B2B invoices, but slower and pricier than local rails.

Bottom line: pick the rail that matches client location, invoice size, and urgency. For US clients, ACH to a virtual USD account is usually the cheapest, for EU, use SEPA, for very large invoices or conservative finance teams, SWIFT still works.

Pro tip: Platforms that support multiple rails and currencies give you leverage, you can meet the client where they are and still receive INR fast at fair FX.

How ACH payments from US clients to India really work

The common question is, “My client is in the US and wants to pay me via ACH. I am in India, how does that work?” ACH is a domestic US network, it does not send money directly to an Indian bank account, as explained in this merchant guide to payment rails and this breakdown of money movement infrastructure.

- Open a virtual USD account with a platform like Karbon Business, you get a US routing and account number in your name.

- Invoice your client with those USD details, they send a domestic ACH, it lands in one to three business days.

- The platform converts at the mid market rate, zero markup, and settles INR to your Indian account in 24 to 48 hours.

- Purpose code is auto mapped and your e-FIRA is generated within 24 hours, so compliance is handled.

Why this beats SWIFT or wallets for US clients: lower cost, faster INR, less friction for your client, automatic documentation.

Get paid for GitHub freelance work in India, practical use cases

For bounties and quick fixes, payments are small and uneven, wires are overkill and wallet fees add up. Here is a simple workflow that just works.

- Small payments and milestones: send payment links that accept cards or bank transfers, funds arrive to your virtual account and settle to INR in a couple of days.

- Retainers and bigger milestones: invoice clearly, reference repo URLs, issue IDs, and pull request numbers to reduce disputes.

- Invoice to match compliance: include client legal name and address, describe the service plainly, for example “Software development services for authentication module.”

- Milestone billing for risk control: 30 percent upfront, 40 percent mid project, 30 percent on delivery.

- Keep documents tidy: store invoices, confirmations, and e-FIRAs together for tax season.

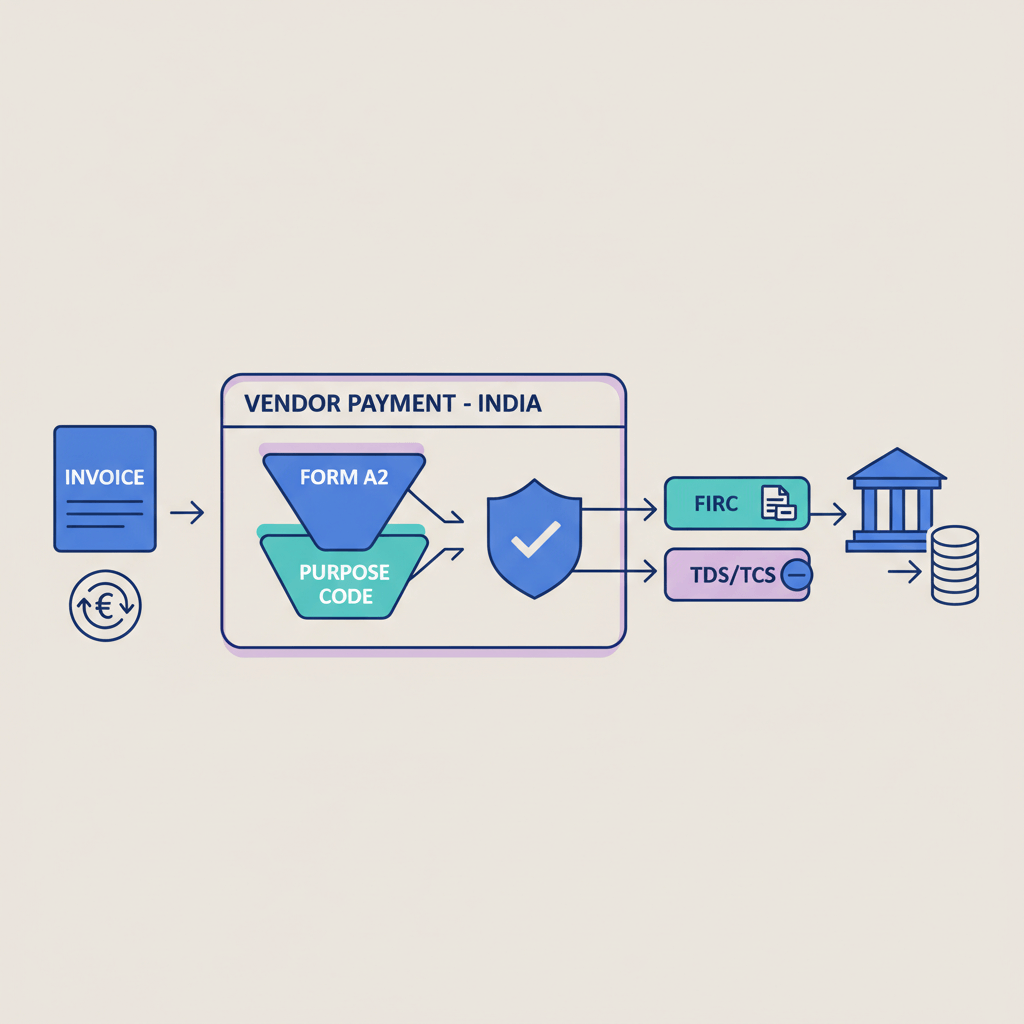

Choosing the right RBI purpose code for IT consulting, and auto e-FIRA

Every export receipt from abroad needs a purpose code, this feeds India’s balance of payments and helps enforce FEMA. For context on the broader rails landscape, see PwC’s view on trends in national payments rails.

- S0191: Software development and implementation.

- S0199: Other IT enabled services, for DevOps, cloud, integrations, support.

- S0101: Technical consultancy.

What is e-FIRA and why you need it: it is your digital proof of inward remittance, required for income tax, GST on exports if applicable, and RBI audit trails. Modern platforms auto generate it within 24 hours of settlement.

Common mistakes to avoid: mismatching invoice description and purpose code, invoice name differing from payer entity without a note, forgetting to store e-FIRAs safely.

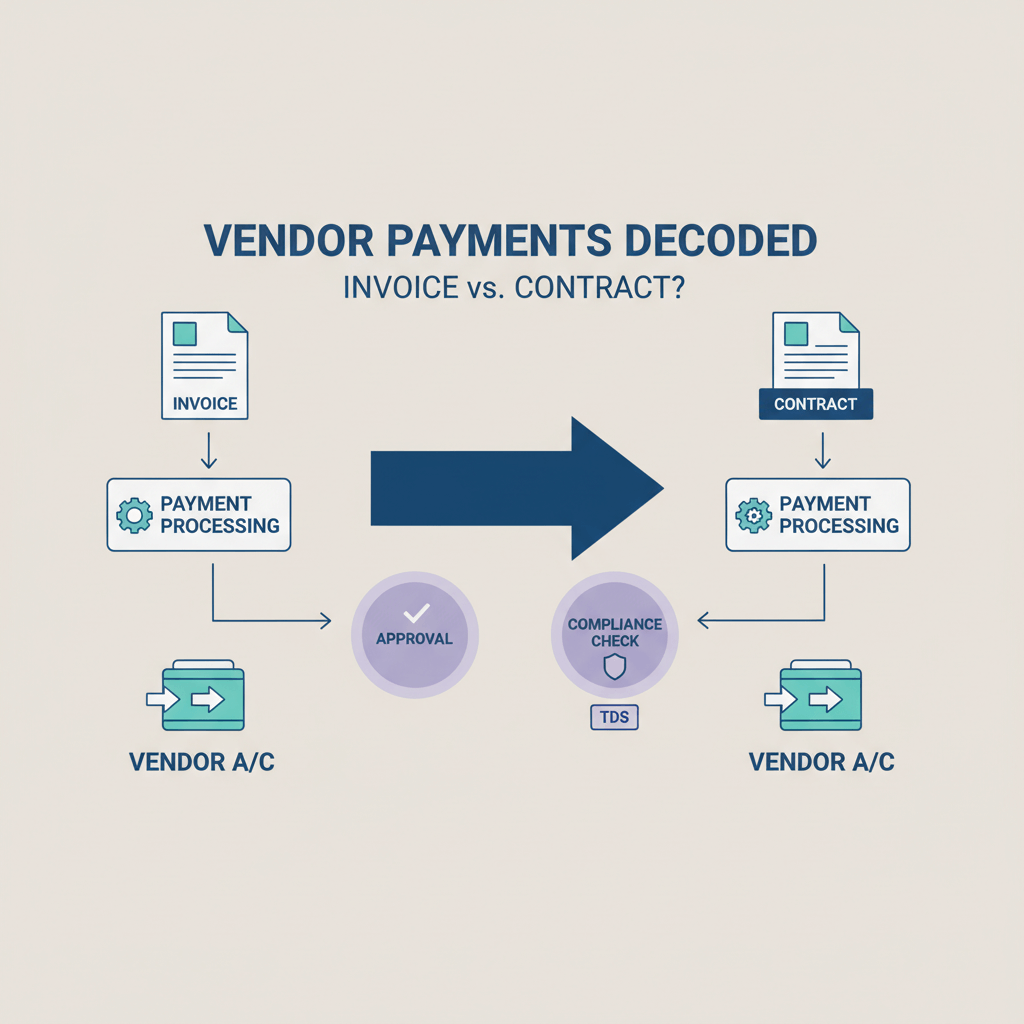

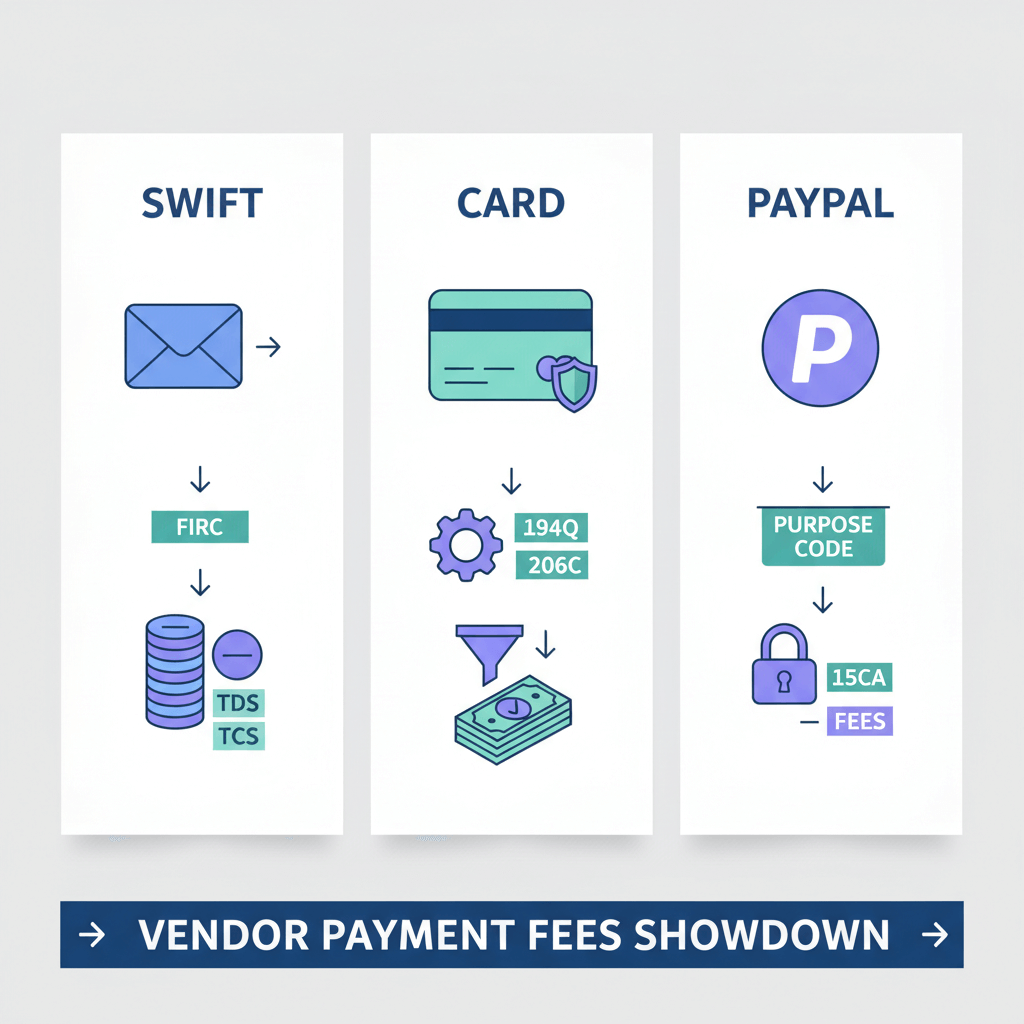

Comparing rails and providers for Indian developers

Here is a practical way to choose without spreadsheets.

- PayPal: easy for clients, expensive overall due to 3 to 4 percent fees and FX markup, dispute risk exists.

- Wise: transparent pricing and good FX, total cost still higher than a flat platform fee at larger amounts.

- Direct SWIFT: reliable for big invoices, slower and carries flat fees on both ends plus FX margin.

- Stripe or Payoneer: strong integrations and card acceptance, availability and KYC vary in India.

- Karbon Business: local USD, EUR, GBP, CAD accounts, 1 percent platform fee, zero FX markup, INR in 24 to 48 hours, automatic e-FIRA.

Decide by: invoice size, client location, urgency, chargeback sensitivity, and whether you need automated compliance.

Recommended platforms to try first

Karbon Business: virtual multi currency accounts, auto e-FIRA, fast INR settlement. Wise Business, Payoneer, and PayPal are good comparisons to benchmark on price and speed.

Cost and speed example, real numbers

Invoice is 2,000 USD from a US startup.

- ACH to virtual USD, Karbon Business: about 1 percent or 20 USD, mid market FX, INR in 24 to 48 hours, e-FIRA auto.

- SWIFT wire to Indian bank: 25 to 50 USD client bank fee, 10 to 25 USD intermediary, 500 to 2,000 INR incoming fee, plus 2 to 3 percent FX loss, 2 to 5 days, you request e-FIRA separately.

- PayPal: 3 to 4 percent or 60 to 80 USD, plus 2 to 3 percent FX markup, settlement one to three days to wallet then to bank, dispute exposure.

The math is clear, ACH to a virtual USD account saves meaningful money and time, while giving you compliant documents on autopilot.

Bonus: some platforms let you hold USD, EUR, GBP, or CAD for up to 60 days, so you can time conversion or pay overseas subscriptions directly.

End to end workflow checklist for Indian developers

- Pre engagement: scope, deliverables, timeline, payment terms, rail selection, fee responsibility clarified in writing.

- During project: track milestones, communicate progress.

- Invoicing: full legal details for both parties, clear service description, currency and amount, correct virtual account fields, due terms like Net 15.

- Collection: send invoice or payment link, share ACH or SEPA instructions in plain language.

- Compliance and settlement: mark paid, purpose code auto mapped, INR arrives in 24 to 48 hours, download and file e-FIRA.

- Post settlement: reconcile, decide on FX conversion timing if holding funds, update trackers.

Edge cases and practical solutions

- Split payments: issue separate invoices or split requests so each entry gets its own e-FIRA and ledger line.

- Refunds: process back on the same rail, record a credit note, and adjust documentation with your platform or CA.

- Chargebacks on cards: keep evidence, or prefer bank rails for large amounts to lower dispute risk.

- Enterprise onboarding: have PAN, masked Aadhaar, bank statements, GST if applicable, and a strong LinkedIn or portfolio ready.

- Multi currency clients: use USD, EUR, GBP virtual accounts in one dashboard, settle to INR when you choose.

- Client insists on PayPal: explain fee differences, offer ACH as a cheaper option, many clients will switch.

Getting started with Karbon Business, quick onboarding

What you need: PAN, masked Aadhaar, last three months bank statements, and an online profile like LinkedIn, Upwork, GitHub, or a portfolio.

Timeline: application in minutes, verification in two to four working days, accounts activated immediately after, INR settlements arrive in 24 to 48 hours post claim.

Four step flow: create invoice, client pays via local rail, claim the payment, receive INR and download e-FIRA.

Pricing: 1 percent inward fee plus 18 percent GST on the fee, mid market FX at zero markup, no setup or maintenance fees, e-FIRA free.

Support: WhatsApp, email, and phone, fast responses, account managers for higher volumes.

Many developers start with a 100 to 200 USD test invoice, once they see INR in 24 to 48 hours and the e-FIRA in their dashboard, they switch their regular clients over.

FAQ

How can a US client pay me via ACH if I am in India?

ACH is domestic in the US, so you collect into a virtual USD account from a platform like Karbon Business, your client makes a local ACH to that account, and you receive INR in 24 to 48 hours. For a primer on the rails involved, see this guide to payment rails.

Which RBI purpose code should I select for software development freelance income?

Most developers use S0191 for software development and implementation, S0199 for other IT enabled services like DevOps, or S0101 for technical consultancy. Platforms like Karbon Business auto map the code from your invoice description.

Is e-FIRA mandatory for freelancers receiving international payments in India?

Yes, e-FIRA is the accepted proof of inward remittance for tax and FEMA compliance, you will need it for audits and filings. With Karbon Business, e-FIRA is auto generated within about 24 hours of settlement.

ACH vs SWIFT, which is cheaper and faster for a 2,000 USD invoice to India?

ACH to a virtual USD account typically costs around 1 percent with INR in 24 to 48 hours, SWIFT often costs 50 to 100 USD equivalent plus a worse FX rate, and takes two to five days. For US clients, ACH is usually the better option.

Client is in Europe, can I take SEPA and still get INR quickly?

Yes, collect locally into a virtual EUR IBAN via SEPA, then settle INR in 24 to 48 hours through your platform. This is cheaper and simpler for EU clients than international wires.

Can I hold USD for some days and convert when the rate is better?

Many platforms allow holding USD, EUR, GBP, or CAD for up to 60 days, so you can convert when it suits your cash flow or FX view. Karbon Business supports this use case for freelancers.

What documents are needed to onboard with an international payments platform?

Expect PAN, masked Aadhaar, last three months bank statements, and an online profile like LinkedIn or GitHub. Karbon Business typically completes verification in two to four working days.

Do I need a GST number to receive international freelance payments?

Not always, exports of services are generally zero rated. If your turnover crosses the threshold or you have domestic clients, register for GST. The platform fee will carry 18 percent GST on the fee portion only, not on your client invoice.

Client wants to pay by card, is that safe for larger invoices?

Cards are convenient but carry chargeback risk and higher fees. For larger amounts, request a bank transfer like ACH or SEPA. If you must use card, send a payment link and keep strong documentation.

Will I get automatic purpose codes and documentation if I use Karbon Business?

Yes, Karbon Business maps RBI purpose codes from your invoice description and issues e-FIRA automatically after settlement, which saves time and reduces compliance errors.

How do fees compare between PayPal, Wise, and Karbon Business for freelancers in India?

PayPal often totals 3 to 4 percent plus FX markup, Wise is transparent but can add up with transfer and FX fees, Karbon Business charges about 1 percent with zero FX markup and auto compliance. Always test with small invoices and compare actual INR received.

How do I explain ACH to my US client so they pay faster and cheaper?

Share simple instructions: “Please send a domestic ACH to these US bank details, it is a normal local transfer for you, low cost and quick.” If you use a guide on payment rails, you can attach it for context, and mention that ACH avoids international wire forms on their side.

Compliance note, always verify with professionals

Rules evolve, and your situation may differ by contract type, turnover, and business structure. Use this guide for orientation, consult a CA for tax and FEMA specifics, and keep your invoices and e-FIRAs organized.

Final thoughts, choose the right rails and get paid faster

The best payment solution for software developers India depends on client location, invoice size, speed needs, and how much you value automatic compliance. For most US clients, ACH via a virtual USD account hits the sweet spot. To go deeper, see this merchant overview of payment rails, this infrastructure explainer on money movement, and PwC on national payments rails.

Next steps: sign up for a platform that fits your clients, complete KYC with PAN, Aadhaar, and statements, send a small test invoice, verify the flow from ACH or SEPA to INR and e-FIRA, then migrate your regular invoices and track your savings.