Get your international payments processed quickly, with Karbon Business taking care of the details.

An IBAN (International Bank Account Number) is a globally recognized format that helps identify a bank account for international transactions. It’s not a new account number, but rather a standardized way of representing your existing bank details so that foreign banks know exactly where to route the money.

Since IBAN is widely used in 70+ countries, many Indian exporters and freelancers often hear the question: “Can you share your IBAN number?”

If you’ve been asked the same, here’s what it really means and how it works for Indian banks like HDFC, ICICI, Axis, and SBI.

How Do IBAN Numbers Work?

An IBAN is a combination of letters and numbers that tells the exact country, bank, branch, and account where money should land. It includes a country code, check digits for error detection, the bank/branch code, and the account number.

Example: GB29 NWBK 6016 1331 9268 19 (a UK IBAN)

- GB → Country code (UK)

- 29 → Check digits (to verify)

- NWBK → Bank code (NatWest)

- 601613 → Branch code

- 31926819 → Account number

Do Indian Bank Accounts Have IBANs?

No, Indian banks do not issue IBAN numbers. India is not part of the IBAN system, which is mainly used in Europe, the Middle East, and some other regions.

Instead, Indian banks rely on:

- SWIFT/BIC codes – to identify banks internationally

- Account numbers – to identify customer accounts

- IFSC codes – for domestic transfers within India

This means, if you are in India and receiving money from abroad, you need to share your SWIFT code + account number + branch details, not an IBAN.

👉 Note: Even though Indian banks don’t provide IBANs, you can still get one through fintech platforms like Karbon, Wise, or Payoneer.

Benefits of Having an IBAN (via Fintech Accounts)

- Simpler payments – One number covers everything, reducing errors.

- Faster transfers – Payments often clear the same day in Europe/UK, unlike SWIFT which takes 2–5 days.

- Lower costs – IBAN transfers (via SEPA, etc.) are cheap or even free, while SWIFT has multiple fees.

- Better client experience – Clients abroad can pay you like a local.

- Professional image – IBAN looks global and trustworthy.

- Easier tracking – IBAN transfers are direct and transparent.

HDFC Bank IBAN Number

HDFC Bank does not provide IBANs. Instead, HDFC uses SWIFT codes for inward remittances. To receive money from abroad into your HDFC account, you’ll need to provide:

- HDFC Bank SWIFT code → e.g., HDFCINBBXXX (varies by branch)

- Your HDFC account number

- Bank and branch details

Axis Bank IBAN Number

Axis Bank also does not issue IBANs. Like other Indian banks, Axis relies on SWIFT codes. For international transfers into your Axis account, provide:

- Axis Bank SWIFT code → e.g., AXISINBBXXX

- Your Axis Bank account number

- Branch address

SBI (State Bank of India) IBAN Number

SBI does not use IBANs either. For inward remittances, SBI requires:

- SBI SWIFT code → e.g., SBININBBXXX (varies by city/branch)

- Your SBI account number

- Branch address

ICICI Bank IBAN Number

ICICI Bank customers also do not have IBANs. To receive money from abroad in ICICI, you have to provide:

- ICICI SWIFT code → e.g., ICICINBBXXX

- Your ICICI account number

- Branch details

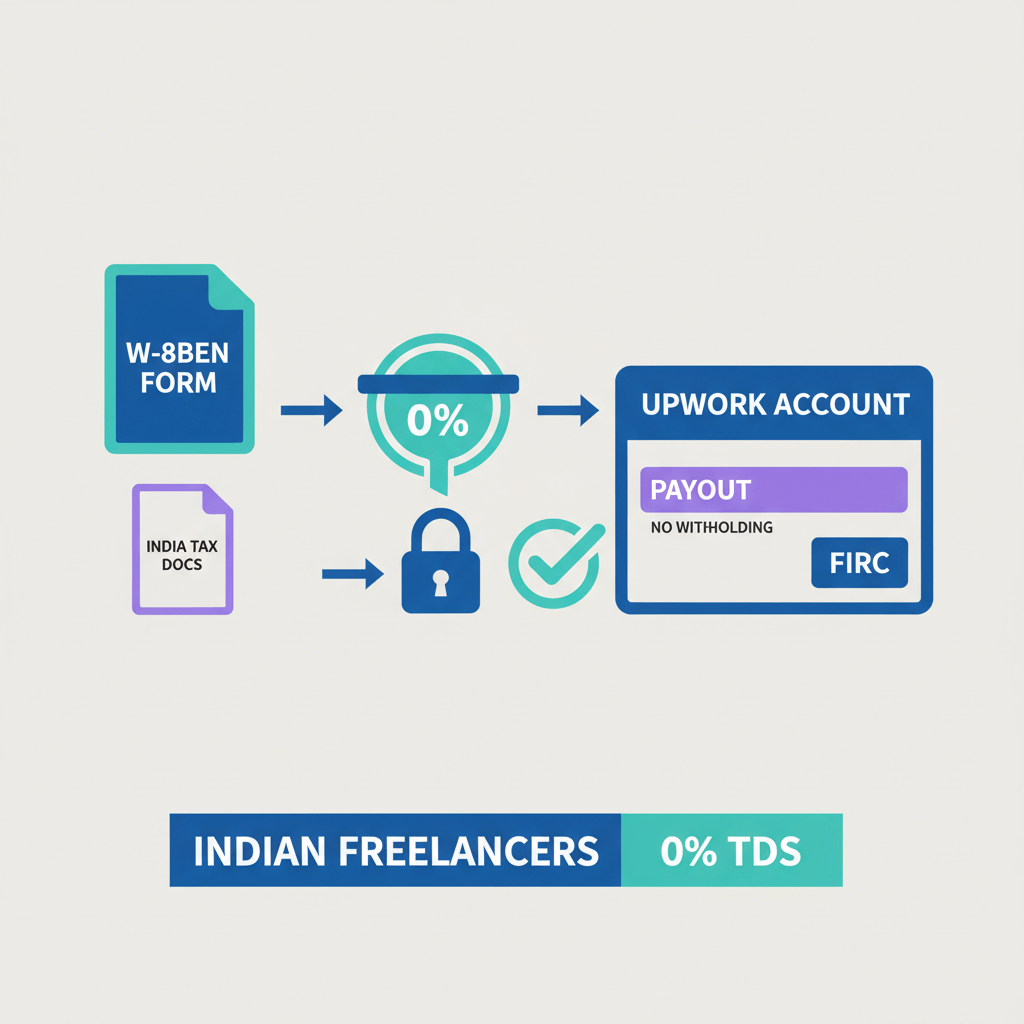

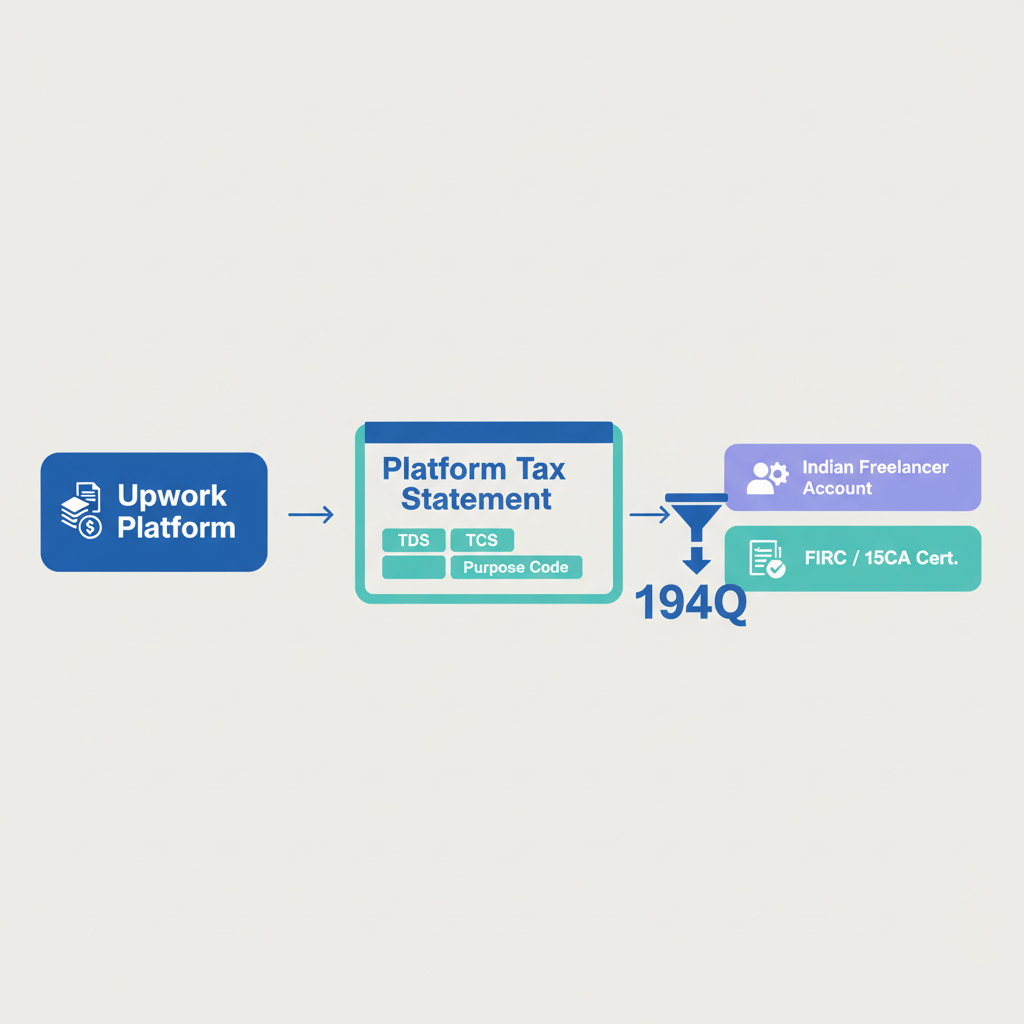

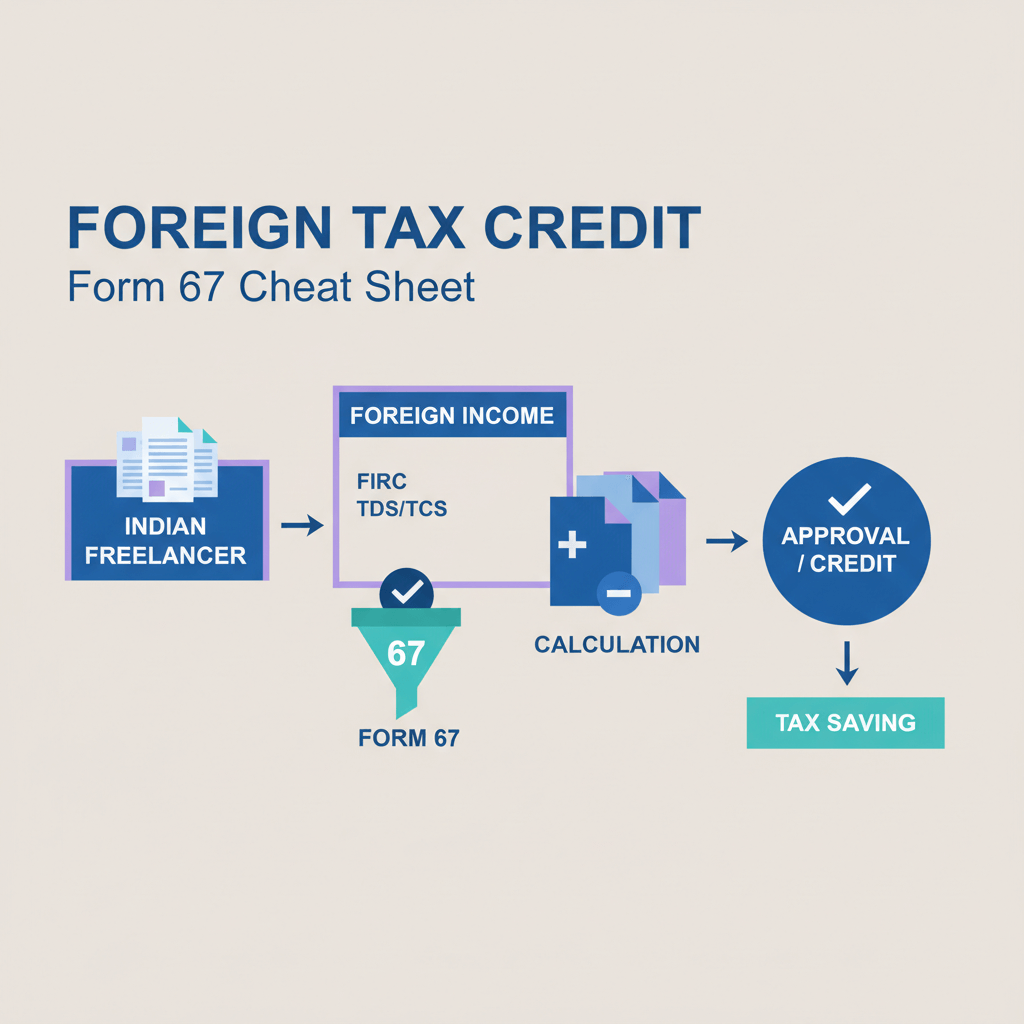

How Do Indian Fintech Platforms Provide IBAN Numbers?

Even though Indian banks don’t issue IBANs, fintech companies can because they partner with licensed banks in IBAN-using countries.

Here’s how it works:

- Partnership with Local Banks – Fintech platforms tie up with regulated banks in Europe, the UK, and elsewhere.

- Issuing Virtual Accounts – When you sign up, they open a virtual account in your name with their partner bank.

- Assigning IBANs – The partner bank issues you a valid IBAN based on its country (e.g., GB for UK, DE for Germany).

- Using the IBAN – You give this IBAN to your international clients, who pay as if it’s a local transfer.

- Funds Settlement in India – The fintech converts the payment into INR and deposits it into your Indian account.

Karbon’s Virtual Account with IBAN Number

Imagine you run an IT consultancy in Bangalore and have a client in London.

- If they pay directly to your Indian account → you face high SWIFT fees, forex markups, and delays.

- If you open a Karbon multi-currency account → you get a UK IBAN number.

Your client in London simply makes a local GBP transfer to your IBAN.

- Karbon receives the payment instantly in GBP.

- You withdraw funds into your Indian bank account at competitive exchange rates.

FAQs

1. What’s the difference between SWIFT Code, BIC, and IBAN?

- SWIFT/BIC code → Identifies the bank and branch globally (used in India).

- IBAN → Identifies the account in a standardized format (not used in India).

- In short: SWIFT finds the bank, IBAN finds the account.

2. Why don’t Indian banks use IBAN?

Because India is not part of the IBAN system, which was originally designed by the EU for cross-border transactions in Europe.

3. What should I do if a sender insists on an IBAN?

Tell them India does not use IBANs and provide your SWIFT code + account number.

If they cannot process without an IBAN, you can use fintech platforms like Karbon, Wise, or Payoneer.

4. Which countries use IBAN?

Over 70 countries, including all EU nations, the UK, UAE, Saudi Arabia, Qatar, and Turkey.

5. Does HDFC issue IBAN numbers?

No, HDFC Bank does not provide IBAN numbers. It only supports international transfers through SWIFT codes.

6. Does SBI provide IBAN numbers?

No, SBI accounts do not come with IBANs. Customers must use SWIFT codes for international payments.

7. Does Axis Bank give IBANs?

No, Axis Bank does not issue IBAN numbers. Like other Indian banks, it uses SWIFT codes for cross-border transactions.

8. Can I get an IBAN from ICICI Bank?

No, ICICI does not issue IBANs. For global transfers, you will need to use a SWIFT code.