Let’s explore opportunities, tailor strategies, and chart a course to financial success together.

Imagine this.

A small business owner wants to pay an overseas supplier. It’s a large sum, so they care more about security than speed.

Meanwhile, a parent needs to send money urgently to their son studying abroad because his college fee is due today. That payment can’t wait, even for a few hours.

Both need to move money across borders, but the best way to do it is different in each case.

Wire transfers are trusted for moving large sums safely through the global banking network. Real-time payments are designed for speed when time is critical and the amount is smaller.

But speed and amount aren’t the only differences. These two methods work differently, cost differently, and protect your money differently. Knowing which one fits your situation can save you days, fees, and headaches.

This guide breaks down how wire transfers and real-time payments work, their key differences, and which one you should choose.

What is a Wire Transfer?

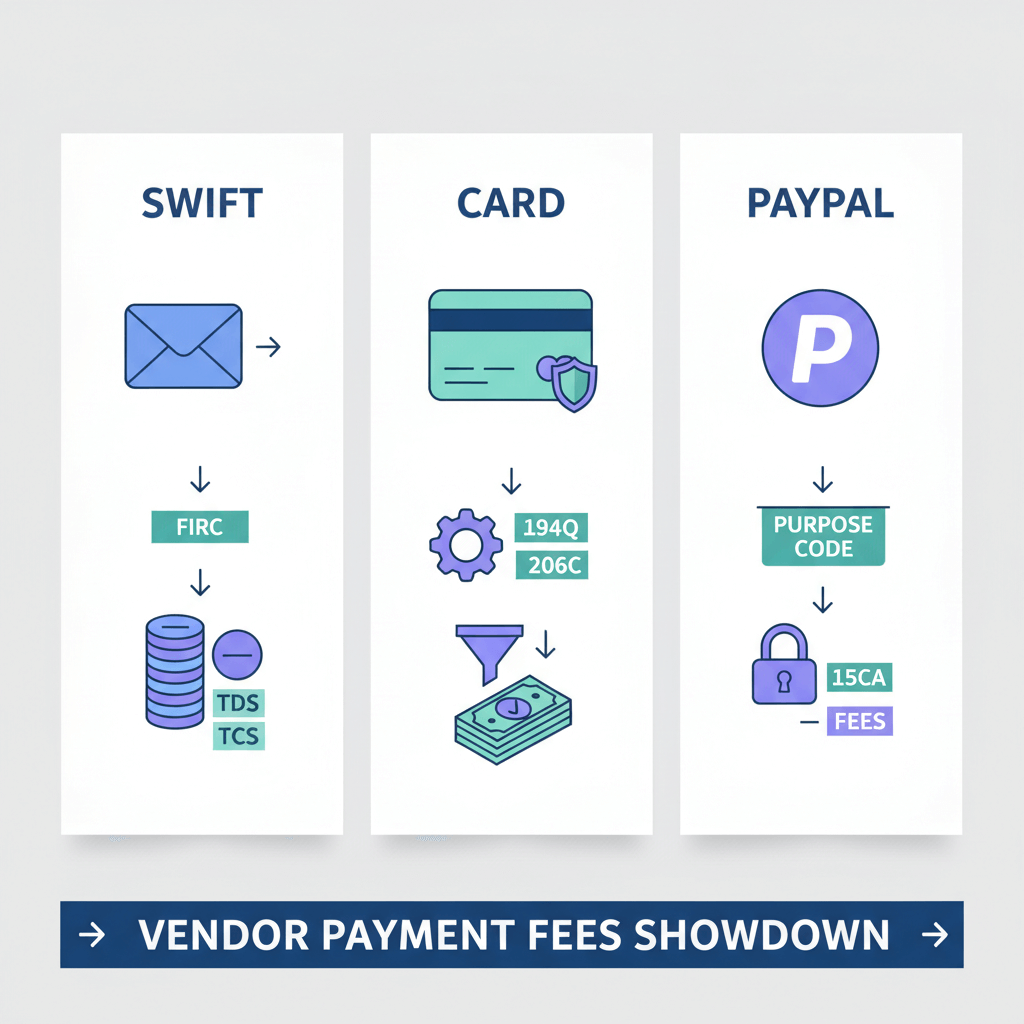

A wire transfer is a way to send money from your bank account to another person or company in another country. It works through a secure global system called SWIFT, which connects banks all over the world.

How Wire Transfers Work for International Payments?

- You go to your bank (or online banking) and give details: the amount, the recipient’s name, their bank account number, their bank’s name, and the bank’s SWIFT code.

- Your bank checks if you have enough money and if the details are correct.

- If your bank does not have a direct link to the recipient’s bank, it uses intermediary banks (called correspondent banks) to pass the money along.

- Each bank in the chain checks the payment to prevent fraud and to follow each country’s money rules.

- Once all checks are done, the recipient’s bank gets the money and adds it to the recipient’s account.

This whole process can take 1 to 3 working days because the money moves from one bank to another, sometimes across different time zones and holidays.

What is a Real-Time Payment (RTP)?

A real-time payment (RTP) means the money moves from you to the recipient immediately. This is common for payments within the same country, like using UPI in India, Zelle in the US, or Faster Payments in the UK.

For international payments, real-time is newer and still growing.

How Real-Time Payments Work for Cross-Border Transfers?

- Some countries connect their local payment systems to each other so money can move fast across borders. For example, India’s UPI can accept instant payments from a few foreign partners.

- When you send money, the payment goes through these linked networks instead of multiple intermediary banks.

- Because the systems talk to each other directly, the money reaches the recipient’s bank account in seconds or minutes, not days.

- This cuts down costs and fees since there are no extra banks in the middle.

However, real-time cross-border payments still have limits. Not all countries are connected yet. There may be maximum amounts you can send in one go. Also, exchange rates might differ depending on the app or provider.

Key Differences: Wire Transfers vs Real-Time Payments

Wire transfers and real-time payments serve the same basic purpose, but they work differently when it comes to speed, cost, and use cases.

Here’s a clear side-by-side comparison:

Platforms That Can Do a Real-Time Transfer for You

Several modern payment platforms now move money instantly when local real-time payment systems are available:

- Wise: For some currency routes, Wise pays out instantly using local real-time rails. For example, sending GBP within the UK goes through Faster Payments.

- UPI in India: UPI is India’s real-time payment system. Apps like PhonePe, Google Pay, and Paytm all use it.

- Payoneer: Some freelancer payouts happen instantly to local accounts, depending on the country.

Real-time means there is no chain of middle banks. The local payment network connects both banks directly and handles the settlement on the spot.

Platforms and Banks That Can Do a SWIFT Wire Transfer for You

Banks: Most major banks like HSBC, Citibank, and ICICI connect directly to SWIFT and handle high-value international wires for individuals and businesses.

Platforms: Modern platforms like Karbon, Wise, and Payoneer also use SWIFT when local instant payout isn’t available, making it easy to pay overseas suppliers or freelancers securely.

Because each bank in the chain does checks in its working hours and in its time zone, an international wire can take anywhere from one to three business days.

Wire Transfers vs Real-Time Payments: Which One Should You Choose?

The right method depends on what you are paying for and how urgently it needs to reach the other side. If you need to send a large sum internationally, with full tracking and bank-level checks, a wire transfer is often still the best choice.

If speed is critical and the amount is reasonable, real-time payments are the smarter option. For everyday transactions under fixed limits, RTP saves time and can improve relationships with vendors, partners, or customers who appreciate getting paid immediately.

Final Thoughts

Wire transfers and real-time payments serve different purposes. Wire transfers handle bigger, more complex payments where security and traceability matter most. RTP takes care of fast, small-to-medium payments that need to reach the other side immediately, 24/7.

If you run a business, it often makes sense to use both: wire transfers for large, planned payments and RTP for day-to-day transactions that benefit from speed and convenience.

Related Questions

Are wire transfers instant?

Not exactly. Domestic wires can clear the same day but aren’t guaranteed instant. International wires can take a few days.

Is RTP the same as IMPS or UPI?

Yes and no. In India, IMPS and UPI are real-time payment systems. They do the same thing as RTP, but the network and rules differ by country.

Can you use RTP for large international transfers?

RTP is growing for cross-border payments, but limits still exist. Most high-value international payments still run through wire transfers and SWIFT for now.