If you run an IT agency, export goods, or consult for clients abroad, chances are one of your clients is from the US. And if not directly from the US, you’ve probably had another international client who still asked you, “Can you share a US account?”

Why? Because US clients love using ACH transfers. They’re faster, cheaper, and way more convenient for them. Without a US account, you’re stuck with international SWIFT transfers that take days, cost more, and quietly cut into your margins with hidden FX fees.

It’s not just American clients either. Many businesses in other countries also prefer paying into a US account, since the dollar is a global benchmark. On top of all this, having a US account makes you look credible and “business ready” in the eyes of potential partners.

In this blog, let’s break down how you, as a non-resident Indian, can actually open a US business bank account without all the usual headaches.

Why Having a US Business Bank Account Matters for Indian Businesses

1. Faster Payments from US Clients

Without a US account, most payments come through SWIFT transfers, which can take 3–5 business days or more. With a US account, clients can use ACH transfers, which are almost instant for them and usually settle within 1–2 business days. This means you get your money faster, helping your cash flow and reducing payment-related stress.

2. Lower Transaction Costs

International wires often come with high fees from both sending and receiving banks. On top of that, your local bank may apply hidden FX margins when converting USD to INR. A US bank account reduces these extra costs, allowing you to keep more of what you earn.

3. Better Control Over Currency Conversion

When you receive USD in a local Indian account, banks often force immediate conversion to INR at rates that may not be favorable. With a US account, you can hold funds in dollars and decide when to convert, giving you control to take advantage of better rates. This is especially useful for exporters, freelancers, and agencies dealing with recurring USD payments.

4. Credibility with Clients and Partners

Having local US account details makes your business look established and trustworthy. Clients feel confident that they are paying a serious business, and it removes friction during negotiations or contracts. For long-term partnerships, this small detail can make a big difference.

5. Multi-Currency and International Operations

Many US bank accounts or fintech alternatives allow you to hold multiple currencies, not just USD. This is a huge advantage if you’re dealing with clients from Europe, Canada, or other regions. You can manage payments in several currencies without paying multiple FX charges.

6. Financial Stability and Security

The US dollar is the world’s reserve currency, meaning it’s stable and widely accepted globally. Holding funds in USD protects your revenue from local currency volatility, inflation risks, and sudden market shifts, ensuring your business funds remain secure.

7. Ease of Future Expansion

If you plan to expand your business to the US or deal with more international clients, having a US bank account already in place simplifies things. You can open merchant accounts, receive local payments, and even integrate with US payment gateways more easily.

Common Challenges NRIs Face While Opening a US Account

Here are the biggest hurdles most non-residents run into:

- Banks ask for a US residential address.

- Some require you to visit a branch in person.

- Traditional banks often want a Social Security Number or ITIN.

- Compliance checks under FATCA are more complex for non-residents.

For many Indian businesses, these requirements are deal breakers. That is why most NRIs look for digital-first alternatives instead of relying on legacy banks.

Two Best Ways to Open a US Business Bank Account as Non-Residents

Option 1: Digital and Online-First Banks

Thanks to modern fintech platforms, you can now open a US account from India without ever setting foot in America. These banks are designed for international businesses and freelancers who need local account details but do not have a US address.

Some popular options include:

Option 2: Traditional US Banks

Well-known banks like Bank of America, Chase, and Wells Fargo continue to attract businesses. They offer merchant services, loans, and the trust that comes with a household name.

But the barriers are high. Most require at least one director with a US address. Many insist on in-person verification. KYC and compliance checks take longer for non-residents.

Traditional banks make sense if:

- You already have a US subsidiary.

- At least one director is based in the US.

- You plan to access services like loans or trade finance.

For most Indian exporters and agencies, fintech solutions remain the more practical choice.

Documents You Will Need as a Non-Resident

Opening a US account requires a few key documents. The exact list depends on the provider, but you should be ready with:

- Passport as your primary ID

- Proof of address such as a utility bill, bank statement, or lease agreement

- Business documents like contracts, invoices, or a certificate of incorporation

- Tax paperwork such as W-8BEN for non-US citizens or ITIN if you do not have an SSN

Digital banks keep the process simpler, while traditional banks may ask for additional notarized or certified copies.

Costs and Fees You Should Expect

Fintech and Online-First Providers

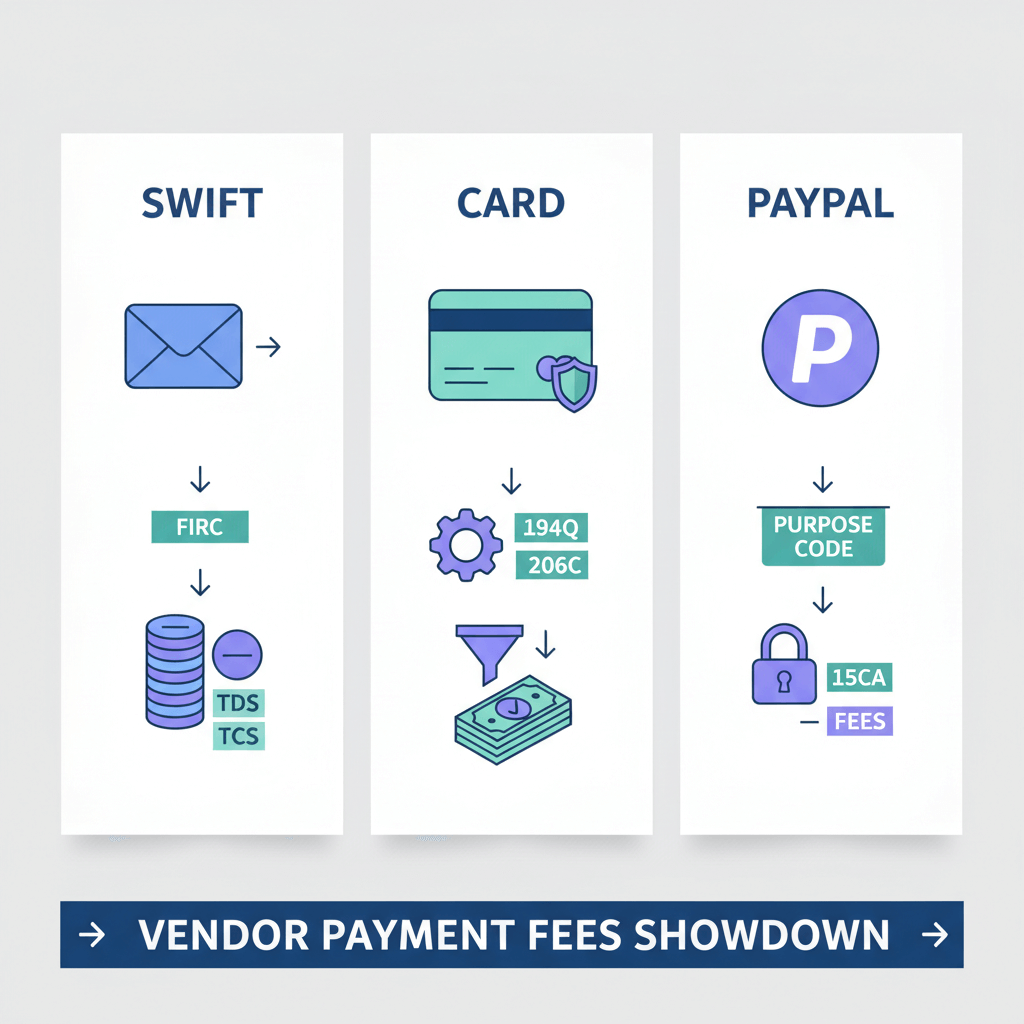

- Zenus Bank – $50 application fee, $19.99 monthly, free local transfers, international wires from $10, FX margin about 1%

- Wise, Payoneer, and Karbon – No monthly fees, but FX margins and transfer costs vary. Wise and Karbon offer mid-market exchange rates without a markup. Wise charges 2% as fees and Karbon flat 1%.

Traditional Banks

- Monthly fees around $15 to $25 (can be waived if you maintain a minimum balance)

- International wires cost $30 to $50 per transfer

- Domestic transfers are usually free

Overall, digital-first banks are faster, cheaper, and more transparent compared to legacy players.

Final Takeaway

Opening a US bank account as a non-resident Indian can feel intimidating, but today it is more possible than ever. Digital-first platforms like Karbon, Zenus, Wise, and Payoneer allow you to receive payments in USD, cut out conversion losses, and build trust with American clients without ever stepping into the US.

Traditional banks still have their place, especially if you want access to loans or already have a US office. But for most Indian agencies, exporters, and freelancers, fintech platforms are the faster and smarter choice.

If US clients are part of your business, setting up an account should not be an afterthought. The earlier you start, the more control you will have over payments, profits, and global growth.

Frequently Asked Questions

Do I really need a US account as an NRI?

If you work with US clients regularly, yes. It saves time, avoids heavy PayPal fees, and makes you look credible.

Can non-residents open a US account?

Yes. Digital banks like Zenus and Wise make it possible without traveling. Traditional banks are stricter.

Is a Social Security Number required?

Not always. Some banks accept ITIN or foreign tax IDs. Digital providers usually rely on passports and proof of address.

How long does it take to open an account?

Digital providers may approve you within a few days. Traditional banks can take weeks.

Does having a US account mean I owe US taxes?

No, not automatically. Taxes apply only if your business creates a taxable presence in the US.