Short answer: P0108 is the purpose code for the export leg of merchanting trade.

Merchanting isn’t a regular export. The goods move foreign-to-foreign, never entering India. No customs filings. No shipping bill.

You contract with a supplier abroad. You contract with a buyer abroad. Your margin is the difference between the two.

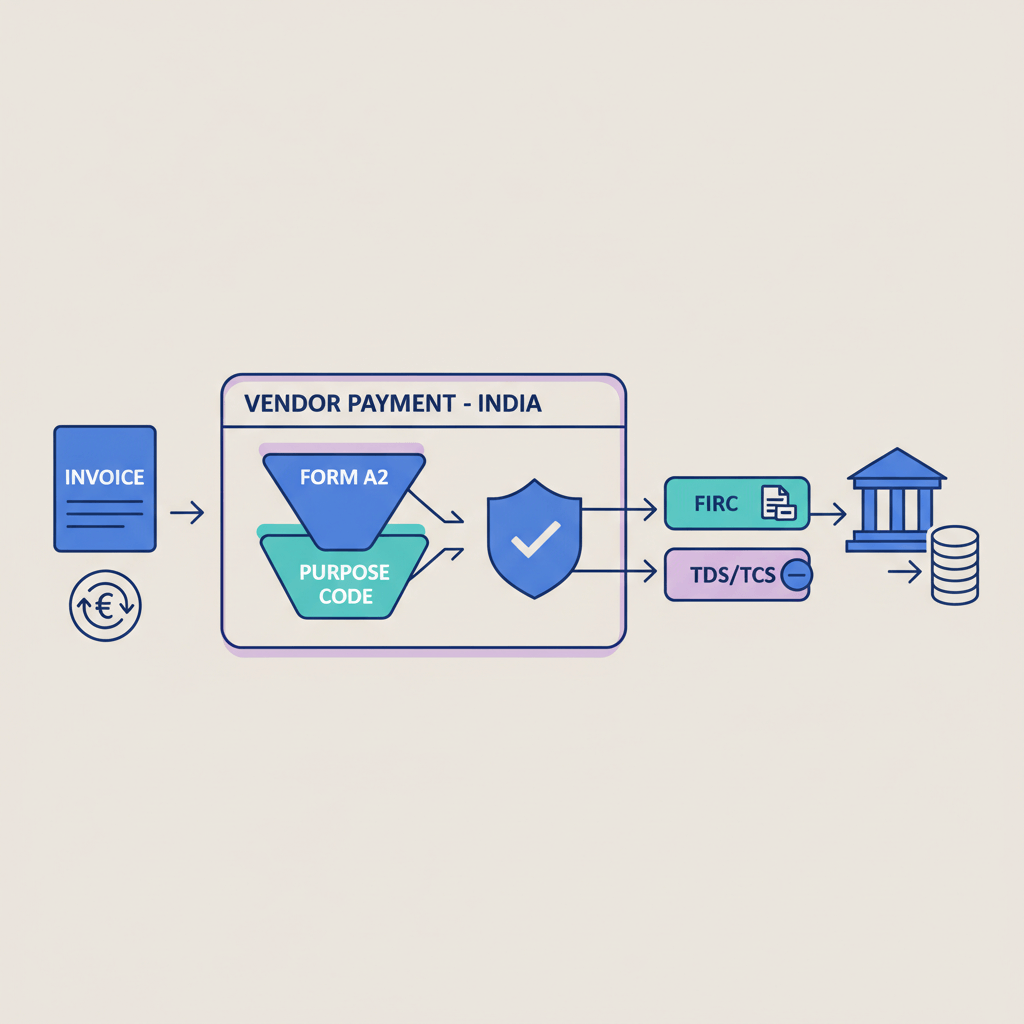

But to bring that margin into India, you must meet RBI’s compliance rules. That means knowing exactly when P0108 applies, when it doesn’t, and what documents your bank will ask for to prove it.

What Is P0108 Purpose Code?

P0108 is a purpose code issued by the Reserve Bank of India (RBI) used to receive payments for the export leg of merchanting trade transactions.

Understanding Merchanting Trade:

- Merchanting trade is a type of international trade where an Indian company buys goods from one foreign country and sells them to a buyer in another foreign country, without the goods ever entering India.

- The Indian company earns a margin from the difference between the purchase price and the selling price.

P0108 is specifically used to report the export leg of merchanting trade transactions.

If there is an import leg in the transaction, it must be reported separately under S0108.

Example of P0108 Purpose Code

Contracts:

- Supplier (Germany) → You (India) at USD 95,000 (CIF Santos).

- You (India) → Buyer (Brazil) at USD 100,000 (CIF Santos).

Legs & Codes:

- Import Leg Payment: From India to Germany: S0108 for USD 95,000.

- Export Leg Receipt: From Brazil to India: P0108 for USD 100,000.

Profit:

- Profit = USD 5,000 minus bank/insurance costs. The RBI requires that the merchanting transaction results in profit.

If Buyer Pays First:

- Park USD 100,000 in an EEFC/INR earmarked account until you pay the supplier. Once the supplier is paid, you can settle the S0108 from those funds.

When Should You Use P0108 (and when not)?

Use P0108 When:

- You have back-to-back contracts: This means you should have one contract with the foreign supplier and another with the foreign buyer. These contracts should be connected and meet the specific merchanting trade requirements.

- Shipment is foreign → foreign: The goods must not enter India. The transaction is considered merchanting trade when goods are shipped directly from one foreign country to another, bypassing India.

- Your Indian entity earns a trading margin: This is the difference between the selling price and the purchase price of the goods. If this margin is positive, it indicates that the intermediary (Indian company) has earned profit through the transaction.

Do Not Use P0108 When:

- Goods physically enter India: If the goods physically pass through India, the transaction should not be reported as merchanting trade. It becomes a regular export or import, and you must use the corresponding export codes like P0101 to P0107, based on the context.

- You’re receiving payments for services: P0108 applies strictly to merchanting trade in goods, not services. If you are involved in providing services, you should use a different purpose code.

- You intend third-party payments or commission arrangements: If you involve third-party payments or unconventional commission structures, these are not allowed under P0108. RBI restricts such arrangements to maintain proper compliance with its regulations.

Step-by-Step: How to Structure a Compliant P0108 Deal

- Pre-Deal:

- Lock back-to-back terms: Secure the terms of the deal with both the supplier and the buyer, including Incoterms (e.g., CIF or FOB), quality requirements, and delivery windows.

- Confirm Goods’ Permissibility: Ensure that the goods being traded are not restricted or sensitive under the Foreign Trade Policy (FTP).

- Choose an AD Bank: Select the same AD bank to handle both the export and import legs of the transaction. Share the deal outline with the bank and request their checklist of required documents.

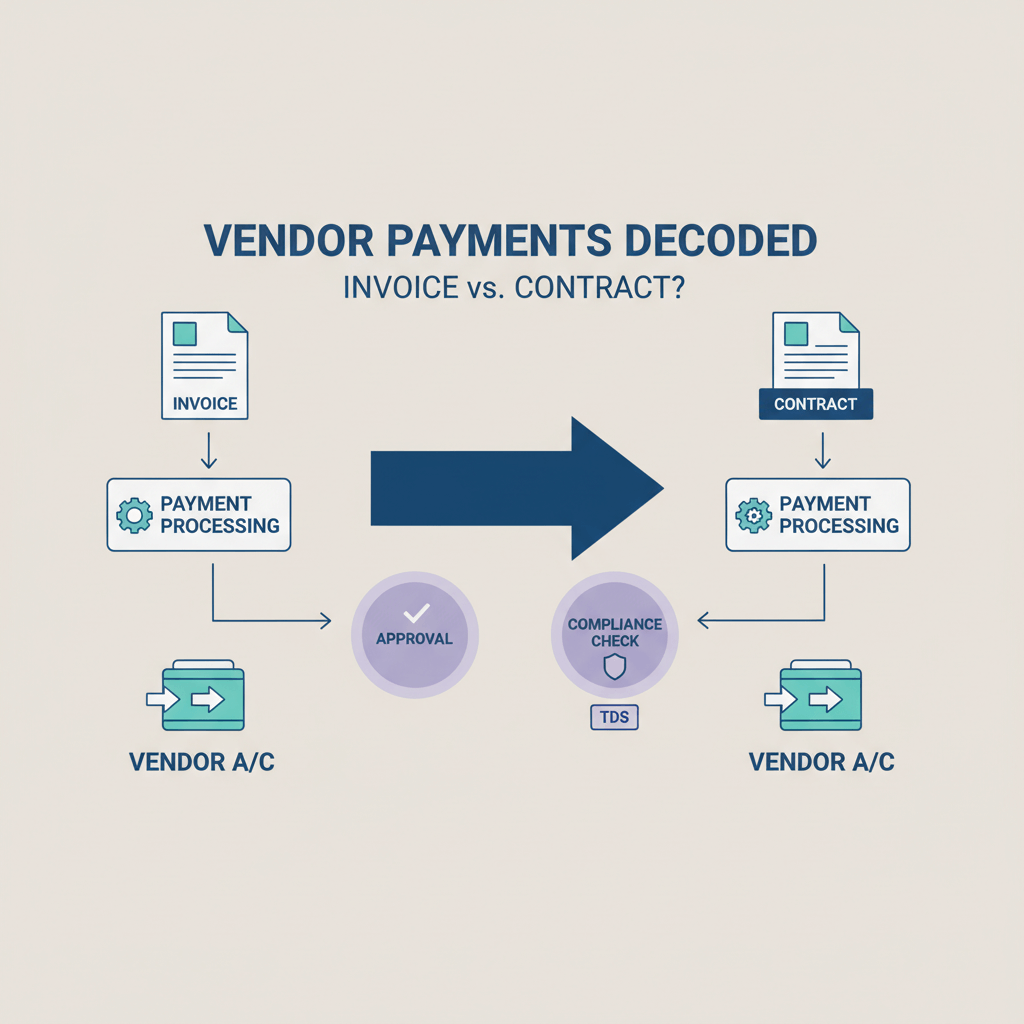

- Contracts & Documents:

- Two Contracts: One contract with the supplier and another with the buyer. These should clearly outline values, specifications, Incoterms, and payment terms.

- Shipping Documentation: The shipping documents must include a Bill of Lading (BL) or Air Waybill (AWB) that confirms the foreign-to-foreign shipment. The bank may accept authenticated non-original documents and may verify these online.

- Payment Plan:

- If the buyer makes the payment first, the funds should be parked in EEFC/INR earmarked until the supplier is paid.

- If the supplier requires an advance of more than USD 500,000, you must arrange a BG/SBLC.

- Reporting:

- Report the import leg payment under S0108 and the export proceeds receipt under P0108, using the same AD bank to ensure compliance. The transaction must match one-to-one.

- Close-Out:

- Ensure that the trade is profitable and complete the transaction within 9 months, with the foreign-exchange outlay completed within 4 months.

How Can You Prove P0108 Purpose To The Bank?

- Contracts: Both the supplier and buyer contracts are required to prove that you are a genuine merchant and not simply a financial intermediary.

- Invoices and Transport Documents: The bank will require invoices from both the supplier and buyer, along with transport documents (e.g., BL/AWB) and proof of insurance, if applicable.

- Proof of No DTA Entry: Documentation such as routing details and BL ports is needed to confirm that the goods did not enter India (Domestic Tariff Area).

- Timeline Evidence: The bank will ask for proof that the trade will complete within 9 months and that the foreign-exchange outlay is limited to 4 months.

- Mapping: Ensure that the export receipt (P0108) is matched to the import payment (S0108), and provide evidence of one-to-one matching.

Frequent Failure Modes That Freeze P0108 Receipts

- Wrong Purpose Code: Using a generic export code (such as P0101) instead of P0108 for the export leg can cause delays or rejections.

- Two Different AD Banks: Using different AD banks for the import and export legs breaks the one-bank rule, leading to compliance issues.

- Third-Party Payments or Unusual Commission Structures: These are prohibited under P0108 and can lead to delayed payments or penalties.

- Exceeding Timelines: If the transaction is not completed within 9 months or if the foreign-exchange outlay exceeds 4 months, the bank may freeze the remittance.

- Not Showing Profit: RBI expects that merchanting transactions result in profit at the trade level. If the transaction is not profitable, it may be flagged for review.

Receiving International Payments for Merchanting Trade With Karbon Business

If you’ve ever done forex trasactions under P0108, you know the trouble.

Buyers say they’ve paid, but nothing arrives. You pay a supplier, and the funds never reach them.

Banks keep asking for the same contracts, invoices, and purpose declarations. Miss one detail, and your money is stuck.

With Karbon, your account manager handles the compliance and paperwork. You just approve the transfer.

Send and receive payments in 30+ currencies—USD, EUR, GBP, AUD—through your virtual multi-currency account, always at the mid-market rate.

FAQs

Are there any customs filing in India for merchanting?

No, there is no shipping bill or Bill of Entry in India for merchanting. However, export/import rules (other than these filings) still apply to the respective legs of the transaction.

Can I receive the money first and pay the supplier later?

Yes. You can park the money in EEFC/INR earmarked and use it to settle the import leg. Hedging of INR balances is allowed.

Can my supplier pay a third party or can I route via an agent?

No, third-party payments are not allowed in merchanting. Agency commissions are restricted and can only be paid after the deal is completed and not in a way that turns the trade into a loss.

Do I need to show profit per transaction?

Yes, RBI expects that merchanting transactions result in profit at the trade level.