The Non-LRS (Non-Liberalised Remittance Scheme) is a regulatory framework instituted by the Reserve Bank of India (RBI) to oversee outbound remittances from India that fall outside the purview of the Liberalised Remittance Scheme (LRS).

While the LRS permits resident individuals to transfer up to USD 250,000 per fiscal year for specific permissible transactions, the Non-LRS scheme governs transactions exceeding this limit or involving purposes not covered by the LRS.

The main question is - Is LRS applicable to companies?

Read on to find out

What is the Non-LRS scheme?

The key features of the Non-LRS scheme include the following :-

- Approval Requirement:

- Transactions under the Non-LRS scheme typically require prior approval from the RBI.

- Permitted Transactions:

- Non-LRS transactions encompass various activities such as direct investments abroad (excluding real estate and banking sectors), capital account transactions surpassing the LRS limit, and funding for overseas subsidiaries and joint ventures.

- Documentation and Compliance:

- Rigorous documentation is imperative to substantiate the purpose behind the remittance.

- Adherence to reporting and compliance norms, including RBI regulations concerning Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT), is mandatory.

- Special Cases:

- Certain transactions, like remittances for medical treatment, education abroad, or legitimate business purposes, may necessitate detailed justification if surpassing the LRS limit.

- Exchange Control Regulations:

- Remitting banks are tasked with ensuring transactional compliance with RBI's exchange control regulations.

- Banks, acting as authorized dealers, play a pivotal role in verifying and facilitating non-LRS transactions.

Can remittances be made only in US Dollars for business remittances from India under the non-LRS scheme?

The Non-LRS (Non-Liberalised Remittance Scheme) is a regulatory framework instituted by the Reserve Bank of India (RBI) to govern outbound remittances from India that extend beyond the scope of the Liberalised Remittance Scheme (LRS). Under the LRS, resident individuals are permitted to transfer up to USD 250,000 per fiscal year for specific allowable transactions. However, the Non-LRS scheme covers transactions exceeding this limit or involving purposes not covered by the LRS.

Key features of the Non-LRS scheme include:

- Approval Requirement:

- Transactions under the Non-LRS scheme typically require prior approval from the RBI.

- Compliance with the guidelines outlined in the Foreign Exchange Management Act (FEMA) is mandatory.

- Permitted Transactions:

- Non-LRS transactions encompass various activities such as direct investments abroad (excluding real estate and banking sectors), capital account transactions surpassing the LRS limit, and funding for overseas subsidiaries and joint ventures.

- Documentation and Compliance:

- Comprehensive documentation is necessary to justify the purpose behind the remittance.

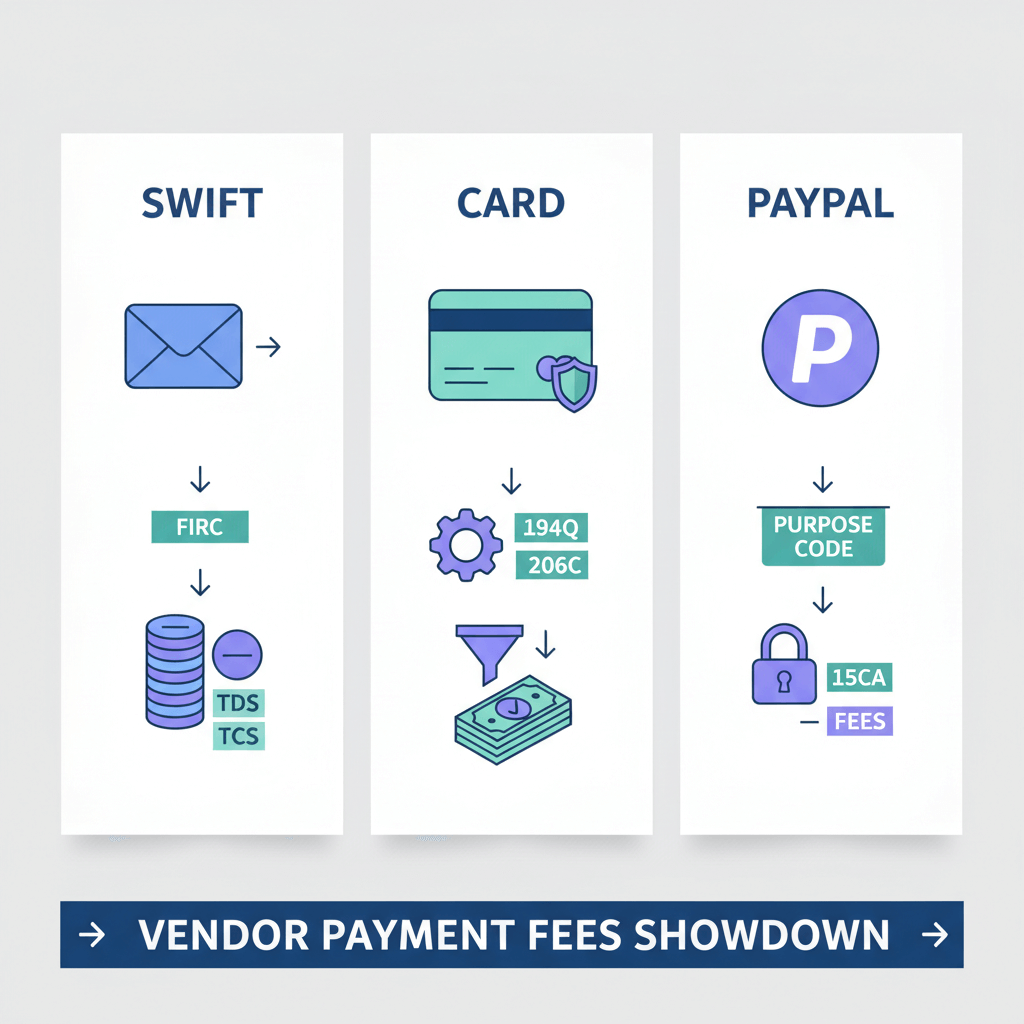

- Currency and Wire Transfer:

- While USD is commonly used for many Non-LRS transactions due to its international acceptance, remittances can be made in other currencies as well, subject to RBI regulations and approval.

- Wire transfers serve as a prevalent method for Non-LRS transactions, facilitating swift and secure movement of funds across borders.

- Special Cases:

- Certain transactions, such as remittances for medical treatment, education abroad, or legitimate business purposes, may require detailed justification if exceeding the LRS limit.

- Exchange Control Regulations:

- Remitting banks are responsible for ensuring transactional compliance with RBI's exchange control regulations.

- Banks, acting as authorized dealers, play a crucial role in verifying and facilitating non-LRS transactions.

Is there any restriction on a number of remittances during an FY under the non-LRS scheme?

Indian businesses engaging in outward remittances must adhere to the regulations set forth by the Reserve Bank of India (RBI). Under the Liberalised Remittance Scheme (LRS), there isn't a specific restriction on the number of remittances that Indian businesses can conduct within a financial year (FY). However, the LRS imposes a limit on the total amount that can be remitted during the FY.

As per current RBI guidelines, Indian businesses are permitted to remit up to USD 250,000 per FY for eligible transactions under the LRS. This cap applies to the cumulative amount of all remittances made by the business entity throughout the FY, irrespective of the number of individual transactions conducted.

Therefore, while there isn't a predefined constraint on the number of remittances, Indian businesses must ensure that the total remitted amount does not exceed the USD 250,000 threshold per FY established by the LRS. Any remittances exceeding this limit would necessitate prior approval from the RBI and would fall under the Non-LRS (Non-Liberalised Remittance Scheme) framework.

What does the non-LRS scheme say about the permissible current account transactions for businesses?

For companies, the permissible current account transactions under the Liberalised Remittance Scheme (LRS) in India mirror those available to resident individuals. However, the specific transactions may vary depending on the company's business nature and requirements. Permissible current account transactions for companies typically include:

- Overseas trade payments: Covering expenses for importing goods and services, including raw materials, machinery, and equipment.

- Overseas business travel: Encompassing costs related to business trips, such as airfare, accommodation, and daily allowances for employees traveling abroad for business purposes.

- Remittance for business operations: Including payments for establishing and managing overseas offices, such as rent, utilities, and salaries of foreign employees.

- Investment in foreign subsidiaries or joint ventures: Involving capital injections, loans, or investments in foreign subsidiaries or joint ventures.

- Payment for professional services: Comprising fees for services provided by foreign consultants, legal advisors, and other service providers.

- Repatriation of dividends and profits: Entailing the transfer of profits earned by foreign subsidiaries or joint ventures back to the parent company in India.

- Royalty and license fee payments: Covering expenses for utilizing intellectual property rights, such as patents, trademarks, and copyrights, from foreign licensors.

- Registration and renewal fees: Encompassing charges for registering and renewing licenses, permits, and trademarks abroad.

- Loan repayments: Including the repayment of loans obtained from foreign entities, encompassing principal and interest payments.

- Miscellaneous expenses: Entailing other legitimate expenses essential for the company's overseas business operations, subject to RBI guidelines.

Who is not eligible for LRS?

LRS is not available to corporates, partnership firms, HUF, Trusts, etc. We break down the detailed categories of entities not eligible for the LRS scheme.

Is LRS applicable for companies?

No. The LRS scheme does not apply to companies, organizations, or any other entity that has a business nature to it. The Liberalised Remittance Scheme (LRS) is for individuals in India, not for companies or businesses. Companies have different rules for sending money abroad. They need approval from the Reserve Bank of India (RBI) and must follow specific guidelines. So, while people can use the LRS to send money, companies can't. They have their own rules to follow.