Understanding GST on inward remittances for business owners can be complex. As GST on inward remittances doesn't directly apply to foreign remittances, understanding the specific taxes and charges involved is important.

Read on to find out more...

GST on inward remittance

The revenue generated from Goods and Services Tax (GST) on inward remittances significantly contributes to our nation's economic income. In March 2023, GST revenues experienced a notable growth of 13%, marking the second-highest monthly collection in the history of the indirect tax, amounting to ₹1.6 lakh.

Furthermore, there was an 8% increase in receipts from imports, while income from both domestic transactions and services imports saw a substantial rise of 14% compared to the previous year. This signifies a positive trend in economic activity and revenue generation through GST on inward remittances.

In the context of receiving foreign currency through inward remittances in India, it's important to note that GST on inward remittances is generally not applied as a separate charge. While certain online platforms may impose an 18% transaction fee on specific products for international money transfers, it's crucial to understand that this fee doesn't equate to a distinct GST levy on the remittance transaction itself.

Businesses working with clients from other countries get a big benefit—they don't have to add extra GST on the money they receive for their services.

Exporters usually get paid in foreign currency for their goods or services. Right now the remittance conversion rate is done in USD. Some have a special account (EEFC) to directly store foreign currency in an Indian bank. But, for most exporters, the norm is to receive payments in Indian currency. Before that, they deduct remittance charges, conversion fees, and other expenses. This way, the funds are converted to local currency, and any charges are taken out before they get the final amount.

GST zero-rated supply

GST on export of physical goods

The export of physical goods is classified as a zero-rated supply, meaning that no GST will be imposed on the export of any type of goods.

GST on export of services

There is no GST on the export of services from India as well. Exports of services are also exempt from duties, and any duties paid on exported goods or inputs are eligible for a refund. Submit a Letter of Undertaking (LUT) or an export bond to get an exemption from IGST. Opting for export under LUT or bond is advantageous as it eliminates the need for pursuing a tax refund, saving you time and effort.

How to save on foreign remittance taxes?

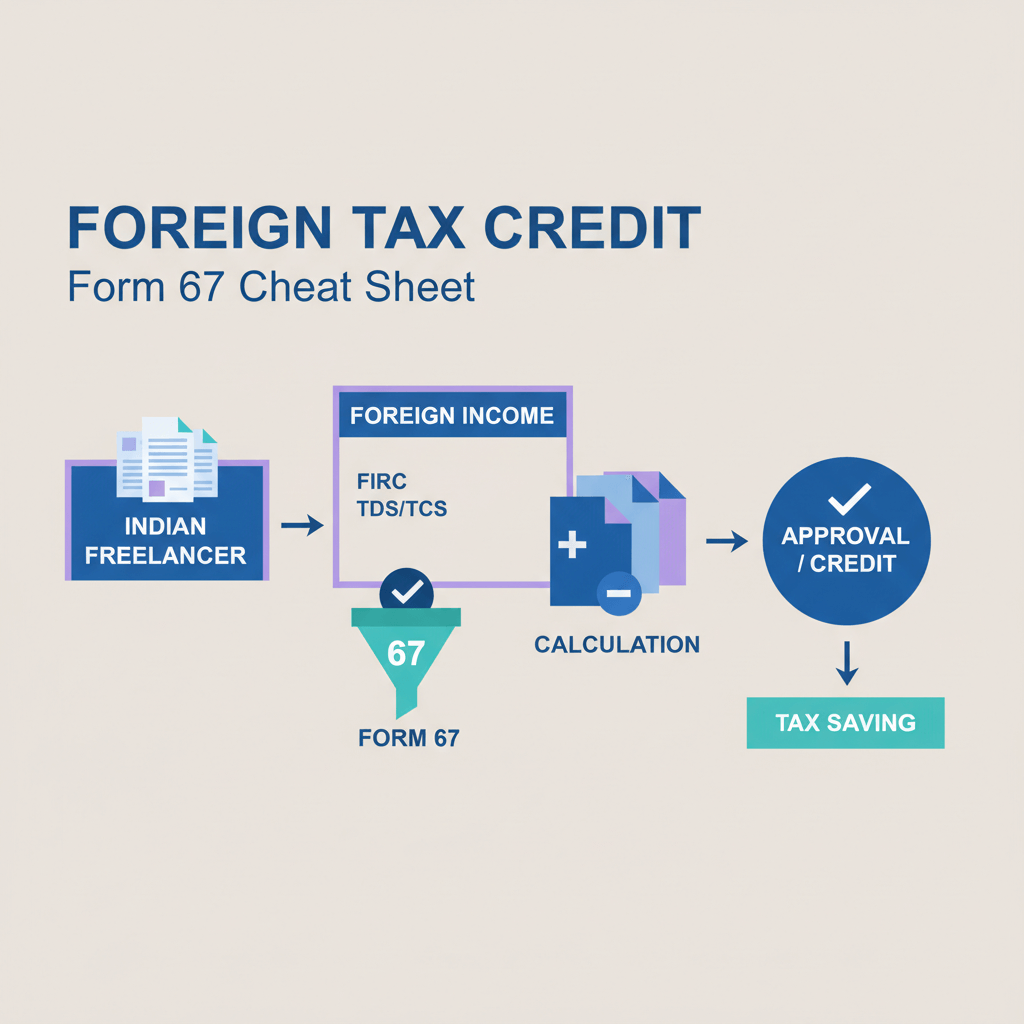

Imagine your business is based in India, and you're expecting an inward remittance of $10,000 from a foreign client for services you have provided. Upon receiving the funds, the bank applies a Tax Collected at Source (TCS) of 5%, deducting $500 before crediting the amount to your business account.

To offset this TCS and potentially reduce your taxable income, your business explores eligible business expenses and deductions. Let's say you have legitimate business expenses worth $2,000 that can be claimed. By properly accounting for these expenses, you can reduce your taxable income.

Now, when you file your business tax return, the reduced taxable income is considered for TCS calculation. The 5% TCS on the reduced taxable income of $8,000 amounts to $400.

In this scenario, your business has effectively managed the impact of TCS by minimizing the taxable income, resulting in a reduced TCS amount. This strategic approach helps optimize the use of funds received through inward remittance and ensures compliance with tax regulations.

How is GST on inward remittance calculated in India?

The Goods and Services Tax (GST) on inward remittances does not directly apply to foreign remittances in India, as GST is designed for goods and services consumed within the country. Foreign remittances involve the cross-border transfer of money and are not subject to GST.

Compliance: GST on Inward remittance

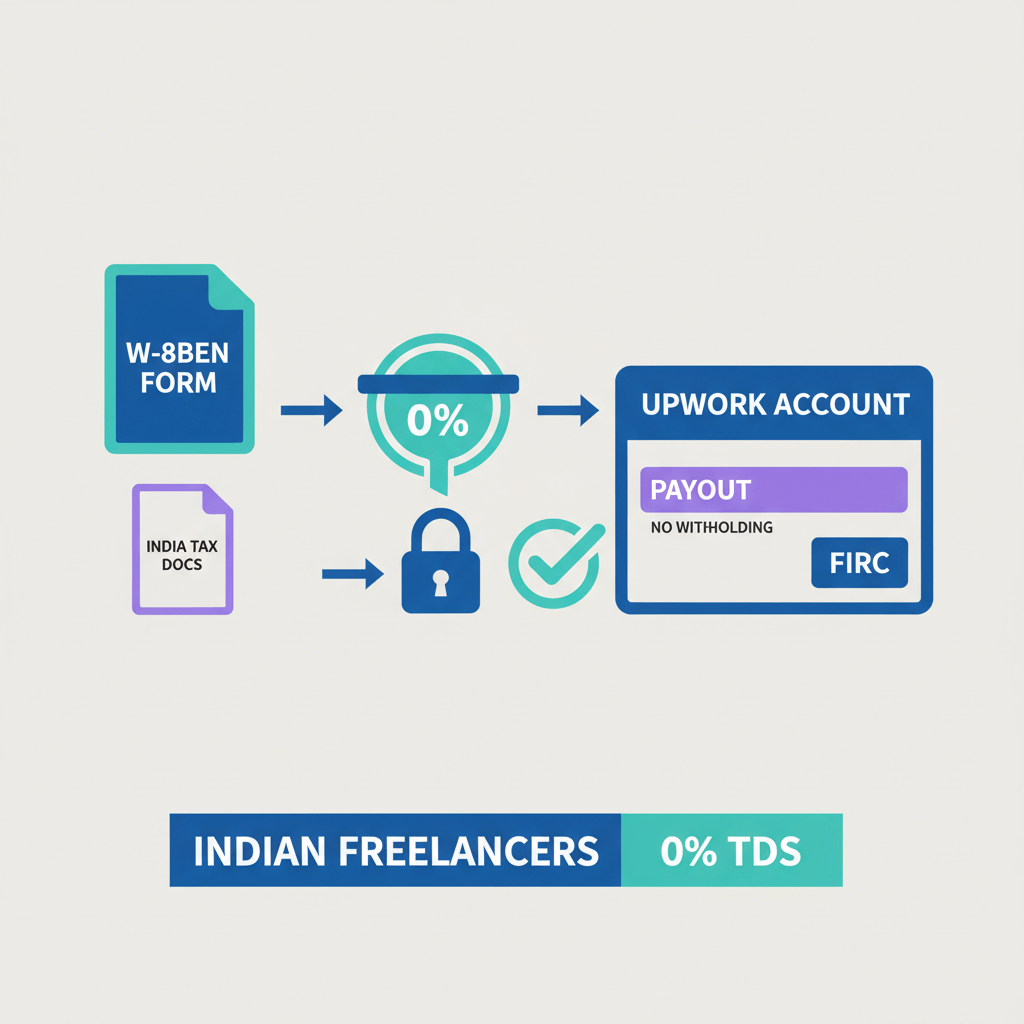

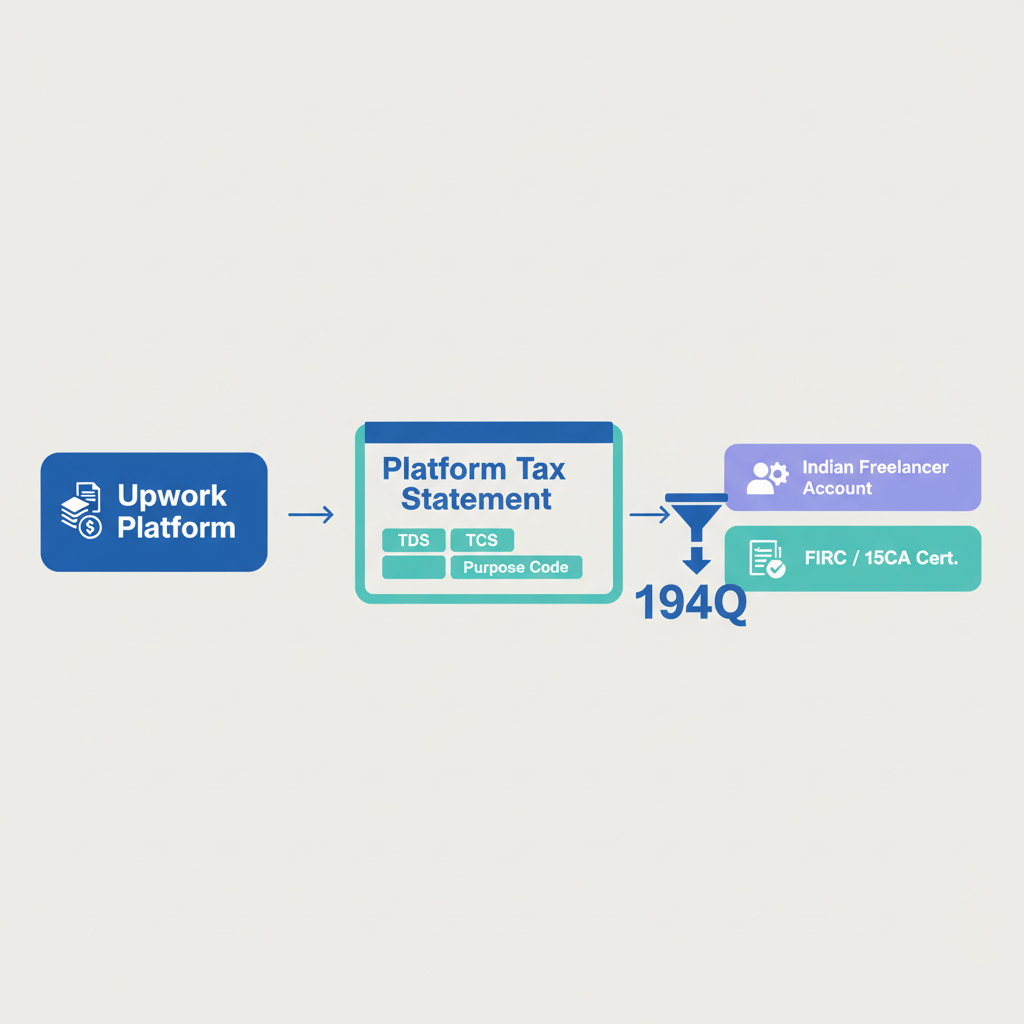

The GST guidelines related to inward remittances focus on services like compliance handling and the issuance of Foreign Inward Remittance Certificates (FIRCs) and Bank Realisation Certificates (BRC) in India. What distinguishes this scenario is the utilization of the reverse charge mechanism. This mechanism alters the dynamics by transferring the responsibility of directly remitting GST to the Indian government from the service provider's business to the foreign clients, ultimately exempting the service provider from this financial responsibility.

As a result, there's no requirement to list or add GST as a separate charge on invoices when offering these services to foreign clients. This straightforward approach makes billing easier for both the service provider and international clients.

For instance, if a company helps a foreign client with compliance issues, the foreign client takes on the responsibility of paying the GST directly to the Indian government through the reverse charge mechanism. This relieves the service provider's business from this financial responsibility.

FAQ’s

- What are the charges for inward remittance?

Traditional banks may apply forex margin charges ranging from 1.5% to 2.5%, along with additional tax charges. On the other hand, fintech platforms may offer a more transparent fee structure for inward remittances. Instead of variable charges, fintechs for inward remittances, often charge a flat fee, which can range from 2% to 2.5%, inclusive of all applicable taxes.

- Is GST applicable on foreign payments?

No. Banks and fintechs follow different rules when it comes to GST costs. Karbon’s tie-up with partner banks in the US for all inward remittances follows a transaction path that is internalized and does not require businesses to pay GST on inward remittances.

- How much remittance is tax-free?

In India, inward remittances themselves are generally not taxable. The person receiving money through remittances doesn't need to pay income tax on the received amount. Nevertheless, it's crucial to assess the purpose of the remittance and determine if it might be connected to taxable income.

For example, if the remittance is a gift from a non-relative, it may be subject to gift tax. Additionally, if the inward remittance is related to business income or investments, the tax can vary.

- Is there a limit on inward remittance to India?

No. There is no limit on the remittance amount.

- What are the documents required for inward remittance?

There are no special documents required for inward remittance to India. All you need to provide is the invoice with the remittance amount and other company/personal details along with the ID proof.

Final Word

While GST on inward remittance doesn't directly impact the process, it's essential to consider other fees imposed by banks or financial institutions for remittance services.

By staying updated on the taxation landscape and being aware of potential charges, business owners can ensure compliance and make informed financial decisions regarding inward remittances.