Avoid delays and rejections. Karbon ensures every foreign payment meets RBI norms, with ultra-low FX markups.

The Reserve Bank of India (RBI) sets the foreign money transfer rules in India, by central government tax laws.

As the central authority in the country, overseeing monetary laws and policies that govern the operations of banking, and other financial institutions. Its role extends to the regulation of domestic and international wire transfers involving India.

The Foreign Exchange Management Act (FEMA) provided the rough framework to bring together and change the rules about foreign exchange. The idea was to improve how we trade with other countries and handle payments. This law was meant to help grow and care for India's forex market.

But are there any exceptions to this rule? Are the foreign money transfer rules different for inward and outward remittances?

If yes, how so?

Let’s find out!

Foreign money transfer rules for business remittances

Inward remittances

When businesses receive money from other countries, there are rules to follow. Here are some important things to keep in mind:

- Knowing the People Involved: It's important to check and confirm the identities of the people or businesses involved. This includes providing the right documents, showing ID, and stating why the money is being sent.

- Having the Right Papers: Businesses often need to provide complete and correct documents, like invoices and contracts, to prove that the money transfer is legitimate.

- Choosing Safe Channels: It's crucial to use trustworthy and legal ways to send money. Businesses should pick well-known banks or reliable money transfer services.

- Knowing Currency Rules: Being aware of and following the rules about the type and amount of money that can be sent is important.

- Understanding Taxes: Businesses should be aware of how taxes might be affected when sending or receiving money internationally, including any taxes that need to be paid in both the sending and receiving countries.

- Following Currency Controls: Some countries have strict rules about moving their currency in and out. Businesses need to know and follow these rules for a smooth money transfer process.

Outward remittances

When businesses send money to other countries, there are rules to follow. Here are some important things to keep in mind:

- Approval from Regulatory Authorities:

For example, a technology company in the United States planning to invest in a research project in India must obtain approval from the U.S. Department of Commerce. This step ensures compliance with export control regulations, securing regulatory authorization before initiating the outward remittance.

- Purpose and Documentation:

Consider a manufacturing company in Japan that needs to pay an overseas supplier for raw materials. To justify the remittance's purpose, they diligently provide detailed invoices, purchase agreements, and shipping documents. This thorough documentation substantiates the intended use of the funds in the outward remittance.

- Authorized Dealers:

Consider an Indian IT company making a payment to a software provider in the United States. To adhere to regulations, they choose a bank authorized by the Reserve Bank of India (RBI), ensuring that outward remittance from India follows legitimate channels and complies with Indian financial standards.

- Foreign Exchange Declaration:

Imagine a Canadian consultancy firm expanding globally, making an outward remittance to establish a branch in India. In compliance with regulatory requirements, they submit a foreign exchange declaration to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), providing transparency on the transaction.

- Limits on Amount and Currency:

An e-commerce company in the UK intending to invest in marketing activities in the U.S. ensures compliance with currency restrictions. They are mindful of the maximum allowable amount for outward remittances, aligning their transaction with regulatory limits.

- Tax Considerations:

For instance, a pharmaceutical company in India acquiring intellectual property rights from a foreign entity seeks advice from tax experts. This proactive approach helps them understand and comply with the tax implications in both India and the recipient country before making the outward remittance.

- Anti-Money Laundering (AML) Measures:

A financial services firm in Singapore sending funds to open a subsidiary in Malaysia implements rigorous KYC procedures. This includes verifying the identity of the recipient to prevent potential money laundering activities and ensuring a secure and compliant outward remittance.

- Verification of Beneficiary:

A tourism company in Brazil making payments to a foreign tour operator prioritizes verifying the legitimacy of the beneficiary. This involves confirming the business registration and credentials of the recipient before proceeding with the outward remittance.

- Reporting Requirements:

Consider an agricultural export company in Argentina making a significant outward remittance to pay for machinery from Germany. To comply with regulations, they submit transaction details to the Central Bank of Argentina, fulfilling reporting requirements for transparency.

- Exchange Rate Considerations:

An IT services company in India making an outward remittance to pay for software licenses from the U.S. actively monitors exchange rates. This strategic approach helps them choose the optimal time for the transaction, maximizing the value of the remitted amount amidst fluctuating currency values.

Foreign money transfer rules for foreign exchange reserves

India, much like other nations, has specific regulations governing the movement of money across borders and the management of foreign exchange reserves. Here are key aspects of these regulations in India:

- Capital Account Transactions:

The movement of foreign exchange reserves is significantly influenced by capital account transactions, which include investments, loans, and financial dealings with entities outside India. The RBI closely regulates and monitors these transactions to maintain stability in foreign exchange reserves.

- Current Account Transactions:

Certain foreign money transfers linked to current account transactions, such as trading in goods and services, are subject to regulations. The RBI works to balance these transactions, ensuring the protection of foreign exchange reserves.

- Liberalized Remittance Scheme (LRS):

The LRS is a scheme allowing Indian residents to freely send funds abroad for various purposes, including education, travel, and investments. However, there are limits and reporting requirements in place to ensure transparency and control over capital outflows.

- External Commercial Borrowings (ECB):

Rules govern the borrowing of funds from foreign sources by Indian entities. The RBI oversees external commercial borrowings to prevent excessive debt accumulation and to manage their impact on foreign exchange reserves.

- Foreign Exchange Management Act (FEMA):

FEMA is a comprehensive law granting the RBI authority to regulate foreign exchange transactions. It establishes the legal framework for foreign money transfers, including penalties for violations.

- Reporting Requirements:

Entities involved in significant foreign transactions are often required to report details to the RBI. This reporting helps maintain transparency and enables authorities to monitor the utilization of foreign exchange reserves.

- Currency Controls:

The RBI may implement currency controls to manage the movement of Indian rupees in and out of the country. These controls aim to stabilize the exchange rate and prevent abrupt fluctuations that could impact foreign exchange reserves.

- International Commitments:

India, as a member of international organizations like the International Monetary Fund (IMF), adheres to specific commitments and agreements that influence its foreign exchange policies and the management of reserves.

Restrictive Foreign Money Transfer Rules in India

- Prohibited Transactions: Outward remittances related to gambling, lottery winnings, or other speculative activities may be restricted.

- Currency Controls: There are limits on the amount of foreign currency that can be remitted annually under the Liberalized Remittance Scheme (LRS), and transactions exceeding these limits require special approval.

- High-Risk Activities: Speculative trading in derivatives and forex markets is restricted. Investments in high-risk financial instruments may also be limited.

- Countries under Sanctions: Transactions involving countries under international sanctions, as identified by Indian authorities, are restricted or prohibited.

- Illegal Activities: Any outward remittances associated with or suspected of supporting illegal activities, including money laundering or financing terrorism, are strictly prohibited.

- Cryptocurrency Transactions: As of my last update, outward remittances for cryptocurrency transactions faced regulatory uncertainty, and there were restrictions in place. However, regulations can evolve, so it's essential to check for the latest updates.

- Certain Investments: Investments in foreign entities engaged in real estate or certain business activities may be subject to restrictions or require specific approvals.

Foreign money transfer rules under RBI

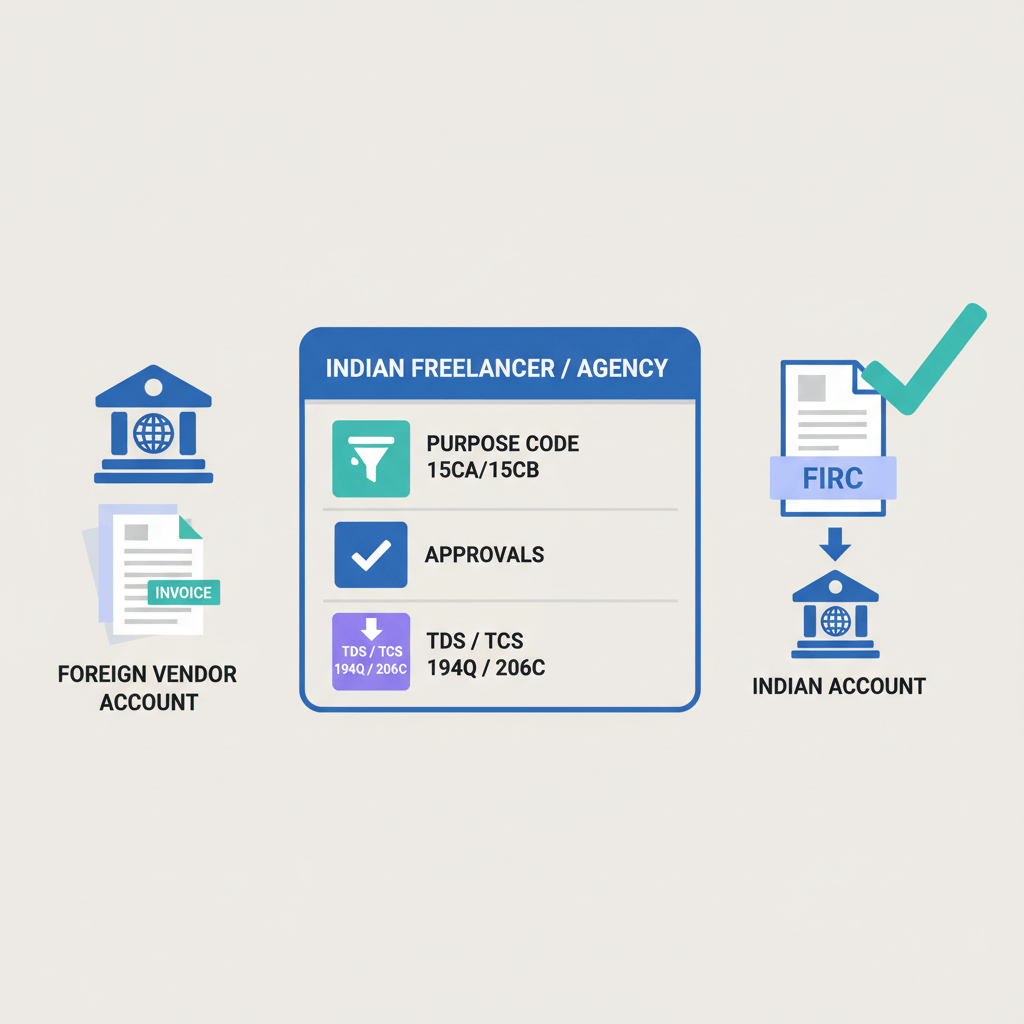

- Freelancers can receive inward remittances with ease, needing only an invoice and providing their PAN number. The funds are deposited directly into their savings bank account.

- There's no specific limit on the amount that can be received as inward remittance under business inward remittances. Proper documentation, including a GST certificate or shop establishment certificate, is required for these transactions.

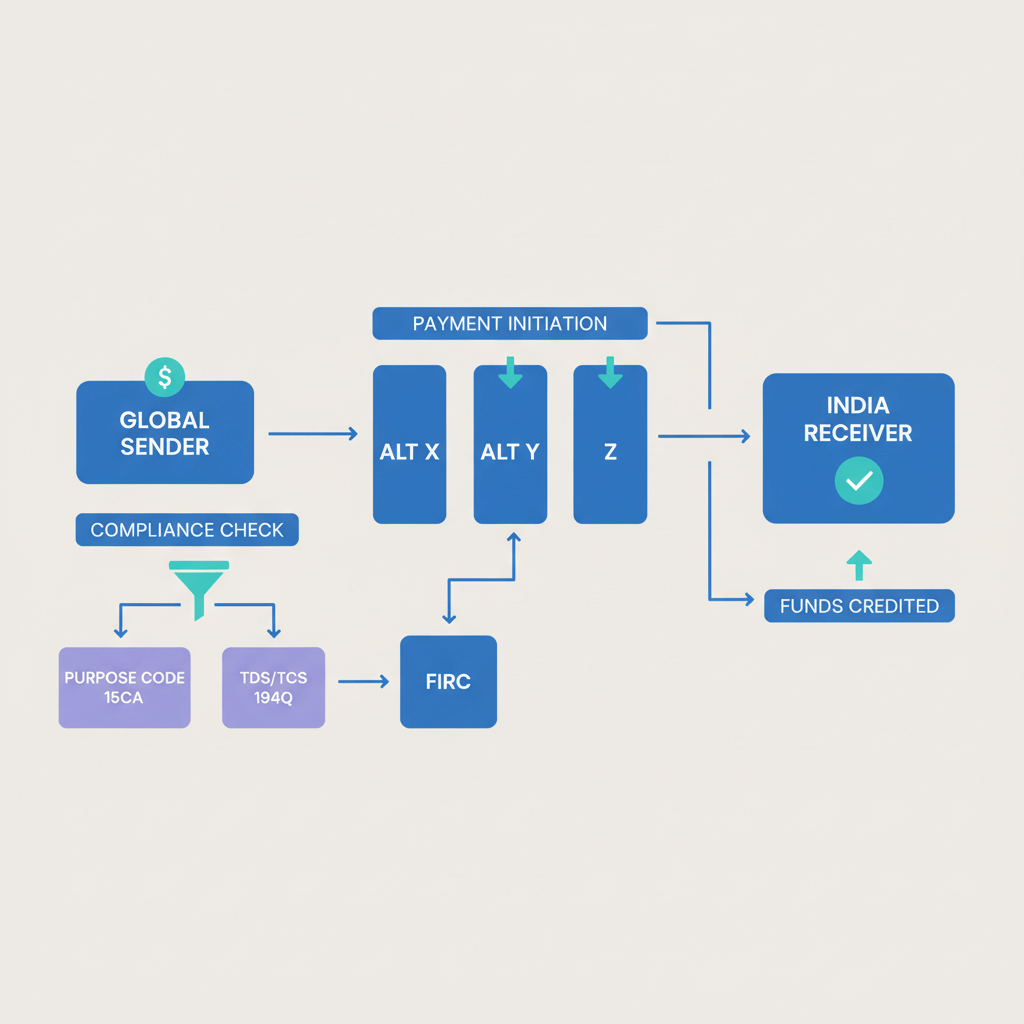

- Outward remittances, on the other hand, involve more restrictions and documentation. The scrutiny is heightened to prevent money laundering when money leaves the country.

- For outward remittances from India by business establishments, there is no set limit, provided the proper documentation and invoices are in place.

What are the documents required for foreign remittance?

The documents needed for inward remittance to India:

- Identity Proof

- Proof of Address

- Remittance Application Form

- Invoice or Payment Advice (for business transactions)

- Foreign Inward Remittance Certificate (FIRC)

- KYC Documents

- PAN Card (for large remittances)

The documents needed for outward remittance from India:

- Identity Proof

- Proof of Address

- Remittance Application Form

- Purpose of Remittance Documentation

- Bank Statement

- Tax Compliance Certificate

- Foreign Exchange Declaration

- PAN Card

- FEMA Declaration Form

- Compliance with Regulatory Approvals

FAQs

How much money can be sent from abroad to India?

Individuals: Up to USD 250,000 per financial year.

Businesses: Specific limits may apply as they do not come under the LRS scheme.

Do I have to pay tax on money transferred from overseas to India?

Receiving money from overseas in India is generally not taxed. However, tax implications may arise depending on:

- Gift Tax: Money received as a gift from a non-relative may be subject to gift tax, while gifts from close relatives are usually exempt.

- Business Income: Money received in business transactions may be taxable based on the business nature and tax regulations.

- Foreign Assets: Overseas assets must be reported to Indian tax authorities, and income from these assets may be taxable.

- Remittance for Specific Purposes: Money sent for specific reasons like education or medical treatment has tax exemptions for transactions up to 7 lacs.

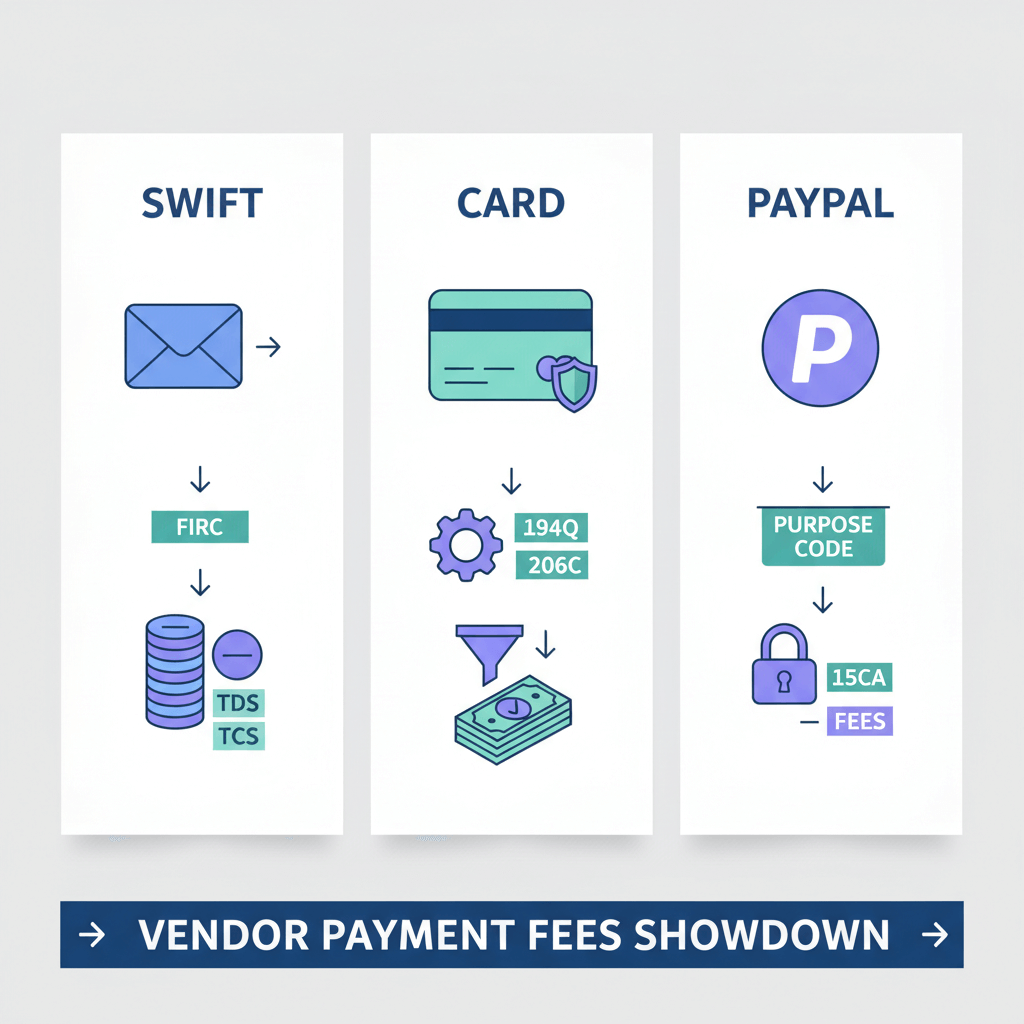

How much do banks charge for international transfers?

Inward remittance fees for business transactions usually range from 3-6%. Karbon Forex specializes in these transactions and charges only 1-3% of the total amount. Contact us for more details!

What is the cheapest option available for international money transfers?

For business remittances, Karbon Forex provides the most cost-effective international money transfer solution. Our competitive rates set us apart as one of the best in the market.