There is no doubt that a 15CA limit has been set by the RBI for money moving out of India. But in the case of business outward remittances, there is no limit, which is of course subject to certain conditions.

Transactions falling below certain thresholds are exempt from the requirement of filing Form 15CA.

What are the thresholds? Is there a limit?

Read on…

What is Form 15CA?

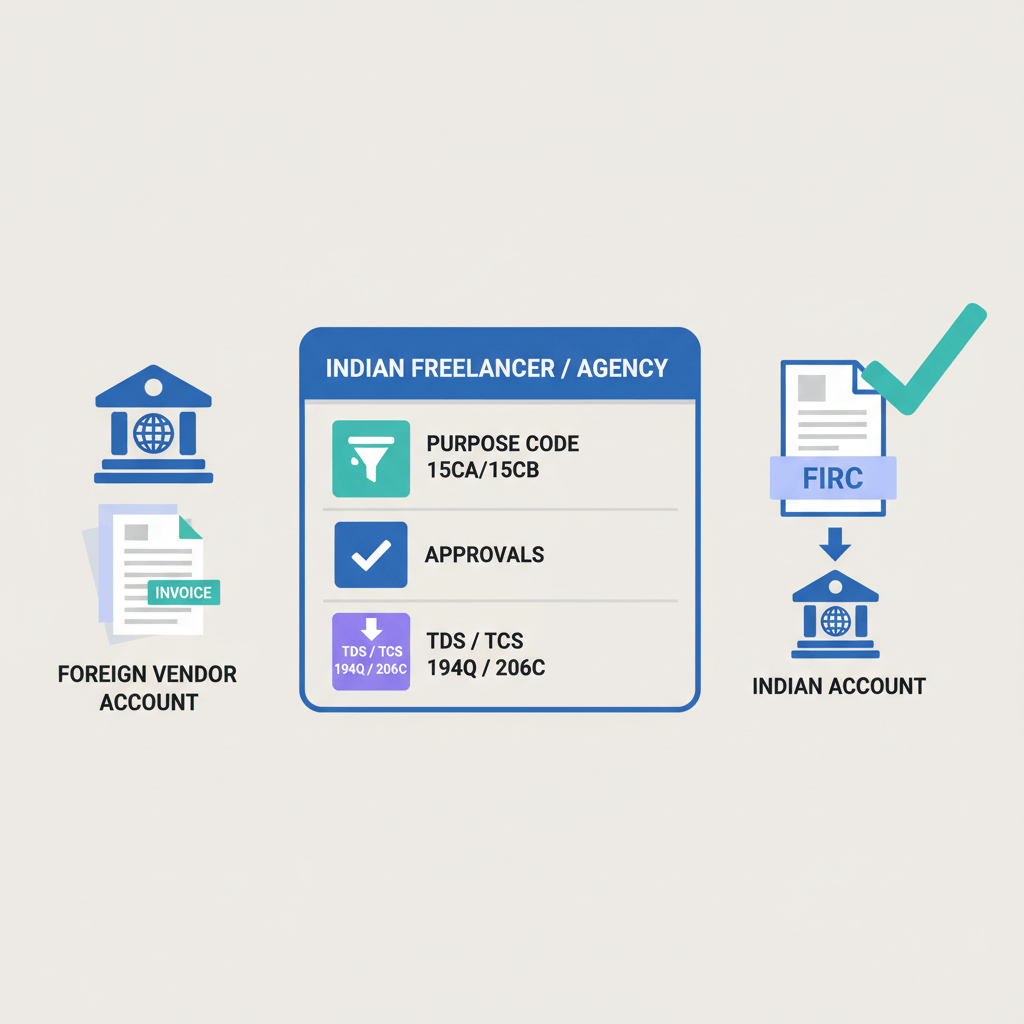

Form 15CA serves as a declaration form mandated under the provisions of the Income Tax Act, 1961 in India. Its purpose is to facilitate the remittance of funds to non-residents or payments subject to withholding tax, ensuring compliance with the 15CA limit.

When a resident individual or entity intends to remit funds to a non-resident, they are obligated to furnish Form 15CA to the Income Tax Department electronically. This declaration asserts that the remittance conforms to the prescribed limits outlined in the Income Tax Act and affirms that the applicable tax has been deducted at the correct rates, or that the payment qualifies for an exemption from tax withholding.

Submission of Form 15CA is done through the online portal of the Income Tax Department. Depending on the nature and purpose of

Who is eligible for form 15CA?

Form 15CA is typically required to be filled out by resident individuals or entities in India who are initiating payments or remittances to non-residents. These transactions encompass various scenarios such as:

- Transferring funds to non-residents for purposes like investments, imports, or travel.

- Making payments to non-residents that are subject to withholding tax.

- Any other payments or transactions specified by the Income Tax Act where the remittance is taxable or where tax must be deducted at the source.

It's crucial to recognize that the necessity of submitting Form 15CA extends to a broad spectrum of transactions, and the specifics of each transaction dictate whether Form 15CA is required and the relevant details to be provided.

However, exemptions and thresholds are outlined under the Income Tax Act, exempting certain transactions from the requirement of Form 15CA if they fall below the specified 15CA limit. In such cases, it's advisable to seek guidance from a tax professional or refer to the guidelines provided by the Income Tax Department to determine the eligibility and prerequisites for filing Form 15CA in particular circumstances.

What is form 15CA used for?

Form 15CA is utilized to submit declarations to the Indian tax authorities by individuals or entities remitting funds to non-residents or foreign companies, ensuring compliance with the 15CA limit. This electronic form is filed through the Income Tax Department's website.

Its main purpose is to ensure adherence to the provisions of the Income Tax Act, 1961, specifically concerning tax deduction at source (TDS) and the payment of applicable taxes on such remittances. Form 15CA aids in monitoring and regulating foreign remittances originating from India.

Here are the primary uses of Form 15CA:

- Declaration of Remittance: It serves as a declaration where the remitter provides details regarding the remittance made to a non-resident or foreign company.

- Tax Compliance: Form 15CA verifies that taxes have been deducted at the correct rates or that the remittance qualifies for an exemption from tax withholding, ensuring compliance with tax laws.

- Regulatory Compliance: This form assists tax authorities in monitoring foreign exchange transactions and ensuring adherence to regulatory standards.

- Documentation: Form 15CA offers documentary evidence of the remittance, which may be necessary for audits or inquiries conducted by tax authorities.

Is there a limit for filing Form 15CA?

Yes, there is a 15 CA limit for foreign remittances from India. You have to fill out Form 15CA for any foreign remittance that's more than INR 5 lakhs in one go, or if the total amount sent throughout the financial year adds up to more than INR 2.5 lakhs. But if your transactions are under these amounts, you don't have to fill out Form 15CA.

What is Form 15CB?

Form 15CB is a certificate given by a chartered accountant (CA) in India, which is needed under the Income Tax Act, 1961. It helps with sending money abroad from India. You usually need it when some tax needs to be taken out of the money being sent, as per the Income Tax Act or relevant Double Taxation Avoidance Agreements (DTAA).

The main reason for Form 15CB is to make sure the person sending the money gets advice from a CA about the tax rules for the money they want to send. The CA looks at things like what the money is for, the rules in the Income Tax Act or DTAA, and then fills out Form 15CB with details like how much money is being sent, the tax rate, and if the money is taxable in India or not.

Form 15CB acts as a crucial document alongside Form 15CA, which is submitted by the remitter to declare remittance details to the Income Tax Department. These forms collectively ensure adherence to tax regulations when executing foreign remittances from India.

What is the limit of 15CB?

Form 15CB does not have a specified monetary limit. Instead, it is necessary for transactions where a chartered accountant's certification is needed to ensure compliance with tax regulations, particularly for foreign remittances from India.

Although there isn't a predetermined threshold for Form 15CB, it is typically mandated for transactions involving TDS, regardless of the remittance amount. The certification provided by the chartered accountant in Form 15CB verifies the tax implications of the remittance, ensuring adherence to tax laws.

However, it's worth noting that Form 15CB is commonly associated with larger remittance transactions due to the greater complexity and potential tax implications, which often necessitate professional certification.

What are the rules for 15CA and 15CB?

FAQ on 15 CA limit

How long is Form 15CA valid?

Form 15CA remains valid for the specific transaction for which it is filed with the Income Tax Department, adhering to the 15CA limit. Its validity is tied to the particular remittance being made and does not extend beyond that transaction.

Unlike certain documents that have a predetermined validity period, Form 15CA is transaction-specific. Each time a remitter initiates a new foreign remittance exceeding the prescribed thresholds, they must submit a new Form 15CA declaration tailored to that specific transaction. This ensures that the information provided in the form accurately reflects the details of each remittance being made.

What happens if Form 15CA is not filed?

Failure to submit Form 15CA as required by the Income Tax Department, complying with the 15CA limit, can lead to various penalties and legal consequences under Indian tax laws. When Form 15CA is not filed when necessary, the following consequences may arise:

- Penalties: Non-compliance may result in penalties imposed by the Income Tax Department. The penalty amount can vary based on the severity and extent of the non-compliance.

- Disallowance of Expenses: Expenses related to the non-compliant remittance may be disallowed for tax purposes. This means that the remitter may lose the ability to claim deductions or benefits associated with those expenses.

- Interest Charges: The Income Tax Department may levy interest charges on any outstanding tax liability resulting from the non-compliant remittance.